- Posts: 1089

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

World Precision Machinery

13 years 11 months ago #8422

by Joes

Replied by Joes on topic Re:World Precision Machinery

James, it looks like they took on bank loans for the expansion of their new factory. This looks normal capex. What do you reckon is an acceptable gearing ratio?

Please Log in to join the conversation.

- Eagle

- New Member

-

Less

More

- Thank you received: 0

13 years 11 months ago #8423

by Eagle

Replied by Eagle on topic Re:Re:World Precision Machinery

Finance expense is really ballooning due to building the Shenyang plant. But total finance expense in FY2011 (Rmb 11m) still a fraction of gross profits from Bohai region (~Rmb70m).

Please Log in to join the conversation.

13 years 11 months ago #8428

by jameskuwe

Replied by jameskuwe on topic Re:Re:Re:World Precision Machinery

i just checked the company's financial statements. over the last 6-7 years, its eps is actually declining 2010-0.314 2009-0.153 2008-0.320 2007-0.361 2006-0.384 2005-0.305 2004-0.401 Additionally, its capex is so high every year that, with the exception of 2 years, the capex is higher than cash flow from operating activities. Regardless of its revenue, profit or debts, i think i am opting out of this company.

Please Log in to join the conversation.

13 years 11 months ago - 13 years 11 months ago #8547

by Joes

Replied by Joes on topic Re:World Precision Machinery

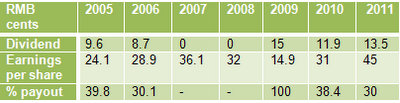

EPS picked up in recent years

WORLD PRECISION: Grows FY2011 net profit 44% to Rmb 180m, blue-chip dividend policy

WORLD PRECISION: Grows FY2011 net profit 44% to Rmb 180m, blue-chip dividend policy

Last edit: 13 years 11 months ago by Joes.

Please Log in to join the conversation.

13 years 11 months ago #8560

by Joes

Replied by Joes on topic Re:World Precision Machinery

Jameskuwe:

They have a big project in Shenyang.

Land cost : RMB123 million.

Total capex (incl land cost) : 500 – 700 m RMB.

1st phase will be completed in 2H2012.

2nd phase in 1H2014.

Q: Why are you expanding your facilities at Shenyang?

We want to be nearer to customers in the Bohai area in Northeastern China, which is a hub for large heavy industries. Leading automotive manufacturers such as BMW and FAW have set up their bases there. Germany’s BMW has a base at Shenyang and there are several hundred high-end automotive component factories serving BMW there. These high-end automotive component factories are very large organizations and rely on us to manufacture and supply their capital equipment. It took us only three years to generate annual revenue contribution of almost Rmb 180 million from this region.

We are producing high-tonnage equipment valued at Rmb 3 million to Rmb 5 million each for our Bohai customers. It is expensive to transport such heavy products from our existing facilities at Danyang to Bohai. Steel, which accounts for about 80% of our cost of goods sold, is also produced in Northeastern China. We can save about 10% in cost of production by eliminating long distance transportation when procuring for steel and delivering our products.

Secondly, the Shenyang government has offered the World Group many investment incentives because it is one of the top 500 PRC enterprises. For example, World Precision was able to acquire land use rights at a 30% discount to market rates because its products directly support high tech heavy industries. To develop the Bohai region into a hub for heavy industries, the government is giving tax rebates to relevant manufacturers like World Precision.

They have a big project in Shenyang.

Land cost : RMB123 million.

Total capex (incl land cost) : 500 – 700 m RMB.

1st phase will be completed in 2H2012.

2nd phase in 1H2014.

Q: Why are you expanding your facilities at Shenyang?

We want to be nearer to customers in the Bohai area in Northeastern China, which is a hub for large heavy industries. Leading automotive manufacturers such as BMW and FAW have set up their bases there. Germany’s BMW has a base at Shenyang and there are several hundred high-end automotive component factories serving BMW there. These high-end automotive component factories are very large organizations and rely on us to manufacture and supply their capital equipment. It took us only three years to generate annual revenue contribution of almost Rmb 180 million from this region.

We are producing high-tonnage equipment valued at Rmb 3 million to Rmb 5 million each for our Bohai customers. It is expensive to transport such heavy products from our existing facilities at Danyang to Bohai. Steel, which accounts for about 80% of our cost of goods sold, is also produced in Northeastern China. We can save about 10% in cost of production by eliminating long distance transportation when procuring for steel and delivering our products.

Secondly, the Shenyang government has offered the World Group many investment incentives because it is one of the top 500 PRC enterprises. For example, World Precision was able to acquire land use rights at a 30% discount to market rates because its products directly support high tech heavy industries. To develop the Bohai region into a hub for heavy industries, the government is giving tax rebates to relevant manufacturers like World Precision.

Please Log in to join the conversation.

13 years 11 months ago #8572

by Joes

Replied by Joes on topic Re:World Precision Machinery

CIMB covered the investor presentation yesterday, including the Q&A, in a good report this morning.

Corporate Focus Series…

How is WPM going to fund its projected RMB 600m capex for the Shenyang plant?

WPM will fund this through its internally generated cash and debt. Currently WPM has approximately RMB 250m in cash and a yet to be drawn down bank facility of RMB 300m. The cost of debt for WPM is about 6%. WPM does not discount the fact that they may dip into the equity

market if required.

• Why is the share price of WPM constantly depressed despite its strong growth prospects and historical performance?

According to CFO, Samuel Ng, the fundamentals of WPM are strong. The major reason for its depressed valuation comes from the stigma on S-Chip companies. People generalize that all S-Chip companies are indecent due to a few bad eggs that tarnished the image of S-Chip companies. There is also a misalignment in media reports with the media preferring to constantly

highlight bad S-Chip companies and neglect the existence of genuine Chinese gems.

Corporate Focus Series…

How is WPM going to fund its projected RMB 600m capex for the Shenyang plant?

WPM will fund this through its internally generated cash and debt. Currently WPM has approximately RMB 250m in cash and a yet to be drawn down bank facility of RMB 300m. The cost of debt for WPM is about 6%. WPM does not discount the fact that they may dip into the equity

market if required.

• Why is the share price of WPM constantly depressed despite its strong growth prospects and historical performance?

According to CFO, Samuel Ng, the fundamentals of WPM are strong. The major reason for its depressed valuation comes from the stigma on S-Chip companies. People generalize that all S-Chip companies are indecent due to a few bad eggs that tarnished the image of S-Chip companies. There is also a misalignment in media reports with the media preferring to constantly

highlight bad S-Chip companies and neglect the existence of genuine Chinese gems.

Please Log in to join the conversation.

Time to create page: 0.262 seconds