- Posts: 584

- Thank you received: 21

NextInsight

a hub for serious investors

NextInsight

a hub for serious investors

REX INTERNATIONAL . Worth a buy now ?

3 years 11 months ago #25963

by Val

Replied by Val on topic REX INTERNATIONAL . Worth a buy now ?

So long already, now revisit REX at 35 cents. More than 100% rise since the last post 2 years ago.

I'd like to share an investor's view:

"Based on earnings at 80USD average WTI oil price last year, this stock should be around 70-80c based on PE of just 10-12. This quarter i believe earnings will even be more since oil price has been conssitently above 100 for a month plus now and likely to stay there or even go higher. So long as no bad things happen in their main oman well and secondary one in netherlands,they should be able to do 10k BPD a day with 70 profit per barrel. thats 700k profit a day!!"

www.valuebuddies.com/thread-5728-post-165028.html#pid165028

I'd like to share an investor's view:

"Based on earnings at 80USD average WTI oil price last year, this stock should be around 70-80c based on PE of just 10-12. This quarter i believe earnings will even be more since oil price has been conssitently above 100 for a month plus now and likely to stay there or even go higher. So long as no bad things happen in their main oman well and secondary one in netherlands,they should be able to do 10k BPD a day with 70 profit per barrel. thats 700k profit a day!!"

www.valuebuddies.com/thread-5728-post-165028.html#pid165028

Please Log in to join the conversation.

3 years 8 months ago #25985

by Val

Replied by Val on topic REX INTERNATIONAL . Worth a buy now ?

Please Log in to join the conversation.

3 years 8 months ago #25987

by Joes

Replied by Joes on topic REX INTERNATIONAL . Worth a buy now ?

I read "heartland boy's" article on his blog, i think it is balanced. I reproduce here the concluding pars:

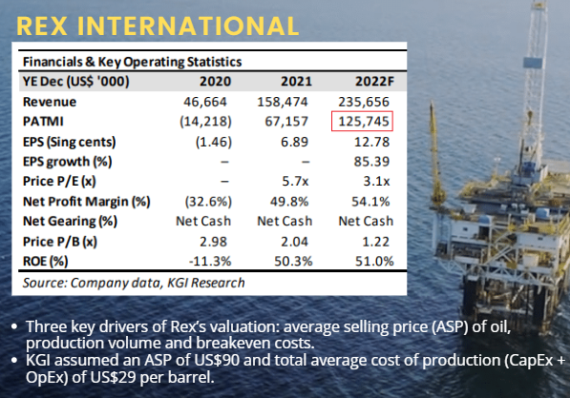

"After reviewing Rex International as a possible equity investment option, I am patient enough to give it time for its share price to converge to the trend of WTI crude. That is why I have initiated a position in Rex and consider this as one of the counters alongside the likes of Bumitama, Wilmar, Geo Energy and Uni-Asia in my portfolio to ride the surge in commodity prices.Analysts such as KGI and UOB have target prices of $0.54 and $0.58 respectively. Heartland Boy’s long-term price target is $0.50. Vested at an average price of 34 cents since Mar 2022.?

The reasoning and background content can fully be accessed at:

www.heartlandboy.com/rex-international-report-target-price/

"After reviewing Rex International as a possible equity investment option, I am patient enough to give it time for its share price to converge to the trend of WTI crude. That is why I have initiated a position in Rex and consider this as one of the counters alongside the likes of Bumitama, Wilmar, Geo Energy and Uni-Asia in my portfolio to ride the surge in commodity prices.Analysts such as KGI and UOB have target prices of $0.54 and $0.58 respectively. Heartland Boy’s long-term price target is $0.50. Vested at an average price of 34 cents since Mar 2022.?

The reasoning and background content can fully be accessed at:

www.heartlandboy.com/rex-international-report-target-price/

Please Log in to join the conversation.

3 years 7 months ago #25988

by Joes

Replied by Joes on topic REX INTERNATIONAL . Worth a buy now ?

some food for thought

At $0.285, market cap of Rex Int’l is S$368mln,

trailing 12-mth P/E is 4.0x. Great starting place to consider Rex.

current P/B is 1.5x and

dividend yield is 1.8%.

Bloomberg 12 month consensus target price of 50 cents, implies upside of 72%.

At $0.285, market cap of Rex Int’l is S$368mln,

trailing 12-mth P/E is 4.0x. Great starting place to consider Rex.

current P/B is 1.5x and

dividend yield is 1.8%.

Bloomberg 12 month consensus target price of 50 cents, implies upside of 72%.

Please Log in to join the conversation.

3 years 7 months ago #25992

by Rock

Replied by Rock on topic REX INTERNATIONAL . Worth a buy now ?

Rex latest share price trading @ 24.5 cents, P/E 3.5x is very cheap.

- FY 2022 expected dividend of 0.5 cents yield = 2.04%. Management revealed that an additional dividend of 0.5 cents maybe considered for 1H2022 owing to good financial performance.

- FY 2023 expected dividend of 2 cents yield = 8.16%.

I strongly believe the catalyst for Rex share performance will comes if Rex 1H2022 good financial performance and paying out additional 0.5 cents dividend, yield over 4%. This will good reason for investors to hold Rex for longer term as long as crude oil price is trading above US$65.

- FY 2022 expected dividend of 0.5 cents yield = 2.04%. Management revealed that an additional dividend of 0.5 cents maybe considered for 1H2022 owing to good financial performance.

- FY 2023 expected dividend of 2 cents yield = 8.16%.

I strongly believe the catalyst for Rex share performance will comes if Rex 1H2022 good financial performance and paying out additional 0.5 cents dividend, yield over 4%. This will good reason for investors to hold Rex for longer term as long as crude oil price is trading above US$65.

Please Log in to join the conversation.

3 years 7 months ago #25995

by Rock

Replied by Rock on topic REX INTERNATIONAL . Worth a buy now ?

For the past one month Rex share fall from 36.5 cents to as low as 22 cents, about 40% fall.

Rex price had been weaken by short selling in line to crude oil price falling from US$120 to US$100. (shares borrow record)

Rex last year profit of US$78.94m achieved on average average selling price of US$67. Crude oil had been trading above US$100 since February 2022.

The impact of production disruption verses good profit margin will reflect on coming share performance in the coming performance.

As long as crude oil price stay above US$60 per barrel, Rex will soon become a shining star!

Rex price had been weaken by short selling in line to crude oil price falling from US$120 to US$100. (shares borrow record)

Rex last year profit of US$78.94m achieved on average average selling price of US$67. Crude oil had been trading above US$100 since February 2022.

The impact of production disruption verses good profit margin will reflect on coming share performance in the coming performance.

As long as crude oil price stay above US$60 per barrel, Rex will soon become a shining star!

Please Log in to join the conversation.

Time to create page: 0.257 seconds