Excerpts from analysts' report

|

|

During the 2008 global financial crisis, the oil & gas share prices fell 5-10% in the first month of decline, before dropping another 20-30% over the next two months. In 2012, maritime, oil & gas, basic material stocks fell more in the next two months, even when reasonably resilient in the initial month of when crude oil prices fell >20%.

Whilst current stock valuations are attractive now, the more important factor is fundamentals and we question what has changed. In the sector, the big boys - Keppel and SembMarine - are facing slowdown in new rig orders but have compensated with conversion jobs. Meanwhile, there is a clutch of smaller players that have bought old vessels and converted them for jobs that do not require high-specification vessels.

Our O&M (offshore & marine) analysts believe that if the new normal for oil price is US$80/bbl, the deepwater fields (cost of extraction is more expensive) will be vulnerable to reduced activity. Consequently, overall orders for Keppel and SembMarine will come under more pressure. Hence, our big-cap capital goods pick is Sembcorp Industries, if there is need for any.

"Swissco is our small-cap pick due to its explosive growth," says CIMB.Our O&M team believes that the business models of Swissco and Ezion are more resilient, as their old vessels are cost-competitive and will likely get charters, even if that is at lower day-rates. In the offshore support vessel space, the businesses of players like PACRA (Pacific Radiance), with its locally-flagged vessels operating in shallow Southeast Asian waters, will be more resilient.

"Swissco is our small-cap pick due to its explosive growth," says CIMB.Our O&M team believes that the business models of Swissco and Ezion are more resilient, as their old vessels are cost-competitive and will likely get charters, even if that is at lower day-rates. In the offshore support vessel space, the businesses of players like PACRA (Pacific Radiance), with its locally-flagged vessels operating in shallow Southeast Asian waters, will be more resilient. From a valuation perspective, the smaller names are also closer to trough valuations and warrant a trade.

We estimate the direct earnings impact of an US$80/bbl oil price in 2015 on the major sectors in Singapore. The direct sector losers are clear, they would be O&M and plantations.

ComfortDelGro: Local operations will benefit from falling energy costs and a new public transport cost-plus model.

ComfortDelGro: Local operations will benefit from falling energy costs and a new public transport cost-plus model.

NextInsight file photoIndirectly, the consumer sector is at threat too if Indonesia and Thailand struggle as commodity prices come off. If crude oil prices remain depressed, we would be increasingly positive on the transport sector.

Comfortdelgro would benefit the most from reduced fuel costs. The benefit of lower energy costs to SIA could be whittled away by competition, since it lacks pricing power.

We downgrade our sector ratings for Consumer to Neutral (from Overweight), for Capital Goods to Underweight (from Neutral) and have upgraded Transport to Overweight (from Underweight).

ComfortDelGro: Local operations will benefit from falling energy costs and a new public transport cost-plus model.

ComfortDelGro: Local operations will benefit from falling energy costs and a new public transport cost-plus model. NextInsight file photoIndirectly, the consumer sector is at threat too if Indonesia and Thailand struggle as commodity prices come off. If crude oil prices remain depressed, we would be increasingly positive on the transport sector.

Comfortdelgro would benefit the most from reduced fuel costs. The benefit of lower energy costs to SIA could be whittled away by competition, since it lacks pricing power.

We downgrade our sector ratings for Consumer to Neutral (from Overweight), for Capital Goods to Underweight (from Neutral) and have upgraded Transport to Overweight (from Underweight).

The main fear with the crashing oil prices is that when it occurs, it is almost always accompanied by other factors like economic slowdown and financial dislocation. Therefore, the resulting effects are not all that clear-cut. Currency movements also come into play, as dollar strength and weak Asian and A$ is frequently the companion. An increasing amount of Singapore corporate earnings comes from overseas, and there is risk from translation impact. We have been Overweight on the S-REITs and telco sectors for the bulk of 2014.

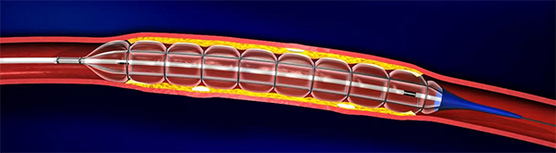

QT Vascular's Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.The FSSTI has been flattish in 2014 but the telcos and REITs have outperformed in the past six weeks. We suspect we are not done yet with the bloodbath and the defensive sectors will look increasingly attractive. We do not think that we have hit trough yet even if there are trading opportunities for oil & gas small caps, the most bombed-out sector YTD.

QT Vascular's Chocolate PTCA Balloon Catheter: The balloon has rings positioned along its tract that prevent it from expanding into a uniform shape, so the balloon doesn't inflate in the shape of a bone, with the edges being larger than the center of the balloon. Additionally, the valleys that are formed allow large bits of particularly hard calcification to snuggle within them rather than being pushed into the vessel wall where they can cause damage.The FSSTI has been flattish in 2014 but the telcos and REITs have outperformed in the past six weeks. We suspect we are not done yet with the bloodbath and the defensive sectors will look increasingly attractive. We do not think that we have hit trough yet even if there are trading opportunities for oil & gas small caps, the most bombed-out sector YTD. Our country model portfolio includes CD (ComfortDelGro), GLP (Global Logistic Properties), MINT (Mapletree Industrial Trust), OCBC, UOL and THBEV (Thai Beverage). Our small cap picks are FCOT (Frasers Commercial Trust), OSIM, PACRA (Pacific Radiance) and QTVC (QT Vascular).

defensive neighbours also need fund the war with oil.

So large supply hit the market. Plus USA oil boom continue on steep upwards sloping curve.