IF THE old cliché, fortune favours the brave, is anything to go by, Mencast Holdings could be in for rolling good times.

After all, the manufacturer of marine sterngear equipment recently shrugged off all volatilities surrounding the local bourse to become the first to successfully list on SGX Catalist, marking a new chapter of growth for the company.

“Going for a public listing has always been our long-term strategy to tap the capital market for further growth,” Glenndle Sim, chief executive officer of Mencast, told Shares Investment (Singapore) during a recent interview.

Despite being listed in such uncertain times, Mencast managed to scale as high as $0.31 on its maiden day of trade. It closed the day at $0.29, translating to a 3.6% premium over its $0.28 initial public offering (IPO) price.

Propelling The Oil & Gas Industry

According to the management, most of the company’s sterngear equipment and services are supplied with a certificate of analysis detailing the chemical compositions and mechanical properties, which conform to the requirements of the relevant Classification Societies.

For the uninitiated, Classification Societies are non-governmental organisations or groups of professionals, ship surveyors and representatives of offices that promote the safety and protection of the environment of ships and offshore structures.

As one of the first sterngear equipment manufacturers in Singapore to achieve the ISO9001:2000 Quality Management System in 2003, Mencast plays an important role in supporting the buoyant offshore oil and gas and marine industry.

“Without propellers, vessels cannot sail. Without propellers, vessels cannot maintain distances or pull out anchors from the rigs,” remarked Sim.

Serving local and regional shipyards and shipowners, Mencast counts amongst its major customers prominent names such as the ASL Group, the Berg Propulsion Group, the Keppel Group, Labroy Shipbuilding and Engineering, Nam Cheong Dockyard, NGV Tech and the SembCorp Marine Group.

On A Healthy Growth Path

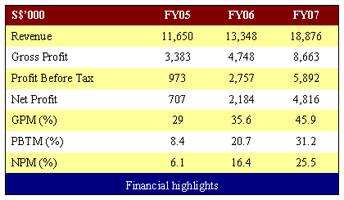

From FY05 to FY07, the company’s revenue and net profit increased at a compounded annual growth rate of 27.3% and 161% respectively.

More importantly, its gross profit margin jumped from FY05’s 29% to FY07’s 45.9%. Notably, the company has an order book of $11.2m. In a bid to fortify its industry position, Mencast intends to embark on a number of business expansion initiatives.

Firstly, the company has plans to raise its production and storage capacity on local shores through the acquisition of another factory premise situated at No. 12 Kwong Min Road.

This is to cater for the expected rise in demand for its sterngear equipment and services. “We have already bought the building and made the down payment,” commented Sim.

“In order to improve the level of efficiency, our existing production facility will become the foundry and carry out state-of-the-art machining works, while most of the steel works will be moved to the new factory,” he added.

Furthermore, Mencast is looking at enlarging its geographical coverage by building new service centres in other countries, particularly Indonesia and East Malaysia, so as to be in close proximity to several of the major shipbuilders, which have shifted their operations to the aforesaid regions to lower their costs of production.

In fact, the company has earmarked $1.8m of the net proceeds from the IPO to fund this expansion.

Reasonable Valuation

Based on its recent share price of $0.275, Mencast is trading at a historical P/E of a mere 8.4 times.

This is definitely comparable to some of its peers that are also supporting the promising offshore oil and gas and marine industry.

They include ASL Marine, Aqua-Terra Supply and BH Global Marine, which are trading at a historical P/E of 9.3 times, 8.2 times and 6.7 times respectively. Meanwhile, Sim remains sanguine about the prospects of the offshore oil and gas and marine industry over the next couple of years.

“Regionally, orders for ship engines take around three years to fulfil, yet companies like Swiber, Swissco and Ezra will literally wait for these engines.

If these players need engines, they would also need shafts and propellers,” said Sim, who owns a 21% direct interest in Mencast. And with oil prices hitting record highs, there could be an increase in the capital expenditure for the exploration, development and production of offshore oil and gas.

This certainly spells good news for Mencast, which endeavors to become a one-stop centre providing comprehensive solutions for sterngear equipment and services.

Originally published at www.sharesinvestment.com, this article is reproduced here as part of a collaboration with NextInsight.