Jack Phang, CFA (left), is a remisier at Maybank Kim Eng Securities. This article was recently published on his blog, and is reproduced with permission. Jack Phang, CFA (left), is a remisier at Maybank Kim Eng Securities. This article was recently published on his blog, and is reproduced with permission."Sino Grandness is one of my favorite counters as it enjoys a good Return On Equity (ROE) mainly due to the transformation of the company from being export-oriented to domestic consumer-oriented after its listing on the Singapore Exchange." |

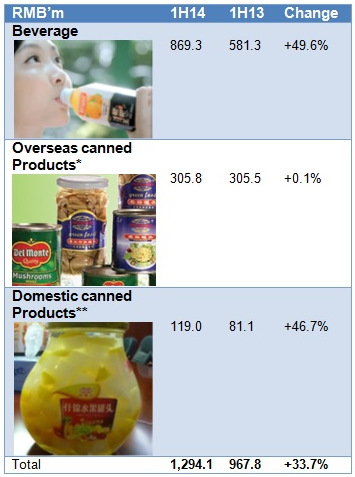

Revenue in RMB'm.

Revenue in RMB'm.

* Includes canned vegetables such as asparagus, long beans, mushrooms and sweet corn

**Includes canned fruits such as peaches, pineapples, pears, mixed fruits and mandarin oranges.Performance Review

The company reported stellar quarterly results. 1H14 revenue improved 34% to RMB1,294 million from a year ago, while net profit increased 32% to RMB230 million, mainly due to an increase in sales by the beverages and domestic canned food divisions as well as higher average selling prices.

Exports of canned food remained on par with last year's performance.

The current product mix is 67% beverage, 24% overseas canned food, and 9% domestic canned food.

Balance Sheet

Current assets increased 27% to RMB1,346 million mainly due to an increase in receivables and inventories, thanks to the increase in business activities.

Non-current assets increased 7% to RMB 853 million mainly due to an increase in purchase of property, plant and equipment (PPE) for the Hubei plant offset by depreciation. Current liabilities increased 23% mainly due to an increase in payables in tandem with an increase in business activities. Non-current liabilities remained on par at RMB 20 million.

NAV per share was 53.9 SG cents. P/B ratio was around 1.3 - 1.4 X (before the listing of Garden Fresh - beverage division).

Cash conversion cycle was at 112 days for 1H14 compared to 110 days for 1H13, mainly due to the increase in receivables turnover days and an increase in payables turnover days offset by the decrease of inventory turnover days. In other words, it took the company about 3 - 4 months to turn over the cash flow.

Company Comments on Outlook

The company's focus is now on China's domestic market, as it would be intensifying sales & marketing activities, ongoing R&D, sales & distribution network expansion and production capacity expansion. Although CAPEX has increased, it may be offset by higher gross profit margins as the average cost of production would be reduced by its own factories instead of through third party business partners.

The company introduced new products - aloe vera juice & snacks, and dried meat & crispy mushrooms & cakes that cater to domestic consumers.

Loquat juice market data from Frost & Sullivan.The company is also in early stages of discussion with potential partners to export beverage products to overseas markets. The company is now trying to leverage on its distributors to reduce the cost of holding inventories, and none of the distributors accounts for more than 4% of sales currently.

Loquat juice market data from Frost & Sullivan.The company is also in early stages of discussion with potential partners to export beverage products to overseas markets. The company is now trying to leverage on its distributors to reduce the cost of holding inventories, and none of the distributors accounts for more than 4% of sales currently.

Some statistics on loquat juice market in China: It is expected to have a compound annual growth rate of around 40% for the next 3 years to 2017 as consumers increasingly prefer healthier drink products.

Garden Fresh (a subsidiary of the company) is now the market leader with more than 70% market share of the loquat juice market, followed by competitors Furenyuan, China Minzhong, Tianhai Dongfang and Kagome.

The company is projected to ramp up juice production at its new Hubei plant with newly installed 240,000 tons per annum capacity and is optimistic about its operating performance in FY2014.

|

|

Previous article by Jack Phang: DUKANG DISTILLERS: Investor sentiment weak, too early to enter stock

See also: SINO GRANDNESS: "Potential Investor" On The Horizon And What It Means

https://www.dropbox.com/s/can85x062t07khj/Sino%20Grandness%20Report%20for%20VIC%20-%20Oct%202014.pdf?dl=0

profit up, gross margin up

Receivables up

Inventories up

Cash Balance down

Capex up