Straits Asia Resources recently traded at $1.60

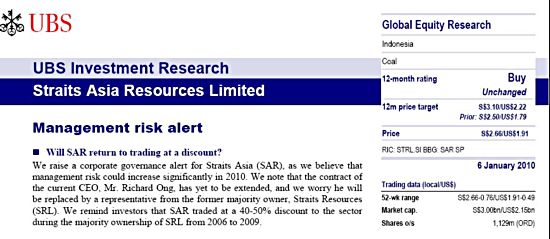

UBS maintains ‘buy’ on Straits Asia Resources

We maintain our Buy rating for Straits Asia following our revised coal price estimate for 2010-13. We lower our price target from S$2.80 to S$2.50 as we increase our 2010 target PE from 8.4x to 12.7x following a lower risk-free rate from 12.8% to 11.5% but lower our 2010 EPS estimate.

Our revised thermal coal price assumptions accounts for 95% of the total net earnings revision. We

highlight that the effect on Straits Asia’s earnings is negative relative to its peers as we have previously factored in a higher coal price to account for high-priced contracts. This followed SAR’s US$230m refinancing last year, as lenders required the company to contract future sales in order to provide earnings security.

However, in the meantime it has been necessary to renegotiate select contracts in order to maintain customer relationships. Consequently, we reduce our average selling price estimate by 16% for 2009, while increasing our quality discount assumption slightly to account for a higher production output from the lower calorific Jembayan mine.

Target price for IndoAgri: $1.35

DBS Vickers says Indofood Agri has ‘sweeter outlook”

Notwithstanding an anticipated rise in palm oil inventory over the next few months, we believe seasonal weakness in Crude Palm Oil price is temporary. IndoAgri is now attractively priced and yields 17.4% upside given our target price of S$1.35. We reiterate our Buy call on the stock.

IndoAgri strives to maintain profitability and – in line with rising CPO prices – has recently raisedits cooking oil selling prices. The group may have a second price increase this month, which will maintain EBITDA margin of between 5 and 10%.

CIMB neutral on China XLX Fertiliser

We have conservatively kept our urea average selling price assumptions of Rmb1,725/tonne for FY09 (up just 1%), as improvements could be limited by offsetting export duties, and the current oversupply negates the effect of the price-cap removal by the government.

Maintain Neutral and target price of S$0.34, still pegged at 6.2x CY09 P/E. In our view, the stock could continue to trade at a wide discount to Hong Kong-listed peers and about the sector average, due to its limited urea export exposure vs. China BlueChemical (3983 HK). CXLX’s portfolio is also less diversified than that of Sinofert Holdings (0297 HK).

CXLX’s tax holiday has expired and it will attract a 17.5% tax rate in FY09-11. That said, lower anthracite coal prices (Rmb880/tonne) are a positive. We are not expecting a turnaround for CXLX in 2Q09, but the above factors have been captured in our forecasts. Maintain Neutral.

Recent story: INDOAGRI: FY08 EBITDA up 102%