Lunching with Singapore analysts in Dongguan: Fung Chi Wai, the CEO, is a 25-year veteran of Jadason.

Lunching with Singapore analysts in Dongguan: Fung Chi Wai, the CEO, is a 25-year veteran of Jadason. Photo by Leong Chan Teik

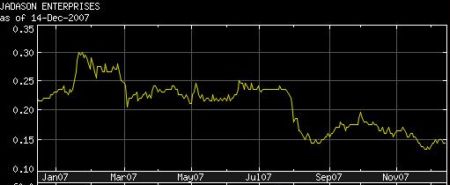

FROM A high of 31.5 cents early this year, shares of Jadason Enterprises fell to as low as 13.5 cents in November.

As the net tangible assets of the company is higher at about 14 cents, the company started its share buyback programme, buying 300,000 shares at 13.5 cents in November 27. (The stock recovered and has not traded at 13.5 cents or lower since then.)

At that price and assuming an unchanged net dividend of 0.8 cents, the yield works out to be 5.9%.“We have good reason to buy back our shares at that level,” said Fung Chi Wai, its CEO.

He was responding to questions during a trip made by Singapore analysts and NextInsight to Jadason’s manufacturing plant in Dongguan, in south China, recently.

The share buyback amounted to $41,000 but the company has lots of cash to sustain the buyback if the opportunity arose again. It had cash of about S$18 million as at the end of Sept this year.

Jadason has another motivation for buying back shares: it will also benefit employees, who hold in aggregate about 25 million stock options outstanding with the strike price being between 13 cents and 20 cents.

Drilling for big profits

Listed on the Singapore Exchange since 2000 and having a market capitalisation of about $105 million based on a recent stock price of 14.5 cents, Jadason has two key businesses:

* It distributes almost the full range of equipment that is required for the manufacture of printed circuit boards. This segment contributed 48% of the operating profit and 70% of revenue of Jadason in the first nine months of this year.

* It provides manufacturing and support services to printed circuit board makers. In other words, Jadason will use the very same machines that it distributes to do services that its buyers are not able to cope with.

“The drilling process is the bottleneck of the printed circuit board industry,” said Mr Fung.

Fung with analysts (front row, from left) Lee Kok Joo (Phillip), Geraldine Eu (Kim Eng) and Jacky Lee (CIMB-GK). Photo by Leong Chan Teik

Fung with analysts (front row, from left) Lee Kok Joo (Phillip), Geraldine Eu (Kim Eng) and Jacky Lee (CIMB-GK). Photo by Leong Chan Teik

This segment has a higher profit margin than the distribution business: It contributed 52% of Jadason's operating profit and 30% of its revenue for the first nine months of this year.

A key service is the drilling of microscopic holes in printed circuit boards.

The walls of the holes, for boards with 2 or more layers, are plated with copper to allow for electrical connection between the conducting layers of the printed circuit board.

“The advantage we have is that since we are the supplier of the machines, so we know how to fine-tune the machine to speed it up,” said Mr Fung, explaining this business segment of Jadason.

Printed circuit boards are used in many electronic gadgets, including personal computers and mobile phones.

At Dongguan: Jadason has a new factory for drilling services. Photo by Leong Chan Teik

At Dongguan: Jadason has a new factory for drilling services. Photo by Leong Chan Teik

Drilling services for printed circuit boards for personal computers command lower profit margins than for mobile phones.

The printed circuit board industry in China is on edge as it waits for the Chinese government to issue 3G licences to Chinese telecom operators, so they can set up 3G networks using the Chinese standard.

China has given a commitment that 3G networks will be in place before the Olympic Games in Beijing in August 2008.

"When that happens, not just Jadason but a lot of businesses will be very busy,” quipped Mr Fung, a 25-year veteran of Jadason.

A SBI E2-Capital report in Dec '07 noted that the TD-SCDMA network in ten Chinese cities has been completed and trial operation would begin soon. "We expect handset makers to benefit from this," said the report.

Drilling bits to punch tiny holes in PCBs.

Drilling bits to punch tiny holes in PCBs. Photo by Leong Chan Teik

As the 3G launch in China will benefit the local handset industry, Jadason expects to share in the good times as its support services for printed circuit boards reap higher profit margins than boards for personal computers.

In addition, most of Jadason's end-customers for handsets are the local China handset manufacturers.

These local players will benefit more from the 3G launch than foreign manufacturers as the 3G will be based on the Chinese standard ("TD-SCDMA") instead of foreign standards "W-CDMA" or "CDMA2000"

In preparing for a surge in work, Jadason has been expanded its capacity for doing mass-lamination of printed circuit board – that is, multi-layer boards.

From 800,000 sq ft, the production capacity grew to 900,000 sq ft this year and will surge to 1,700,000 sq ft next year. And it has upped the number of drilling machines from 105 in 2005 to 140 last year to 220 this year.

In all, Jadason’s capital expenditure costs S$15-20 million a year.

Asked about the company’s dividend policy, Mr Fung said: “Our policy is when we make more profit, we will pay more to shareholders.”

That’s why last year when the net profit rose 93%, the dividend payout rose from 0.375 cent to 0.8 cent a share. Top management has an incentive to do so. Mr Fung owns a 4.72% stake in Jadason (which has a share capital of 726.1 million shares) while chairman and founder Sung Poon Chung owns 32.73%.

Asked about the company's $40 million bills receivable as at Sept 30, he said Jadason has a negligible problem with bad debts. “Every year, it is less than $200,000 or less than $100,000 only.”

52-week trading range: 13-31.5 cents

52-week trading range: 13-31.5 cents

Stock matters

At 13.5 cents, the historical PE of the stock is 4.2.

The PE ratio for the current year probably is higher, considering that in the first nine months of this year, Jadason's net profit was 23.5% lower (S$10 million) than in the same period last year.

There will be earnings per share dilution too, as the company placed out 100 million new shares early this year at 23.7 cents a share. All that is historical, of course, and will become sidelined if Jadason can greatly benefit from China's impending 3G launch.