Icebreaker at the start of the Value Investing Mastery Course last Sunday. Participants ranged from those in their 20s (and just starting on their investing journey) to seasoned investors. BigFatPurse photo

Icebreaker at the start of the Value Investing Mastery Course last Sunday. Participants ranged from those in their 20s (and just starting on their investing journey) to seasoned investors. BigFatPurse photo

Alvin Chow is founder of BigFatPurse.com and author of The Singapore Permanent Portfolio.

Alvin Chow is founder of BigFatPurse.com and author of The Singapore Permanent Portfolio.

"I quit my well-paying job in 2014 in exchange for my passion in this business."

NextInsight photo.

TOWARDS THE END of the day, the name of a stock was flashed on the screen: Powermatic Data Systems.

To the attendees of a course (named Value Investing Mastery Course), it soon became apparent why Powermatic is justifiably worth a lot more than its current market price.

Trainer Alvin Chow took participants through certain sections of Powermatic's 2014 annual report and collectively, we nodded in agreement on the attractiveness of the stock.

Alvin is the founder of BigFatPurse.com, where he and a partner, Louis Koay, developed an investing approach. They not only teach it but also adopt it to invest in stocks with their own money.

It was course No. 34 last Sunday in a series that began in Jan 2014. There were 35 people at the 9am-6.30 pm event held at BigFatPurse's office which is a short walk from the Dhoby Ghaut MRT station.

They had paid $98 each, inclusive of lunch. It's an affordable fee and a steal compared to the thousands of dollars charged by some financial education organisers.

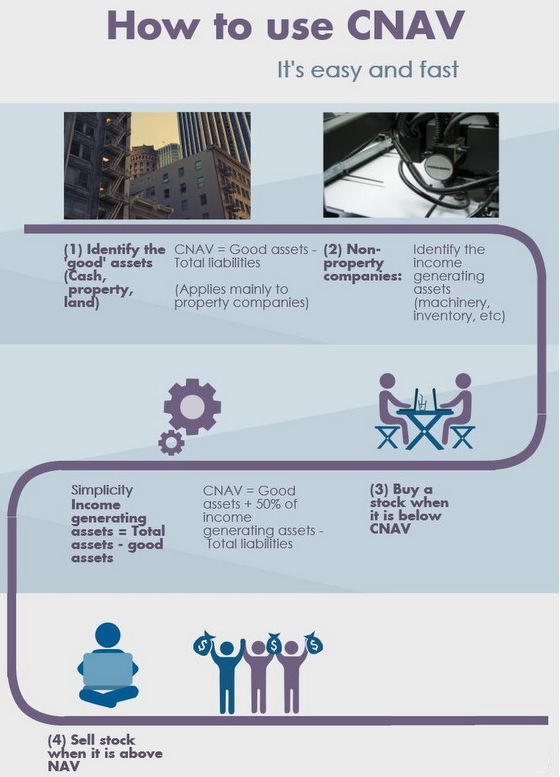

The investing strategy dubbed CNAV (which stands for "conservative net asset value") which participants learnt is safe, rational, and rewarding.

CNAV isn't dense financial mumbo-jumbo -- Alvin and Louis made the learning easy, especially for those who do not have a formal financial education.  Louis Koay has passed all three levels of the CFA exam and has a 1st class honours degree in engineering from NUS.

Louis Koay has passed all three levels of the CFA exam and has a 1st class honours degree in engineering from NUS.

NextInsight photo.BigFatPurse doesn't claim this is the best investing method ever invented -- no such method exists anyway. What, really, investors should want is a method that fits their risk profile, their investment objectives, their domain knowledge, and so on.

CNAV takes out a lot of the downside risk in investing by narrowing the search to stocks trading at a substantial discount to the value of their hard and 'good' assets (such as cash and properties).

The value of these good assets are recognised fully but not other assets such as trade receivables, factories, goodwill and other intangibles. These are, in using the CNAV, accorded 50% of their stated value.

Thus, CNAV is a 'safer' metric than NAV (net asset value) which analysts frequently make reference to.

By looking for stocks with a big discount to its CNAV, the investor concentrates on businesses that currently have a strong net worth. Participants of the Value Investing Mastery Course were attentive and found it easy to follow. BigFatPurse photo

Participants of the Value Investing Mastery Course were attentive and found it easy to follow. BigFatPurse photo

|

|

The investor can improve his search further by using a simple set of criteria which takes into account PE valuation, existence of operating cashflow, and low debt-to-equity.

And with these tools, BigFatPurse trainers have in recent times picked stocks which have gone on to deliver significant percentage gains, such as Hong Fok, Fu Yu, PNE Industries and Hong Kong Land.

Using CNAV, the investor no longer concerns himself with figuring out the extent of the future earnings, or earnings growth of a business.

Most retail investors rely on analyst reports for earnings forecasts but, as we all know, their accuracy is never certain.

Aside from not requiring an earnings crystal ball, the CNAV approach sits well with investors who don't have the time or the financial acumen to delve into reams of financial statements.  Participants were broken up into groups to invest $1m in hypothetical money in five unnamed stocks listed on SGX.

Participants were broken up into groups to invest $1m in hypothetical money in five unnamed stocks listed on SGX.

Applying CNAV, they made investment decisions at the start of Year 1, 2 and 3. Then their investment outcomes were compared to the real-life performance of these stocks. The top 3 teams won $250, $70 and $30 in real cash contributed by all participants.

BigFatPurse photoThe CNAV approach emphasises capital gain and treats dividends as a bonus. Investors should be prepared for a holding period that could extend to a few years, which is not an issue if the capital gain is dozens of percent.

The CNAV method typically uncovers undervalued stocks which are small- or mid-caps. And typically, when they run, they run hard and fast.

BigFatPurse goes one step further for participants: A day after the course, it emails them an Excel spreadsheet calculator.

With that, all they need to do is just pluck numbers from the financial statements for the Excel calculator to calculate the CNAV discount.

And for those who want more, they can join as members to gain access to a portal which regularly screens the 800 or so stocks on SGX and ranks them according to their CNAV discounts.

|

Register now at the BigFatPurse website

|