The SEXY Victoria Junior College girl has been spending a lot of time with us. Out of the blue one day, she emerges with the maximum value that one should pay for Cambridge Industrial Trust.

(She is really quite interesting and surprising! And she likes to determine the Value of anything.

For example, she even determines the value of playing tennis vs spending time with us and she comes up with a figure.)

Anyway, she told us that her teacher says females are better at investing and guys suck cos guys monitor the stock market too much and think too much and rationalise too much.

She also told us her teacher says its the female species that will bring the world out of recession cos her species spend and spend and spend and spend. We got to admit she is right. Just go to a shopping center near you and see who are the ones spending? It's the girls......

Ok let's understand how our SEXY VJC student determined the maximum value of Cambridge. Any amount paid more for Cambridge, you are likely to lose money (based on Discounted Cash Flow analysis, excludes Market Irrationality).

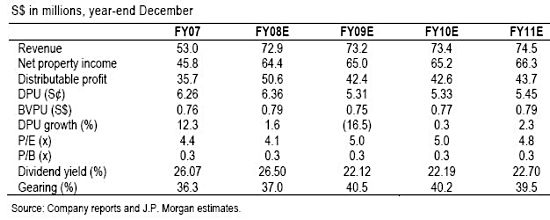

Based on Colliers International data above, it is logical to assume that the rental income growth rate g of industrial properties is 0%, by looking from 2001 to 2006F. (just a cursory glance, she did not do a regression line. Keep it simple. It looks negative actually but let's be nice.).

Based on SGX data, the average dividends, D, of Cambridge Industrial Trust for 2007 and 2008 is $0.0616.

Let's use DBS preferential shares of 6% as our required rate of return, K.

Now, let's look at the average number of years that the assets of Cambridge Industrial Trust have to their expiry as all of them are leasehold except for Lam Soon Industrial which is Freehold. (We will assign 999 years to this freehold property. This is just a judgment call.)

The average number of years left to expiry is 65 years (table on the right).

Using Excel spreadsheet and plugging in the values, the Fair Value (V) for a Cambridge Industrial Trust share is $1.00341.

That’s the maximum amount one should pay and it assumes that Cambridge is able to sustain the average occupancy of its premises currently.

It also assumes that the rentals do not drop and stays constant. It also assumes no exceptional things like volcanic eruptions or earthquake or fire or Tsunami or Terrorist attack happens on any of its site.

So the market price currently as of close 28 Nov 2008 is $0.205. Is it enough for you?

Analysis done by The SEXY VJC GIRL (Aspiring Future Venture Capitalist- who wants to hire her as an intern?)

Important: The objective of the article is to set you thinking about the company before you invest your hard-earned money. Do not invest solely based on this article. Unlike House or Instituitional Analysts who have to maintain relations with corporations due to investment banking relations, generating commissions,e.t.c, SGDividends say things as it is, factually. Unlike Analyst who have to be "uptight" and "cheem", we make it simplified and cheapskate. -The Vigilante Investor, SGDividends Team

Reproduced from http://sgdividends.blogspot.com with permission.

Recent article: REITS: Kim Eng Securities report on yields

You are welcomed to post a comment or question at our forum.