OSK-DMG initiates coverage of ISOTeam with buy, 51.5-cent target

Analysts: Sarah Wong & Terence Wong, CFA

Anthony Koh (left), CEO of ISO Team, and his GM, Richard Chan, at an analysts' briefing. NextInsight file photo

Anthony Koh (left), CEO of ISO Team, and his GM, Richard Chan, at an analysts' briefing. NextInsight file photoWe initiate coverage of ISOTeam with DCF-derived TP of SGD0.515 which results in a 20% potential upside and we recommend BUY.

ISOTeam is a market leader in the Repairs & Redecoration (R&R) and Addition & Alteration (A&A) segments in public sector projects in Singapore. The R&R business boasts defensive, recurrent qualities while the A&A business complements the former, with both riding on government initiatives.

Solid, defensive qualities. Demand for R&R services is inelastic, protected by legislation requiring external walls of buildings to be repainted at least once every five years. Business also enjoys low counterparty credit risks in public sector projects, as counterparties are government-related entities and statutory boards. With an exclusive license to apply paint works for SKK and Nippon Paint Singapore in the public sector, ISOTeam’s market position is further entrenched.

Favourable macro environment; beneficiary of government initiatives and a rising demand pool. Huge supply completions of public and private housing units over 2014-2018 raise the demand pool for R&R services. ISOTeam is also slated to ride on initiatives such as the construction of new hawker centres, a SGD330m plan to expand the network of sheltered linkways and the plan to increase population.

Ongoing estate renewal and rejuvenation programmes also provide steady demand for ISOTeam’s services.

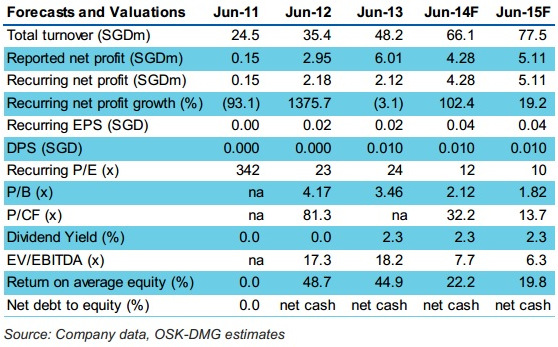

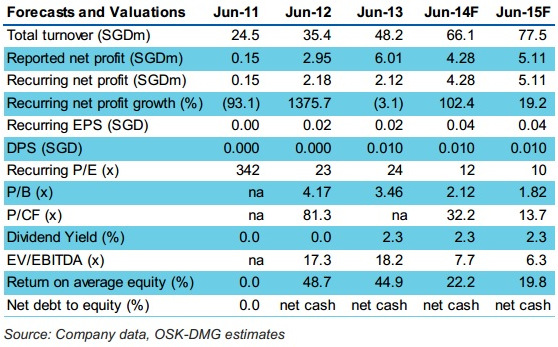

3-year CAGR for revenue and core EPS at c.24% and c.42% respectively from FY13 till FY16F. We expect revenue to grow to SGD90.9m in FY2016F from SGD48.2 in FY2013, mainly led by the R&R segment (c.32% CAGR) which is also the largest contributor of revenues in FY13.

We expect ISOTeam to drive growth through raising market share in the public housing sector and increasing its exposure in the private housing market.

We expect ISOTeam to drive growth through raising market share in the public housing sector and increasing its exposure in the private housing market.

Undemanding valuations; DCF-derived TP SGD0.515. Our DCF valuation of SGD0.515 (WACC 7.3% and terminal growth rate (TGR) 1%) implies 14.3x FY14F’s P/E and 12.0x FY15F P/E. ISOTeam currently has no direct peers listed on the SGX.

We estimate DPS SGD0.01 in FY14F, which translates into approximately 2.3% yield.

Recent stories:

ISOTeam: Strong recurring income from Singapore's R&R and A&A needs

We estimate DPS SGD0.01 in FY14F, which translates into approximately 2.3% yield.

Recent stories:

ISOTeam: Strong recurring income from Singapore's R&R and A&A needs