| |

READERS’ TOP PICKS FOR Q1

|

Stock

|

2010 starting price (cts) |

Mar 31 close (cts) |

% change since Jan 1 |

Reader who highlighted stock |

1. Techcomp

|

30 |

55 |

83.3 |

MacGyver |

| 2. Broadway |

62.5 |

95.5 |

52.8 |

MacGyver |

| 3. SMB |

32 |

31 |

-3.1 |

Josephyeo |

| 4. Eastern Asia |

11 |

11 |

- |

Josephyeo |

| 5. Changtian Plastic |

22 |

19 |

-13.6 |

Morpheus |

| 6. Junma Tyres |

16.5 |

16 |

- |

Morpheus |

| 7. Oceanus |

44 |

35 |

-20.5 |

happin |

| 8. Design Studio |

63.5 |

62 |

-2.3 |

happin |

| 9. Cityspring |

59 |

60.5 |

2.5 |

at301273 |

| 10. Metro |

79 |

82.5 |

4.4 |

Lowsx |

| 11. Second Chance |

32 |

32 |

- |

Sgmarket |

| 12. Rotary Engineering |

105 |

106 |

- |

PKC |

| 13. Sinotel |

63.5 |

50.5 |

-20.5 |

Thinkofstock |

| 14. Saizen REIT |

15 |

16.5 |

10 |

AK71 |

|

EIGHT STOCKS out of 28 highlighted by NextInsight readers in a special thread in our forum have made gains of 10% or more in the three months since the start of this year.

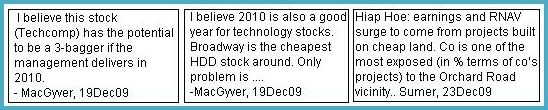

The most sizzling were Techcomp Holdings (up 83%) and Broadway Industrial Group (up 53%), which were highlighted by MacGyver.

Techcomp was a laggard last year until it reported a record profit in Feb this year.

Broadway gained as the market increasingly recognised it is a beneficiary of a strong rebound in the Hard Disk Drive industry that will continue this year.

Once a frustrating laggard for most of 2009, Healthway Medical (recommended by AK71) has soared 37% this year, partly on news of its China expansion plans.

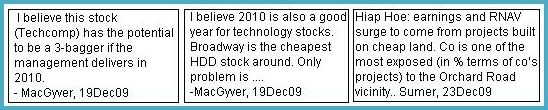

Hiap Hoe (recommended by Sumer) rose 25% on the back of its good performance as a property developer in FY09 when its net profit after tax soared to $34.3 million from $8.2m in FY08.

| |

Stock

|

2010 starting price (cts) |

Mar 31 close (cts) |

% change since Jan 1 |

Reader who highlighted stock |

| 15. Ascott REIT |

120 |

124 |

1.3 |

Kisuke |

| 16. GuocoLeisure |

70 |

67 |

-4.2 |

Kisuke |

| 17. Berlian Laju |

10 |

9 |

-10 |

Kisuke |

| 18. Hiap Hoe |

51.5 |

64.4* |

25 |

Sumer |

| 19. Q&M |

55.5 |

47.5 |

-14.4 |

Sumer |

| 20. Healthway |

13.5 |

18.55* |

37.4 |

AK71 |

| 21. SingPost |

101 |

105 |

3.9 |

Sgmarket |

| 22. Hersing |

36 |

30.5 |

-15.3 |

Sgmarket |

| 23. Tuan Sing |

22 |

24 |

9 |

Dello |

| 24. Roxy Pacific |

29.5 |

34.5 |

16.9 |

Happin |

| 25. United Overseas Australia |

32.5 |

37 |

13.8 |

Keithkeh |

| 26. Keppel |

823 |

912 |

10.8 |

Keithkeh |

| 27. China New Town |

14.5 |

11.5 |

- 20.7 |

Harlequin |

| 28. Miyoshi |

17 |

15.5 |

-8.8 |

Keithkeh |

OVERALL

|

2031 |

2173.0 +6.99% |

|

|

*After adjusting for bonus issue and rights issue, respectively |

On the whole, the stock picks made by NextInsight readers has gained 6.99%, outperforming the Straits Times Index which dipped 0.4% during 1Q.

In other words, the NextInsight readers’ portfolio outperformed by 7.39 percentage points.

Of course, the portfolio had a number of stocks that did badly:

The worst were Sinotel Technologies and Oceanus Group, which lost 20.5% each.

Ah, the perils of buying into stocks that have done exceedingly well in the recent past.

Ok, goodbye 1Q, hello 2Q. The forum is now open to readers to highlight stock picks for 2Q.

Please give good reasons for your recommendations. ('Stock sure will cheong one!' is not going to satisfy anyone)

Please state also the stock price that the stock is trading at when you make the posting, so we can track the stock performance from the point of recommendation (instead of from a common date for all stock recommendations).

Ready? Click here to post (or read about potentially hot stocks).