However, the buybacks will be viewed in a larger context by investors. Relevant issues to weigh include: Are the company’s financial performance and its industry outlook improving? Does the company seem to lack ideas on how to grow its business using its cash?

Personal stock purchases by management are more straight forward. After all, the bosses are putting down their own money, so it's not the company's cash that is at risk (since stock prices can still sink substantially below a company's buyback price levels).

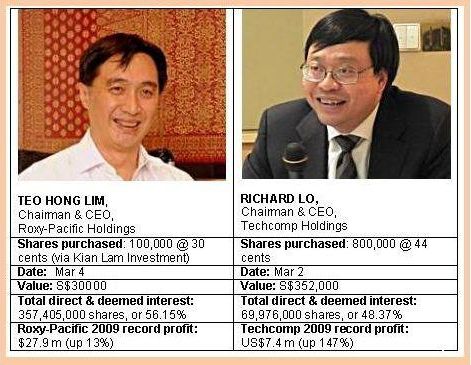

For what they are worth, here are four cases of recent company buybacks and management stock purchases of shares listed on the Singapore Exchange. Notably, Techcomp and Roxy-Pacific have just reported record profits for 2009, while Pan Hong and Innotek have reported sharp improvements in results.

Recent stories: TECHCOMP: What recession? 2009 was a record year!

ROXY-PACIFIC: After record performance, more to come?

|

The net profit was achieved despite FY09 revenue falling to S$361.5 million from S$421.6million in FY08.

Its wholly-owned precision metal component specialist, Mansfield Manufacturing Company, posted a turnaround, with net profit contribution of S$3.0 million in Q4’09 (vs loss of S$9.9 million in Q4’08).

The Group benefitted from cost-cutting and operational efficiency improvements as salesof high-margin products increased while raw material prices declined.

InnoTek proposed a first and final dividend of 5 cents per share for FY09, unchanged fromFY08.

Interestingly, the Group said that if business conditions do not deteriorate, it expected its financialperformance in Q1’10 and FY10 to improve year-on-year. The Group is pursuing more higher-margin automotive and medical-related products.

Recent story: KEVIN'S TAKE on ... INNOTEK (dividend yield of 12.5%)

|

In February, it reported RMB57.3 million in net profit for the third quarter ended 31 December 2009, reversing the loss of RMB3.6 million in the previous year’s corresponding period.

The improvement in net profit came on the back of a substantial increase in Group revenue in3Q2010 to RMB87.0 million, from RMB4.3 million in 3Q2009.

This was driven mainly by the handover of pre-sold residential units from the Group’s property development in Huzhou city, Huzhou Liyang Jingyuan Phase 2 (湖州丽阳景苑二期), to buyers during 3Q2010. The transfer follows the completion of construction for the residential units of Huzhou Liyang JingyuanPhase 2 in December 2009.

Revenue recognition for property developers is dependent on the completion of construction and handover of properties that are sold.

As at 31 December 2009, the Group had a net cash position with cash and cash equivalents totaling RMB174.9 million.