HONG KONG-based Public Financial Holdings Ltd (HK: 626), a 73%-held subsidiary of Public Bank Berhad, Malaysia, “PBB”, believes it has found a very profitable niche in Hong Kong’s seemingly saturated banking sector.

In a recent interview, PFH Ltd’s Director, Mr. Tan Yoke Kong, told NextInsight and Aries Consulting the bank was doing well with its long-practiced business model, and was looking to replicate its success across the boundary in the PRC… when the timing was right.

How are you different from other overseas banks in Hong Kong, and which category of borrowers do you target?

Mr. Tan: Public Financial Holdings in Hong Kong focuses on those customers, particularly middle- and lower-income borrowers, who need short term cash flow solutions. We originally also focused on financing purchasers of older, smaller real estate and now extended to financing new homebuyers alike. We moved on to now finance purchasers of taxi licenses and taxi managements, which is a significant part of our business in Hong Kong. Taxi financing is a very specialized business.

Approximately 15% of our loans are from the financing of taxi drivers to buy licenses, which cost 3.6 mln hkd apiece. There is a very high entry barrier to this business. Taxi license financing is considered “low risk” with the 3.6 mln hkd license serving as de-facto collateral. Therefore they enjoy better borrowing rates. We have now 42 branches for Public Finance Ltd and 32 branches for Public Bank (Hong Kong) Ltd in Hong Kong, all conveniently and strategically located, many near MTR stations and at street level. We have mass market exposure and high visibility which helps us meet our needs of attracting low-cost funding.

Other than the taxi driver license market, where else to you attract potential borrowers?

Mr. Tan: We believe in the value of human assets so we offer many benefits to our employees. This includes having a staff force of Filipinas to cater to domestic helpers to minimize barriers on language, and cultural affinities. They help administer the borrowings by domestic helpers from that country who are on contract here in Hong Kong. While most of our clients are Hong Kong residents and Hong Kong Chinese, that is, we have at least one exception -- domestic helpers. Lending risk to this group is mitigated by the fact that they are on fixed year-long contracts and we believe they would service their loans.

So other than the Filipina domestic helper borrowers, most of your customers are males needing short term financing to meet unexpected expenses or newly planned purchases?

Mr. Tan: Yes, our typical customer in the consumer lending business is male, but the ratio is beginning to even out. Usually, borrowers are between 25 and 50 years of age, and have family commitments that require a sudden injection of cash. Also, borrower’s average take-home salary ranges between 8,000 to 15,000 hkd per month.

Tell us a bit about your bank’s history in Hong Kong and its growth story in the SAR.

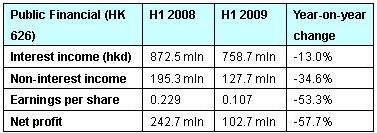

Mr. Tan: Public Financial Holdings Ltd (HK: 626) is a subsidiary of PBB, Malaysia which owns a 73% stake in us. PBB is among the top three domestic banks in Malaysia. Our expertise here is “retail customer loans” ie: focused on high-yield, unsecure lending. But we manage it better than credit card risk. We have very low non-interest income. One example is the 1% processing fees charged on unsecured lendings, and another is fees received from our trade related/stock broking business. PBB has over one mln customers in Malaysia for whom we are tapping in for their stock trading in Hong Kong equities.

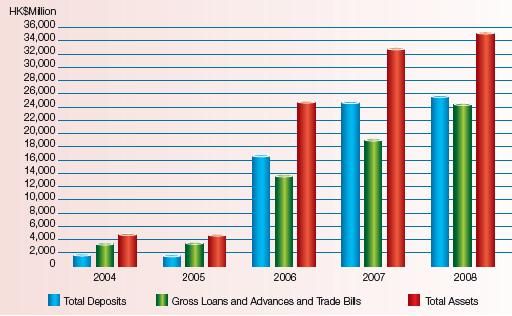

PFH Ltd purely operates in Hong Kong, but we plan to expand into mainland China eventually. In 2006, we acquired Asia Commercial Bank (ACB), a relatively small bank in Hong Kong. It had 12 Hong Kong branches and one in Shenzhen then. After acquiring it, we immediately rebranded it. We have since expanded to 33 branches, with three in Shenzhen. This will increase to 35 in 2010. We will continue expanding our banking business in Hong Kong to also focus on low risk/low yield growth, and at the same time keep growing our financing operations on the high risk/high yield model.

You mentioned you were not content to focus solely on Hong Kong alone for the long term but were also eyeing the mainland Chinese market for future growth opportunities. Can you elaborate?

Mr. Tan: Yes, we are certainly looking at China. In 2007, new rules were issued by the Chinese Authority. Banks hoping to operate branches in China must be locally incorporated. We are locally incorporated in Hong Kong but not yet in the PRC as we have yet to meet the minimum criteria on total asset size of six bln usd. When we reach six bln usd, we will apply to enter the China market. We’ll likely start in Shenzhen and Guangdong province, because these are closer to Hong Kong and are the most developed markets there.

So the US$6 bln asset requirement is the main limiting factor keeping you from operating in the PRC?

Mr. Tan: Not just that alone. We need to be comfortable with the China operating environment, especially in the areas of credit infrastructure, transparency and corporate governance. Public Financial Holdings needs time to not only build up its assets, but also better understand China’s banking environment. We feel we need to be in China for say, two more years to know the market sufficiently before expanding in China. As for entering the China market via acquisition, we prefer to have management, board and equity control as we do not seek to be a passive “investor.” Instead, we want to be able to use our own strategies, applying our own knowhow and experience through organic growth.

Please give us an idea of your typical consumer loan size extended in Hong Kong, and maybe paint a picture for our readers of what this cash is typically used to fund.

Mr. Tan: Our average consumer loan size is not big, commonly between 20,000 to 80,000 hkd. Our maximum loan limit is 600,000 hkd and the minimum is 3,000 hkd. So you can see we are not on the wholesale side, and we will continue to focus on the retail/consumer sector. We like to say that our loans can usually be approved over lunchtime because these borrowers don’t have a lot of time to haggle over loans. We realize that if we don’t serve them quickly, then they will just walk next door to a competitor. We see a large volume of small loan amounts.

Yes, the risk is relatively high, but interest yields are higher also. Our customers come and go and typically are looking for cashflow solutions in a hurry. We have an advantage over our competitors because many other banks are not interested in extending small loans of a few ten thousands hkd at a time. We will continue in establishing our brand name in this market segment, keep building it up.

China is often credited with inventing bureaucracy, and Hong Kong is probably no different in that regard. Therefore, you must have a lot of government workers knocking on your door now and again for short term help?

Mr. Tan: Yes, we also lend to the civil servants. They work in the public sector, so they typically don’t get annual bonuses. For example, they need to borrow for cash flow when Chinese New Year approaches as giving of red envelopes (New Year’s money) and travel for leisure are still very customary among the Chinese. As Hong Kong is still a very high cost city, home rental, education and transportation are expensive. The cost of schooling often need full payment of up-front fees of 6-12 months in advance, so parents often look to us for short term financing. In this regards, we are cautious of our brand name.

We want to be seen as someone the customers can rely on for financial assistance. Hong Kong people work hard, but also like to treat and reward themselves well. We also provide consumer loans to higher income groups. But of course, a bank borrower will enjoy lower rates because their risk level is lower. We have a very high level of repeat customers, many of them practitioners of convenience and impulse spending.

Can you continue to grow your assets despite being focused on the consumer lending level?

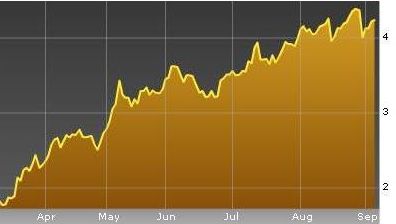

Mr. Tan: Yes, our deposits have grown by double digits annually in the last 3 years, and the bank’s assets have risen to 4.0 bln usd now from over 2.0 bln usd when we acquired it. We will continue to focus on the consumer/retail sector as it’s our core strength while we continue to focus on the consumer financing business under Public Finance. We strive to expand the customer base of Public Bank for both deposits and retail loans.