Colin Tan, research head, Chesterton International

WAS IT not so long ago that we heard complaints of unreasonable hikes in rental?

Between 3Q 2006 and 2Q 2008, the official rental index went up by a hefty 69%. This is almost 10% each quarter. What were the factors responsible for this?

It must be higher demand. It cannot be anything else but … is it?

Amid the euphoria and excitement of the award of the two integrated resorts and the anticipation of the tremendous spillover effects, the market misread the causes. Many attributed it to the surge in foreign talent arriving on our shores.

For sure, more were coming but was it in such large numbers as to cause rents to escalate to such dizzy heights?

Even the new planning population parameter used by our planners to prepare Singapore to accommodate up to 6.5 million people was loosely bandied around as proof that government officials shared the same view. Investors bought the story and snapped up apartments at prices which presupposes a continuation of that strong upward trend.

However, official figures showed the number of rental contracts actually contracted by 17.6% in 2006. It was flat for 2007. On the other hand, average rentals rose by 15% and 43% in 2006 and 2007, respectively.

So, where are the missing expatriate households? Certainly, the high rents did cause some to leave Singapore, others - especially PRs - to purchase and for those without a generous budget, to rent HDB flats.

But shouldn’t there have been at least a substantial - if not dramatic - net gain? After all, they were supposed to have come in droves. The mystery is solved if we realise that the spike was caused, not by a steep jump in demand as many had assumed, but by a sharp contraction in supply.

The net result may be the same but the implications are different. The surge in en-bloc sales had led to groups of tenants being thrown wholesale out of their homes. The competition for homes simply drove rentals sky high. There are no official figures but I estimate that the supply of rental accommodation to have shrunk by at least a quarter to a third of the existing stock.

Today, the rental market has stabilised. Those seeking homes would have found them by now either by buying, downgrading or leaving Singapore. What are the market implications? First, there are now no hordes of expatriates scrambling for accommodation. This means demand will lag supply.

Rents will decline. Lower rents translate to lower yields. Second, for less prime units, it will come to a point when the low rents make no sense. It will be better to sell.

The net yield may turn out to be below 1.8%, which is a very low return.

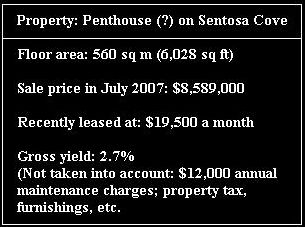

A recent consultant’s report extolled the benefits of owning a home on Sentosa Cove. In a following news report, a $19,500 monthly lease was reported as being achieved recently.

Checks revealed that the 560 sq m unit was sold in July 2007 for $8,589,000. It is probably a penthouse. This translates to a gross yield of 2.7%.

Does this even cover the housing mortgage rate? Lest we forget, we have not factored in property tax of 10% or maintenance charges of about $12,000 a year for a penthouse.

What about the additional security cost for Sentosa homes? Costs of furnishings?

Eventually, the net yield may dwindle to below 1.8% - certainly a high risk to take for such a low return. Is this situation typical of other “investor” units completing over the next 12 months? I hope I am wrong but I fear this may be so.