XTEP INTERNATIONAL Holdings Ltd (HK: 1368), the top-selling fashion sportswear maker in China, is on a mission to enable its brand name to closer approach ubiquity in the 1.3 bln-strong consumer market.

While it remains committed to the highest standards of quality control and keeping its ear to the ground to listen for changes in fashion trends within a very competitive industry, it also realizes that to capitalize on a brand recognition campaign it needs a complement of growing retail outlets to further penetrate into additional regions.

“In around five years, we will have 10,000 stores. This year our China-based retail outlets should rise from 5,405 to 5,800,” said CEO Ding Shuipo at a press briefing in Hong Kong last week coinciding with the company’s interim earnings release.

At the end of June this year, the group had a total of 5,869 retail outlets through its network of distributors or third-party retailers, of which 5,405 were Xtep retail outlets and 464 were other brands (Disney Sport and Koling) retail outlets.

During the period under review, the group established 10 new Xtep flagship stores in bustling commercial areas in cities including Shanghai, Hunan, Shandong, and Zhejiang and in the southern province of Guizhou, bringing the total number of Xtep flagship stores to 22.

“There’s still a lot of room for market growth for a fashion sportswear firm in China. We have a strong niche position in the sector for fashion and function, especially in second and third tier cities. And after we reach a critical mass in terms of market share, we will target international markets.

“We will continue to let fashion and sportswear demand drive our growth going forward and we want to make Xtep #1 in China for fashion sportswear,” said Mr. Ding.

But the nature of the fashion sportswear animal did not smile upon the passive. Only active, aggressive market-savvy firms stood a chance of running with the best.

“We are always keeping our fingers on the pulse of consumer demand and preferences. That is why although our past MO was OEM, now we are self-branding,” he said.

And although the ongoing economic slump and the increased reluctance by consumers to pry open their billfolds was always a concern, Xtep was still sanguine on its prospects going forward.

“Despite the unprecedented world-wide economic recession, we achieved remarkable achievements. The group continued to stand out from its peers through its unique strategy of combining sports and entertainment marketing. This strategy effectively strengthens Xtep brand’s position as the leader of fashion sportswear.”

The CEO added that aggressive tie-in marketing promotions were key to its long-term growth strategy, even more so considering that it was becoming an expert at mixing the most attractive draws from both the entertainment and sporting worlds.

“We successfully secured our position as the sole sports product partner for the 11th National Games of China, one of the most prominent national sporting events in the PRC held once every four years. Meanwhile, the group also sponsored a number of major regional sporting events including running contests, basketball tournaments and CX Games to enhance the corporate brand recognition.”

And fully utilizing the star power and glamour appeal of those celebrities far more likely to perform on stage rather than on a basketball court was what set Xtep apart from some of its domestic rivals like Li Ning, Anta and 361.

“We initiated a series of entertainment marketing activities and organized the ‘2009 Xtep Stars Nationwide Concert Tour’ in the major cities in China where Xtep brand’s major market focuses on provinces such as Hunan, Hubei, Anhui, Zhejiang and Jiangsu.

“These events will significantly increase Xtep’s brand awareness among our target customer group. In fact, we are the leading brand in Hunan,” he said, referring to the highly populated central Chinese province.

And Xtep was not shy about spending money to make money, especially in an industry where brand status and cachet-building were keys to success.

“In the first half, we boosted our A&P (advertising and promotion) expenses by around 60% (year-on-year),” he said.

A&P expenses for the first six months totaled 194 mln yuan compared with 113 mln a year earlier, while the R&D budget jumped to 28.5 mln yuan from 22.5 mln.

Mr. Ding believed that tying free megaconcerts into Xtep’s brand name offered more bang for the yuan than traditional broadcast and print media advertising.

“Costs to hold our promotional concerts are counted within our A&P budget and we give away tickets for free to audience members. But it’s actually more economical on a per-hour basis than TV ads, especially when compared to the Olympics-era rates,” he said.

But the company was not abandoning the mass appeal and exposure of the airwaves in its marathon race toward the finish line.

Xtep has formed a series of strategic partnerships with some of the most influential broadcasting channels in China.

“Through these channels with the highest viewer ratings in the PRC, the group’s thematic TV commercials were broadcast selectively during prime hours at channels which feature programs for young people. Strategic media partners include CCTV 1, the most influential national channel of China Central Television (CCTV), highly popular regional channels such as Hunan Satellite TV in Southern China and Anhui Satellite TV in Eastern China, as well as the dedicated national sports channel -- CCTV 5.

“We have also entered into a 2-year agreement with CCTV 5 and became the official partner with them from 2009 to 2010 to broadcast Xtep’s commercial during all their live coverage of sporting events.”

He said the company would continue to build on the long jump it enjoyed from China’s hosting of the Summer Olympics last year.

“Going forward, following the Beijing Games which has greatly stimulated people’s understanding and enthusiasm of sports in China are various large-scale international sports events in the pipeline to be held in the Asia-Pacific region. These sports events will provide tremendous opportunities in the sportswear industry in China.

“The upcoming 11th National Games of China will provide us a high-profile marketing platform. We can therefore leverage and enhance the Xtep brand’s recognition in Shandong province and further extend the retail network in the northeastern region of the PRC. Moreover, as we have established a leading position in Hunan province and nearby regions, we will also take this as a springboard to reach out to adjacent cities in provinces including Sichuan and Anhui,” Mr. Ding said.

He added that flagship stores were a key component in its race against the competition.

“We intend to reach in total 30 Xtep brand flagship stores by the end of 2009. We will also focus on expanding our profile in the second and third-tier market in the PRC. At the same time, Xtep aims to expand its brands’ presence into the global emerging markets and the Southeast Asian region.

“Following the PRC market, the group has successfully expanded the Disney Sports brand to the markets of Hong Kong, Taiwan and Macau and will further enhance its penetration of the international market. Hence, we endeavor to generate excellent results in the future for our shareholders.”

And despite the financial jitters still keeping consumers kicking tires or merely trying on shoes for size, Xtep would weather the downturn just fine, thank you very much.

“We are expecting 20% sales increase this half,” the CEO added. He said Xtep would likely rely less on discounts this half due to healthy sales momentum.

Downturn no hurdle as Xtep’s H1 performance sprints ahead

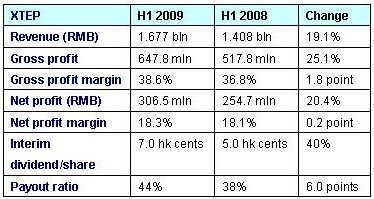

Xtep’s revenue in the six months-to-June rose 19% year-on-year to approximately 1.68 bln yuan.

First half gross profit and profit attributable to shareholders surged 25% and 20%, respectively, to approximately 648 mln yuan and 306 mln. Due to the good results, the Board of Directors declared an interim dividend of 7.0 Hong Kong cents per share, which is equivalent to a 44% payout ratio.

“We had a very impressive first half, with 25% gross margins,” said Xtep’s CFO, Mr. Terry Ho.

And the fashion sportswear firm was working to keep its investors satisfied.

“Because of our strong cash flow situation, we would like to increase dividend payouts. We believe we offer the highest payouts for a sportswear company,” Mr. Ho said at the earnings briefing in Hong Kong.

He said that Xtep was catching up to chief domestic rivals due to its continued emphasis on brand-building through a raft of promotional events and campaigns.

“Our pre-A&P net profit grew faster than Li Ning and Anta. But because our A&P budget rose to 11.6% of total costs (from 8.0% a year earlier) our net profit growth was slower than theirs. It’s necessary to increase our A&P budget to boost our market share.”

This included both linking its name to well-watched sporting events, but also more traditional straight advertisements on both local and national TV networks.

“We’ll continue to enhance our brand status by hosting major events like the 11th National Games, popular events like running and basketball, as well as more unique youth-oriented activities like the University Games.

“This year we have a very strong partnership with CCTV, and in Hunan we have the No.1 market share so we have good media relations there,” Mr. Ho added.

The first six months further clarified the company’s product emphasis.

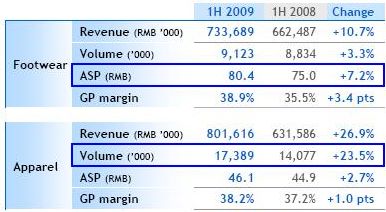

The Xtep brand continued to be the group’s major revenue stream in the first half, accounting for 92% of the group’s total revenue. As the brand status of Xtep increased, sales of Xtep branded footwear and apparel increased by 11% and 27% year-on-year, respectively, to 734 mln yuan and 802 mln.

Of the two main product categories, Xtep branded footwear posted a considerable improvement in gross profit margin by 3.4 percentage points to 38.9% on the back of an increase in average selling prices, while the gross profit margin of Xtep branded apparel widened by 1 percentage point to 38.2%.

As a result, the gross profit margin of the Xtep brand expanded by an impressive 2.2 percentage points to 38.5%.

Recent story: XTEP: Bargain stock at below IPO price?