www.sharesinvestment.com

AMID THE backdrop of a prolonged recession, companies have been unleashing a torrent of profit warnings, causing analysts to downgrade their earnings forecasts.

Hence, it was refreshing for a change to hear a company official proclaiming optimism on the future of his company.

“We are absolutely confident on the prospects of our business and have not suffered any ill-effects from the on-going financial crisis,” stated Chen Yong, executive chairman of China Paper Holdings in an exclusive teleconference interview with Shares Investment (Singapore).

For the past year, investors had fled from China-linked shares, scrunching most of their prices to penny status.

The latest brouhaha over the audit results of Fibrechem Technologies undoubtedly gave investors a further pause in investing in China plays.

Yet with an up-surge in China’s bank lending and massive stimulus package, economists are predicting that the Chinese economy will be among the first to emerge from the downturn.

Based in Shandong province, China Paper manufactures paper products such as printing and writing paper, packing paper and semi-finished toilet paper for 320 customers throughout the Middle Kingdom.

Servicing printers and publishers for education materials makes China Paper recession proof, says executive chairman Chen Yong.

Cash Is King

Armed with a war chest of Rmb362.3m and no outstanding loan, China Paper is equipped with an enormous flexibility in these troubled times, whether for expanding existing facilities or taking over of smaller distressed players.

“We are currently exploring opportunities for expansion and will be announcing these plans once they are finalised,” disclosed Chen.

Currently, total production capacity (FY07) is at 180k tonnes and the company has earmarked Rmb 80 million for the expansion of its paper chemical capacity, which is slated for completion in 1Q09.

Further, the firm is also muscling into the lucrative coated paper market with the planned construction of additional 50k tonnes per annum production facilities to be funded by internal resources.

China Paper makes paper for printing books, newspapers, packaging and toilet use.

Impressive FY08

It was another year of profitability for China Paper. FY08 earnings surged 44.8% to Rmb143.4m boosted by a 19.8% increase in the top line.

Sales grew as the company managed to increase its average selling price in the uncoated printing paper segment, the company’s bread-and-butter product.

Uncoated paper is mainly utilized for the production of education materials, which make it a non-cyclical business with sustainable demand as the educational sector is subsidized by the PRC government.

Adding to the good news is that the prices of raw materials look set to tumble further in the near future as commodities prices take a hit.

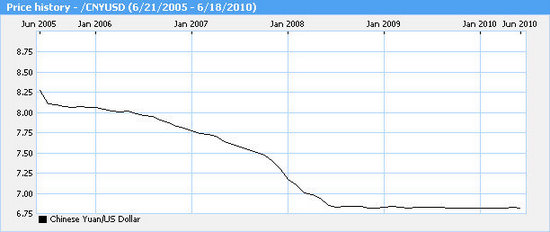

With a massive cash reserve coupled with a focus on the government-linked educational materials sector which insulates it from forex exchange risk as well as demand shocks, China Paper appears as steady as a rock.

Initiating coverage of China Paper on 23 February, SIAS Research gave the stock a ‘buy’ call with target price of $0.315 on the premise that business is fundamentally strong with a stable cashflow.

Originally published at www.sharesinvestment.com, this article is reproduced here as part of a collaboration with NextInsight.