- Posts: 1089

- Thank you received: 25

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

Abterra -- Good deal ?

15 years 9 months ago #3818

by Joes

Replied by Joes on topic Re:Abterra -- Good deal ?

Market is not perturbed by the latest announcement that the idea of a dual listing will hv to be revisited next year. Stock is steady at 6 cents. I think this year would be a good year for Abterra considering the various corporate developments they hv announced in the last six months or so.

Please Log in to join the conversation.

15 years 5 months ago - 14 years 8 months ago #4350

by Joes

Replied by Joes on topic Re:Abterra

Broker sent this:

Firstly, Abterra today is trading on a 25 to 1 Consolidated Basis.

Yesterday last trade done was 4cts.

Today, in theory stock ought to trade at $1.00

Yesterday you have 25 lots...today you have only 1 lot.

Now, this morning, at 0859-0900 hour matching time, a whopping 17.294

Million shares was MATCHED at 82cts.

The next done was at 88cts, then 89.5c...

Now it's at $1.28. Volume at 75m. WHY?

The shake-out news...1 red-hair-devil Broker SHORTED 17M shares that it

didn't have at the matching price!

Heard is 401.

Last edit: 14 years 8 months ago by niadmin. Reason: formatting

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

14 years 8 months ago #6265

by Dongdaemun

Replied by Dongdaemun on topic Re:Abterra --

Abterra is a puzzling stock.

It is the first company in history to report zero revenue in a quarter. Zero - that's right!

No business whatsoever - but go overheads to pay , such as salaries, etc.

So the damn stock falls from 1.10 to 90 cents within 2 weeks in May 2011.

Suddenly, within next 2 weeks, it climbs and climbs back up to 1.13 now.

It is the first company in history to report zero revenue in a quarter. Zero - that's right!

No business whatsoever - but go overheads to pay , such as salaries, etc.

So the damn stock falls from 1.10 to 90 cents within 2 weeks in May 2011.

Suddenly, within next 2 weeks, it climbs and climbs back up to 1.13 now.

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

14 years 2 months ago #7704

by Dongdaemun

Replied by Dongdaemun on topic Re:Abterra -- Good deal ?

Took a look at Abterra's 3Q to see how this former market darling has been doing. Profit attributable to shareholders was S$2.1 million versus $6.7 m a year ago.

The profits seem volatile. Difficult to justify the PE of 23X if you annualised the $2.1 million quarterly earnings.

Only thing is, the stock is down to 76 cents. Might be worth picking up considering that the NAV is S$1.10. Anyone has a view on Abterra?

The profits seem volatile. Difficult to justify the PE of 23X if you annualised the $2.1 million quarterly earnings.

Only thing is, the stock is down to 76 cents. Might be worth picking up considering that the NAV is S$1.10. Anyone has a view on Abterra?

Please Log in to join the conversation.

- Dongdaemun

- Offline

- Platinum Member

-

Less

More

- Posts: 951

- Thank you received: 19

14 years 2 months ago #7719

by Dongdaemun

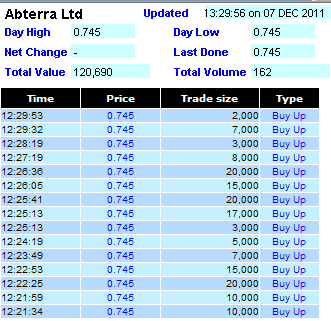

Replied by Dongdaemun on topic Re:Abterra -- this is interesting

Please Log in to join the conversation.

14 years 2 months ago #7729

by Val

Replied by Val on topic Re:Abterra -- Good deal ?

Yes, it smells like something is brewing. And at current price level, the stock is much cheaper than what the exec chairman Cai Sui Xin paid for many months ago. About $1.10 level..... The trouble is, from a value investing pt of view, the stock is not attractive because the financial performance has been very choppy. The profit for 3Q is down. 2Q no revenue!!!

Please Log in to join the conversation.

Time to create page: 0.242 seconds