Excerpts from OSK-DMG analysts' report

Analysts: Sarah Wong & Terence Wong, CFA

Analysts: Sarah Wong & Terence Wong, CFA

|

|

Ong Pang Aik, executive chairman of Lian Beng Group.

Ong Pang Aik, executive chairman of Lian Beng Group. NextInsight file photo.SGD8.45m one-off gain post tax from on potential sale of Midlink Plaza in FY15. Lian Beng's 38%-owned associate, Millenium Land Pte Ltd, owns 50% of 122 Middle Investment Pte Ltd, which is a vehicle that holds the property formerly known as Midlink Plaza (on 122 Middle Road).

The proposed disposal for SGD270m, with carrying cost and construction cost of SGD146.4m and SGD70m, will yield a post-tax gain of SGD44.5m on the entire property. Lian Beng's effective stake of 19% in the property would translate into an SGD8.5m gain for FY15.

Raising FY15F earnings from SGD60.5m to SGD69.0m. With this one-off gain in the bag, we raise our FY15F earnings by c. SGD8.5m, equivalent to a 14% increase.

Look forward to future catalysts. Along the same vein, Lian Beng – through its 32%-owned associated company Epic Land Pte Ltd, is purchasing 92.8% of the aggregate strata area in Prudential Tower from Keppel REIT for SGD512m. Assuming an ASP of SGD2,600psf on units with strata titles, we expect Lian Beng to see a c.SGD23.3m profit boost after tax. As the company is currently in the process of obtaining approval for the deal, we have yet to factor in any earnings from it.

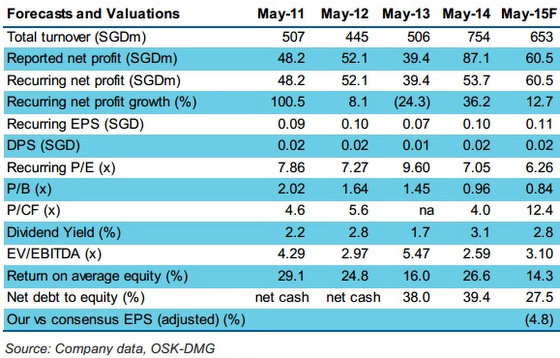

Maintain BUY, with RNAV-derived TP of SGD1.17. Lian Beng is currently trading at an undemanding 6.3x FY15F P/E and 0.84x FY15F P/BV. Our SOP-based TP for the stock is SGD1.17. Its upcoming catalysts in the form of the sale of strata-titled units at Prudential Tower, profit contribution from a new asphalt pre-mix plant and a granite concession may potentially unlock value in the company.

Recent story: LIAN BENG: Ups dividend 80% to 2.25ct on profit growth of 19%

What is P/E, P/B, NTA, Debt, Cash in Hand?