Excerpts from analysts' reports

Analyst: Renfred Tay (left)

Analyst: Renfred Tay (left)

China Sunsine workers packing rubber accelerators, which are chemicals aiding in the production of rubber products such as tyres. The company is the largest producer of rubber accelerators in the world, and the largest insoluble sulphur producer in the PRC.

China Sunsine workers packing rubber accelerators, which are chemicals aiding in the production of rubber products such as tyres. The company is the largest producer of rubber accelerators in the world, and the largest insoluble sulphur producer in the PRC.

NextInsight file photoInsane valuation discount; even for an S‐chip. Sunsine is currently only trading at 4.3x FY14 P/E (using the lower end of our earnings estimate) versus its peers, Lanxess AG and Shandong Yanggu Huatai Chemical (YGHT), who are trading at 22.6x and 34.9x FY14 P/E (consensus) respectively.

Lanxess is also involved in businesses other than rubber chemicals and might not be a perfect comparable peer for Sunsine. YGHT, on the other hand, is in the exact same business, based in the same province, and is also a direct beneficiary from the situation in the rubber chemicals industry in China.

We re‐emphasize the point that Sunsine is 3x bigger than YGHT in terms of capacity and could arguably stand to gain more than YGHT.

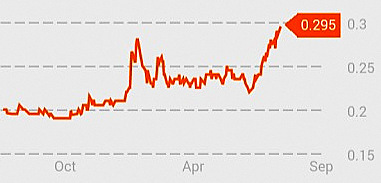

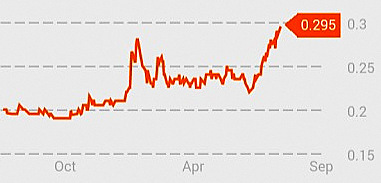

After China Sunsine stock closed at 29.5 cents yesterday, the company announced a positive profit alert.

After China Sunsine stock closed at 29.5 cents yesterday, the company announced a positive profit alert.

Chart: BloombergIf Sunsine were to trade on par with YGHT in terms of valuation, its stock price should be trading at S$2.32. A further 60% “S‐chip discount” would price Sunsine at S$0.95 (322% upside), while a further 80% “S‐chip discount” would imply S$0.48 (63% upside).

We believe this stock deserves a good relook by investors given its insane valuation gap and the fact that this is a much better quality S‐chip.

Analyst: Renfred Tay (left)

Analyst: Renfred Tay (left)Substantial increase in 1H14 earnings. Last evening, Sunsine issued a positive profit alert statement and guided for a substantial yoy increase in net profit for 1H14.

In addition to this, its listed peer, Shandong Yanggu Huatai (300121 CH), 3x smaller in output capacity vs. Sunsine, on the Shenzhen exchange was already guiding for a 100‐130% yoy increase in 1H14 earnings.

In addition to this, its listed peer, Shandong Yanggu Huatai (300121 CH), 3x smaller in output capacity vs. Sunsine, on the Shenzhen exchange was already guiding for a 100‐130% yoy increase in 1H14 earnings.

Expect Sunsine’s earnings to jump. From information gathered on Shandong Yanggu Huatai’s market prices for its rubber accelerators (there are many kinds of accelerators at varying price points), we estimate that rubber accelerator prices grew by about 16% qoq, on average in 2Q14.

By only estimating the same percentage increase in rubber accelerator ASP and at varying levels of expenses, we estimate Sunsine to report 2Q14 bottomline earnings of between RMB 46m to RMB 53m (+129% to +159% yoy).

On an annualized basis (in which, we assume no more increases in ASP for 2H14), we estimate FY14 net profit to range between RMB 163m to RMB 182m (+113% to 138% yoy).

By only estimating the same percentage increase in rubber accelerator ASP and at varying levels of expenses, we estimate Sunsine to report 2Q14 bottomline earnings of between RMB 46m to RMB 53m (+129% to +159% yoy).

On an annualized basis (in which, we assume no more increases in ASP for 2H14), we estimate FY14 net profit to range between RMB 163m to RMB 182m (+113% to 138% yoy).

China Sunsine workers packing rubber accelerators, which are chemicals aiding in the production of rubber products such as tyres. The company is the largest producer of rubber accelerators in the world, and the largest insoluble sulphur producer in the PRC.

China Sunsine workers packing rubber accelerators, which are chemicals aiding in the production of rubber products such as tyres. The company is the largest producer of rubber accelerators in the world, and the largest insoluble sulphur producer in the PRC. NextInsight file photoInsane valuation discount; even for an S‐chip. Sunsine is currently only trading at 4.3x FY14 P/E (using the lower end of our earnings estimate) versus its peers, Lanxess AG and Shandong Yanggu Huatai Chemical (YGHT), who are trading at 22.6x and 34.9x FY14 P/E (consensus) respectively.

Lanxess is also involved in businesses other than rubber chemicals and might not be a perfect comparable peer for Sunsine. YGHT, on the other hand, is in the exact same business, based in the same province, and is also a direct beneficiary from the situation in the rubber chemicals industry in China.

We re‐emphasize the point that Sunsine is 3x bigger than YGHT in terms of capacity and could arguably stand to gain more than YGHT.

After China Sunsine stock closed at 29.5 cents yesterday, the company announced a positive profit alert.

After China Sunsine stock closed at 29.5 cents yesterday, the company announced a positive profit alert. Chart: BloombergIf Sunsine were to trade on par with YGHT in terms of valuation, its stock price should be trading at S$2.32. A further 60% “S‐chip discount” would price Sunsine at S$0.95 (322% upside), while a further 80% “S‐chip discount” would imply S$0.48 (63% upside).

We believe this stock deserves a good relook by investors given its insane valuation gap and the fact that this is a much better quality S‐chip.

Special dividends? Privatisation on the cards? Given its expected strong earnings, we believe that there is a possibility of special dividends being handed out on top of the usual 1 Sct dividend that has been paid out since IPO.

We also believe that there could be an angle for privatization here as well given improved business conditions but low valuation level on the SGX.

To put things into perspective, YGHT is currently being valued at 8 times more than Sunsine when it is only 1/3 its size in terms of capacity.

Recent story: CHINA SUNSINE: Peer issues profit guidance of 100-130% jump for 1H

We also believe that there could be an angle for privatization here as well given improved business conditions but low valuation level on the SGX.

To put things into perspective, YGHT is currently being valued at 8 times more than Sunsine when it is only 1/3 its size in terms of capacity.

Recent story: CHINA SUNSINE: Peer issues profit guidance of 100-130% jump for 1H

S-chip...