IF YOU have passion for something early in life, you probably have an aptitude for it. And you probably will be good – nay, very good - at it.

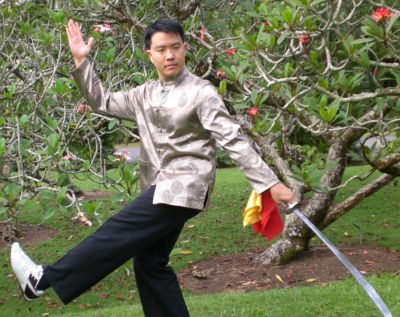

Ang Hao Yao is an example of that.

He remembers his interest in investing began to glow as early as when he was in secondary school. Helping to fan his interest was a teacher with whom he conversed on stocks.

“I remember discussing shares with a teacher whom I saw perusing share prices listed in the newspaper.”

At home, Hao Yao was lucky that his father was also encouraging his interest.

When it came time for him to choose his university education, he pursued learning that would come in handy for investment success. He achieved not only two bachelor’s degrees in mathematics and economics but also an MBA.

At 27, after a few years as a bank officer, he quit to become a full-time investor.

I asked him what stocks might he regard as gems?

“Picking stocks is a matter of personal preference. Even if two people picked the same stock, one can make a profit and another may not. The reason is that picking the stock is but only one part of the battle. Other important decisions thereafter are when to take profit, average down or cut losses.”

Having said that, he revealed that he recently accumulated shares of Sarin Technologies, an Israeli company involved in the diamond industry; QAF, a food manufacturer; and Orchard Parade, a hotel owner.

*****

DAVID LAM has made his money – really big money. He was listed by Forbes magazine last year as being among Singapore’s 40 richest men.

In my interview with him at his Bukit Timah bungalow, this is what I learnt:

* In investing some of his wealth, he has two investment properties and shares in other companies – in addition to his home which he bought for $6 million about 10 years ago.

* He is passionate about cars and owns a Jaguar XJR, the latest in a long line of Jaguars that he has owned since he could afford them.

* When it comes to mobile phones, “so long as they can ring, that’s good enough for me.”

He tends to get his phones for free as he waits until it is time to renew a subscription contract for the phone line.

David is founder and chairman of Goodpack, which is listed on the Singapore Exchange.

Recent NextInsight story: GOODPACK: First major foray into China

*****

JOHN NEFF – heard of him?

He is not as well known in Singapore as the likes of Warren Buffett and George Soros.

But he is a super money manager. And he has written a book that can be as valuable as any of the best on how to invest successfully.

Neff was portfolio manager for Vanguard's Windsor Fund for 31 years, beating the market in 22 of those years.

His fund routinely featured in the top 5 per cent of all US mutual funds. By the time he retired in 1995, each dollar invested in his fund at the start of his tenure in 1964 was worth $56, compared to $22 for the S&P 500.

“Nobody has ever managed a large mutual fund so very well for so very long a time. And no one is likely to do so ever again,” wrote Charles Ellis, chairman of Yale University’s Investment Committee, in his foreword to the 267-page book.

My full articles on the above are published in the latest issue of PULSES, which is available at the news-stand for $5.50.