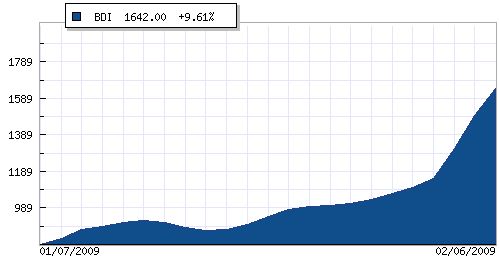

Baltic Dry Index was 789 points on Jan 7 and hit 1,642 on Feb 6. Souce: Baltic Exchange.

Baltic Dry Index was 789 points on Jan 7 and hit 1,642 on Feb 6. Souce: Baltic Exchange.

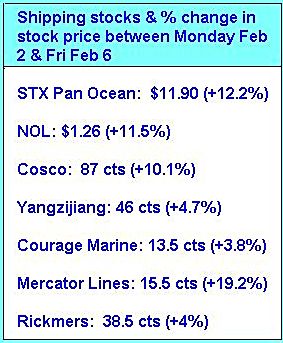

A selection of Singapore-listed stocks that have exposure to the ship industry.

Even shipbuilding stocks in Singapore have risen in the past week - not a surprise as an improvement in the shipping business casts a positive, though indirect, outlook on their business.

The BDI, a measure of shipping costs for commodities, has jumped 112% since the start of the year as demand for iron ore, particularly from China, rose.

The rise was forecasted by BNP Paribas in a report two months ago: “We expect the BDI to rise in 2009 from its dismal level to one that is closer to the marginal operating cost of a vessel.

"We do not believe that global trade can stay muted for so long and a return to sustainable levels is more likely. We think a figure around 2,000 is more likely. This could possibly come in late

1H09.”

Of late, Chinese steel makers have been replenishing iron-ore stockpiles that by mid-January were 22 percent lower than the record high set in September.

Demand has shot up as China has pledged to spend Rmb 4 trillion mostly on infrastructure projects to stimulate the economy.

The main iron ore routes to China, from Brazil and Western Australia, are at the highest since October.

The Baltic Dry Index tracks transport costs on international trade routes ended at 1,642 points on Friday (Feb 6), which is 1,089 points higher since the amazing low of 553 points on Dec 5.

The number of available capesize ships that typically haul iron ore, a steel making raw material, has fallen to almost zero, Oslo-based shipbroker Fearnley Fonds ASA said last week.

The BDI is a good leading indicator for economic growth and production. It doesn't deal with container ships carrying finished goods but with bulk carriers carrying building materials, cement, grain, coal, and iron.

UOB Kayhian: ‘Short-term plays’

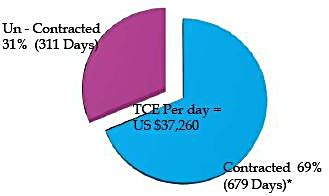

About a third of Mercator's revenue for Q4 (Jan-Mar '09) depends on spot charters for its vessels.

About a third of Mercator's revenue for Q4 (Jan-Mar '09) depends on spot charters for its vessels. Source: MercatorNoting that dry bulk shipping companies’ share prices are closely synchronised with spot dry bulk shipping rates, UOB Kayhian, in a report on Feb 2, said: “The share prices would likely see a sharp rally if the BDI continues to head north.”

The BDI breakeven level for most dry bulk shipping companies is 1,000 to 2,500. Most dry bulk shipping companies are still operating at a loss in their spot chartering business.

A number of companies, including shipping trusts such as Pacific Shipping Trust, have clients whose charter rates are locked into multi-year contracts, and so are not subject to the volatility of spot rates which the Baltic Dry Index reflects.

Another example: Mercator Lines which said during its 9-month results presentation that 69% of its Q4 (Jan-Mar '09) revenue is covered by long-term charters, leaving 31% exposed to spot charter rates.

Courage Marine's stock closely tracks BDI.On the Singapore Exchange, Courage Marine's stock price closely tracks the Baltic Dry index as it is a pure dry bulk shipping company with mostly spot charters.

Courage Marine's stock closely tracks BDI.On the Singapore Exchange, Courage Marine's stock price closely tracks the Baltic Dry index as it is a pure dry bulk shipping company with mostly spot charters.The UOB Kayhian report did not recommend that investors chase bulk shipping stocks for long-term holding.

“We see dry bulk shipping stocks as good short term trading plays on a rising BDI. While the share prices of these stocks have collapsed 80-90% from their peak in May 08, we believe it is still too early to accumulate them for long-term investment. Our fundamental view on the dry bulk shipping sector remains UNDERWEIGHT.”