Part of the athletic apparel company’s game plan for China is to vie for the country’s 1.3 bln consumers by hitching its wagon to a growing handful of Chinese entertainment superstars, rather than simply passing the baton to less charismatic – and more expensive – equivalents in the sports world, to stand behind their brand name.

Entertainment celebrities are a major lynchpin in Xtep’s marketing and promotional campaigns, said company CFO, Mr. Terry Ho.

“Xtep brand is positioned in the fashion sport sector. We have signed on Nicholas Tse, Jolin Tsai, Wilber Pan, Charlene Choi and Gillian Chung as our image and brand representatives in 2008. Their image is sunny, active and youthful, and they give a good image and explanation of our products,” Mr. Ho said.

In an exclusive interview with NextInsight, he said his firm’s focus on these chart-topping singers and entertainment glitterati fit snugly into its overall market strategy and ideal customer.

“Our target demographic is teenager and the youth market. This brand position will not change anytime soon.”

Xtep focuses on the mass under-35 consumer market in China, ie, those most likely to know their Gillian’s and unlikely to have ever heard of Gilligan or his island.

Geographically, it is also looking to fast-growth regions.

Last year, 69% of its revenue came from the country’s eastern and southern provinces like Jiangsu, Hubei and Anhui, where average growth is higher even than the country’s phenomenal GDP expansion.

About 43% of Xtep’s retail outlets are located in these regions, whose sales are expected to keep propelling the company’s future growth.

And not only do Xtep’s average selling prices undercut established domestic rivals like Li Ning, China Dongxiang and Anta Sports, but Xtep’s current valuation is the only sportswear-proxy to still hover below its IPO price.

Don’t tread on me

While most Chinese companies wallowed in the red on a sudden shutdown in external demand sometime last year, Xtep recorded an Olympian-level performance in 2008.

The main reason: its total and complete reliance on the domestic Chinese market.

“Both our top and bottom lines last year more than doubled. There were many drivers. One is from our new shops, up 15% year-on-year. Another is our rapid volume output expansion. Our footwear volume rose 76% last year, while our apparel volume alone was up 145%,” Mr. Ho said.

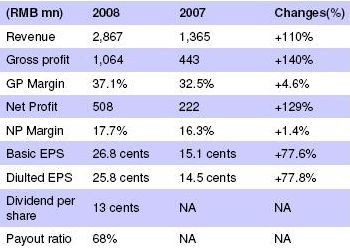

Revenue rose 110% last year to 2.9 bln yuan, while net profit hurdled up 129% to 508 mln yuan.

The company increased its outlets in China last year by 15% to 5,056, and raised its brand flagship storecount to 12.

Mr. Ho said the global economic crisis did take a bite out of revenue momentum in the fourth quarter last year, but there are already signs of a bounceback, as China is still flirting with a very enviable 8% possible GDP growth this year while many G20 economies are still contracting.

“We don’t export …all our products are sold domestically. This ratio will not be changed by end-2009,” he said.

Xtep also hopes to benefit from China’s ongoing 4.5 trln yuan stimulus economic stimulus plan, as well as urbanization efforts in the country which are accelerating and offering “promising growth potential” in second and third tier cities.

Costs under control

Commodity prices like cotton and petrochemicals have been all over the charts in a very volatile year last year, but Xtep is managing them – and then some.

When asked how raw material and labor costs are affecting Xtep’s performance, Mr. Ho said management of upstream input burden was a strong suit for the company.

“Raw material prices comprised 46.3% of total costs last year, and labor costs were only 4.8%. Last year the raw material costs were lower. This is obviously better for our performance.”

Xtep is happy with the move, though it expects shareholders will see the intrinsic value in the company’s share and raise its valuation past its IPO level soon.

“We don’t have any additional listing plans, including the soon-to-be-opened GEM board in Shenzhen,” he said.

Adding more weight to the argument that Xtep’s shares are a bargain is the fact that it offers potential shareholders the lowest price-to-earnings ratio in the China sportswear sector.

Growth going forward would remain organic, though it would not turn a blind eye to attractive pickups. “We will seek good M&A opportunities, but maybe not this year,” he said.

In a note to investors last week, Credit Suisse said it is maintaining its “market weight” recommendation on Hong Kong-listed sportswear sector firms, noting that fashion-oriented athletic apparel firm Xtep is enjoying improved sales performance.

However, while Xtep’s retail sales revenue has only seen “mild” growth of late, its current share price is quite likely undervalued.

The brokerage added that among all the Hong Kong-listed sportswear and athletic apparel firms, Xtep is currently the sole counter whose current valuation is below its IPO price, raising the strong likelihood that its shares are undervalued.

The brokerage initiated non-rated coverage on the fashion-focused sportswear maker, saying that the Hong Kong-listed firm was a likely beneficiary of more affordable marketing campaigns.

“The costs of marketing by the mainstream sports brands are seemingly higher than sports-inspired fashion, but moves taken by the former could make better investments, in our view, when successful.

Credit Suisse would be keeping an eye on the return-on-investment comparisons between athlete celebrity marketing campaigns, and Xtep’s entertainment celebrity focus.

“Specifically, the sustainability of buying airtime on popular TV channels, sponsorship of high rating TV programmes, endorsements by entertainment artistes versus sports stars by the more fashion-oriented needs to be monitored.”

Recent stories:

Xtep given sporting chance for strong China stats

XTEP: Market weight recommendation by Credit Suisse