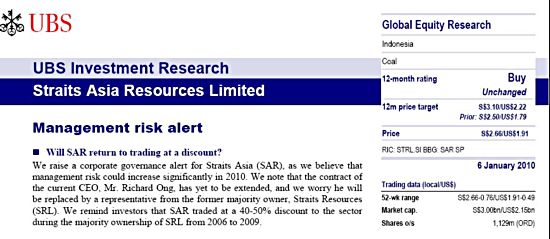

UBS has a buy rating on SAR, raising the target from $2.50 to $3.10 because of a favourable macro coal outlook

STRAITS ASIA RESOURCES shares closed down a hefty S$0.11 today, or 4.04%, to $2.61, following an unusual report by UBS Investment Research.

Noting that Straits Asia Resources CEO Richard Ong’s contract has yet to be renewed, UBS said “we worry he will be replaced by a representative from the former majority owner, Straits Resources (SRL). We remind investors that SAR traded at a 40-50% discount to the sector during the majority ownership of SRL from 2006 to 2009.”

Mr Ong’s contract expires 27 May this year (it’s 2010, although the UBS report repeatedly says 2009).

Richard Ong, CEO, Straits Asia Resources.

UBS said five primary things will likely happen if Mr. Ong’s contract is not extended.

� Firstly, Mr. Ong would be replaced by a representative from SRL.

� Secondly, the new management would continuously attempt to employ a high dividend policy, which would likely result in continuously low investment in SAR’s reserves and production, in our view.

� Thirdly, the new management would continue to charge SAR technical fees, which are not in line with industry practices and would put downward pressure on SAR’s earnings.

� Fourthly, the Brunei and Madagascar coal concessions could be sold from APM to SAR before political certainty, production, investment costs and reserves relating to the concessions have been clarified.

� Fifthly, SAR’s share price would decline and de-rate to a point where thecompany would trade at a significant discount to the sector.

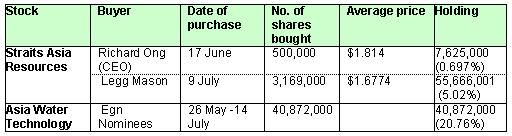

SRL owns 18% of Straits Asia Resources, a stake that was pared down from 46% - perhaps against its own wishes – through a sale to PTT International (Thailand).

As UBS noted: “The transaction was completed at the bottom of SAR’s 2009 share price of S$0.807, as we believe SRL was forced to sell down due to continuous capital commitments atits partially loss-making mining operations in Australia.”

Given its 28% controlling stake and majority board seats, PTT International(Thailand) will likely be the decisive factor in choosing SAR’s future CEO.

Photo: Straits Asia Resources website.

However, UBS currently assigns the highest likelihood (50%) to the scenario where Mr. Ong is replaced by a representative from SRL; and 30% to scenario that Mr. Ong’s contract is extended; and the base case scenario assumes that Mr. Ong is replaced by a PTT representative.

On why it thinks Mr Ong will be shown the door, UBS said: “We believe Mr. Ong’s management strategy is not consistent with SRL’s management practices, such as SRL’s preference for a high dividend payout, high technical fees, and acquisition proposals that favour SRL.

"Consequently,we do not believe that SRL intends to extend Mr. Ong’s contract, which expires on 23 May 2009.”

UBS states its preference for Mr Ong to continue as CEO:

* Strong track record. Mr. Ong has developed SAR since 1994 from being a small producer and single mine operation to among the top eight largest mines in Indonesia today. In particular, we are encouraged by SAR’s infrastructure capacity which, contrary to the remaining Indonesian coal sector, exceeds its production capacity significantly. This is testament to Mr.Ong’s foresight and commitment to reach 20 mt production by 2012 from 9mt currently.

* Replacement and execution was swift. Following the collapse of the bargeloader, Mr. Ong immediately minimised the damage by employing replacement equipment, which should keep the production volume intact and only add 5% to production costs in 2010.

To this end, we believe SAR willemerge stronger from the accident in 2011 as a higher capacity loader will berebuilt on a granite surface close to the current barge loading site, which should be partially financed by the insurance proceeds from the collapse.

* Very modest ownership plan. We highlight that Mr. Ong’s compensation has been low by industry standards, as he currently owns less than 1% ofSAR. We attribute the modest MSOP agreement to SRL’s continuous attempts to increase dividend payouts for its own benefit.

UBS, in further support of Mr Ong, said SAR’s shares only declined 6% immediately following the recent collapse of the barge loader at its Jembayan mine, and have since gained 29%, reaching the highest level since 2008.

”As such, we note that SAR has performed significantly better under PTT and Mr. Ong’s management when compared with during SRL’s majority control when the company was trading at a 40-50% discount to the sector.”