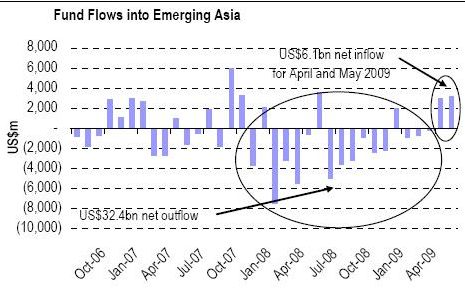

In May 2009, the net inflow to Emerging Asia markets were US$3.1 billion, while April saw an inflow of US$3 billion for a cumulative net inflow since the markets turned in March 2009 of US$6.1 billion.

CIMB, in a report yesterday, said this inflow was 20% of the cumulative outflow of US$32.4 billion in the bear market (from November 2007 to March 2009).

”Foreign funds have, in a mere two months, put back 20% of what was taken out over 17 months. This could be a measure on the abundant global liquidity now that is driving the powerful rallies once risk appetite switches directions. We expect that the likelihood of more inflows to be high over the coming months on that note.”

Sources: EPFR, CIMB Research

The CIMB research report, co-authored by Toh Hoon Chew and Chang Chiou Yi, noted that Singapore has a head start among the five Asean countries under coverage, and is a clear favourite among foreign funds.

Singapore’s current weighting of foreign funds of 5.5% as a percentage of Emerging Market holdings is strong when compared to the average of 5.8% post Asian crisis and is higher than 5.2% on average during the 2003-07 upcycle.

Indonesia comes in a strong second when comparing the current foreign fund weighting against its own historical averages. The strong political landscape and commodities exposure bodes well, but it is local funds that are driving the markets up.

Thailand is slipping as well on political uncertainties, but not to the extent that Malaysia is experiencing. Hong Kong meanwhile looks relatively neutral.

China, however, is very strong magnet for funds. From a mere 3.8% of the total Emerging Asia holdings of the sample funds tracked by EPFR as at September 1998 (Asian crisis market trough), its weighting is now 33% (latest as at May 2009).

”Over the same period, the combined weightings of the five countries under our coverage have fallen from 52.5% to 25.5%. What we have lost, China has gained,” said the CIMB report.

Keppel Land is developing Central Park City condominium in Wuxi, China

The report recommended the following buys for the Singapore market, and the reasons:

1. Keppel Corporation (target price: $8.50) – Keppel Corporation could boost its order book (S$9.5bn) by another US$4bn for FPSO hull constructions.

2. Keppel Land (target price: $2.77) – we believe investors should now turn towards KepLand's balance sheet and asset quality. We estimate current share price to imply office rents at depressed levels of S$5-6psf based on peak cap rates of 6%. This should form a good support level for the stock. The renewed optimism for properties in China, Singapore and Vietnam should also allow KepLand to turn its inventory.

3. OCBC (target price: $7.79) – Marked-to-market reversal of losses could see OCBC enjoy some benefit. Subsidiary GEH had a bad 2008 but could reverse some of those losses in 2Q asequity markets and bond markets have done well.

The stocks to sell, according to CIMB, are:

1. Capitaland (target price: $1.84) – Stock is implying asset values that exceed our most bullish estimates for its physical properties. Negative catalyst from write-down of asset values (alreadyguided) when next results is out; key candidates for write-downs are China property, Char Yong Gardens, Farrer Road site.

2. Cosco (target price: $0.36) – Poor results, weak demand outlook for bulk-shipping and ship-building are a feature and liquidity-driven run-up in share prices makes it a candidate for profit-taking as markets cool.

3. SIA (target price: $9.60) – Passenger load factors have not recovered, yields are likely to come down significantly. Cargo remains in the red. Specter of swine flu adds another threat.Profitability will be tested severely this year.

Recent article: BNP Paribas: 10% more correction, then it's target 2,600 points

Post or read comments in our forum here.