QIAN HU Corporation didn't set out to teach other listed companies how to communicate but the way it announced its FY08 results sure has lessons for many.

Qian Hu put out a financial statement which few SGX-listed peers can match in detail and corporate transparency, and a press statement not only in English but also Chinese.

At the same time, it had a factsheet (13 pages!) about the business and a powerpoint presentation on its FY 08 performance.

The chairman, Kenny Yap, crafted a message (3 pages!) to investors - and he sounded persuasive and personal, when it could have been dry the way many are. By the way, there is also a Chinese translation of his message.

Most companies produce only two - a results statement and an English press release - out of the six things that Qian Hu did.

When I checked the SGX website archive for how Qian Hu reported its results for FY07, I found that, yes, they did put out six items too.

Proving itself to be something of a rarity, Qian Hu has consistently won accolades for investor relations, corporate governance and corporate transparency. It has outdone even the big boys.

FY 08 profit up 22%

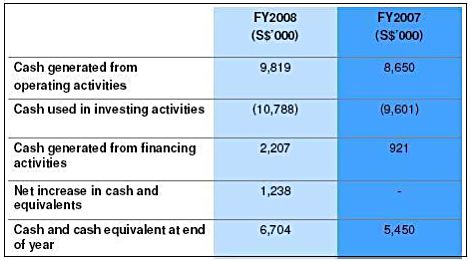

Its FY08 financial results are something - and if you go on to read the part about the company's outlook for FY09, you will get the sort of clarity about the business that many companies don't - or can't - give.

Qian Hu’s net profit for 2008 jumped 22.1% to $6.0 million – a result that would have been even more impressive if not for some once-off events:

to Qian Hu's profits.

* The closure of Bangkok International Airport in Nov 2008 due to political protests, which affected Qian Hu’s fish exports from its subsidiary in Bangkok.

* A shortage in the supply of dragon fish to meet demand in Q4.

* Spill-over effect of a delay in roll-out of accessories products for OEM customers at its Guangzhou factory in the previous third quarter.

Still, the Group achieved a 10.0% rise in 4Q net profit to $1.7 million as a result of better cost control.

Its net profit margin in Q4 improved from 7.8% to 9.0%.

Said Kenny Yap: “All of our core businesses are growing well, particularly our accessories business. It truly is and will be the engine of growth in our Group, even as our ornamental fish segment continues to generate strong contributions, particularly our self-bred Dragon Fish.”

Phillip Securities’ fair value of 15 cents

Phillip Securities maintained a positive outlook on the company and its ‘buy’ call on the stock.

“Our Discounted Cash Flow derived fair value estimation remains at $0.15, which translates to 11x FY08 earnings and 1x book value.”

Qian Hu stock closed at 9.5 cents on Friday (Jan 16), or a PE of 6.9X based on last year’s earnings.

Its net asset value is 15.11 cents a share.

Qian Hu expects its revenue and profitability to grow in FY2009.

“I would like to assure you that Qian Hu will not rest on its laurels – we have only just begun, and will continue to intensify the momentum of growth as we move into another exciting chapter,” said Kenny.

The following are Qian Hu’s strategies for swimming against the current:

1. Increase ornamental fish exports beyond the more than 80 countries that it currently exports to. Focus on high-growth regions such as the Middle East, Eastern Europe, China and India.

2. Export its aquarium and pet accessories to more than 40 countries by end of FY2009 from 30 countries now.

In October 2008, the Group embarked on the second phase of its cutting-edge research on the Asian arowana that will eventually yield “pedigree” fish.

Armed with the findings from the first phase of the project which began in 2004, Qian Hu, in collaboration with Temasek Life Sciences Laboratory, plans to use in-vitro breeding to develop the pedigree Asian arowana, thereby enabling Qian Hu to be more effective in selective breeding and improving the quality and quantity of the future generations of the Asian arowana.

4. Increase its profit margin as profit growth in FY2009 is expected to be faster than sales growth, boosted by the Group’s strong brands, R&D performance and efficient supply chain management, as well as continued efforts in containing operating costs and enhancing productivity.

5. Continue to increase its domestic distribution of accessories and ornamental fish in its subsidiaries in Singapore, Kuala Lumpur, Beijing, Shanghai and Guangzhou. The growth in its Singapore base will be about the same as in FY2008, but the Group envisages that Thailand, Malaysia, and China will continue to grow at a faster pace. In China, for instance, Qian Hu will raise its distribution points from 150 locations to more than 200 in FY2009.

Qian Hu has proposed a first and final dividend of 0.2 cent per ordinary share, which translates into a dividend yield of 2.1%.

Recent stories:

QIAN HU eyes nascent Indian ornamental fish market

QIAN HU: Boosting sales of dragon fish