Excerpts from recent analyst reports….

Credit Suisse raises Yongnam’s target price to 35 cents

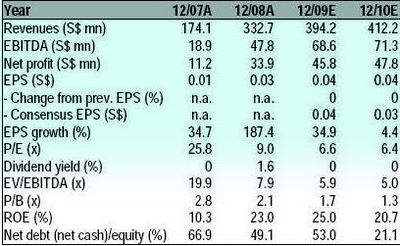

Credit Suisse (analyst – Chua Su Tye): Yongnam’s June quarter results were in line with our estimates. While revenues were flat, net profit jumped 22% YoY to S$10.6 mn, with 6MTD revenue and core earnings achieving 46% and 49% of our full-year FY09 estimates, respectively.

● Growth was driven by several ongoing large scale projects (the Marina Bay Sands IR and Vista Xchange hub developments), and completion of the New Delhi International Airport, with structural steelworks up 16% YoY, while commencement of the Marina Coastal Expressway project partly offset reduced activities at the IR, for the specialist civil engineering segment (-36% YoY).

● Going forward, we see strong earnings growth visibility for Yongnam extending into FY11E, with its outstanding order book at S$497 mn, but which we estimate to reach S$700 mn by FY10E, would be progressively recognised over the next three years.

● We have kept our forecasts intact, but roll over our DCF-based target price. We now see fair value at S$0.35 (from S$0.30), which implies 25% upside, and reiterate OUTPERFORM.

Yanlord: JP Morgan retains its ‘neutral’ rating and $2.80 target.

JP Morgan (analysts – Joy Wang, Lucia Khong, Christopher Gee): With land prices having run up significantly in China, management indicated that they have sufficient landbank to sustain their growth in the near term and would be rather rational in making the acquisition decisions.

Given most of Yanlord's major launches are done for the year, we believe that the stock is likely to be range bound in the near term.

• We retain our Neutral rating on Yanlord, with our Jun-2010 price target unchanged at S$2.80/share, on par with our RNAV estimates.

Key risks to our rating and price target include a substantial increase in ASP achieved and a quicker-than-expected deployment of the 'war-chest'. A key downside risk would be potential measures from the government.