Analyst: Wei Bin

Bullish on China's water sector. NextInsight file photoInitiate with Overweight; new growth wave to come

Bullish on China's water sector. NextInsight file photoInitiate with Overweight; new growth wave to come We initiate coverage of China’s water sector with an Overweight recommendation.

In our view, the sector is poised for a golden era in the next three years, with rising water price, strong government policy support and industry consolidation fuelling rapid growth.

We expect sector EPS to rise at 15% CAGR over FY14E-16E alongside ROE expansion. Mounting pollution woes and the government’s increasingly stringent environmental protection standards should keep investor interest in this sector high.

Good asset quality, strong project sourcing ability and ample financial firepower are the three factors we believe will help companies in the sector become winners.

State-owned enterprises (SOEs) have an edge on the competition, given their connection with the government and the more favourable financing terms they enjoy.

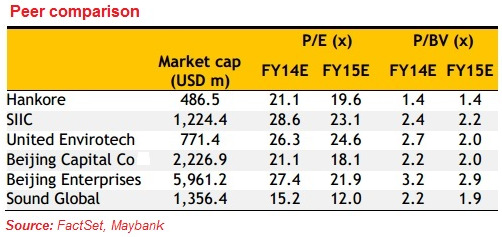

Stock picks: BUY SIIC and Hankore, HOLD UENV

We initiate coverage of SIIC Environment and Hankore Environment Tech Group with a BUY recommendation, and United Envirotech (UENV) with a HOLD rating.

We like SIIC for its strong ties with the government and its recurring income base which is not only large but also high margin.

Its balance sheet is also the strongest out of the trio.

Hankore’s growth profile is the most robust in the sector and we think the stock merits a BUY rating even without the potential game-changing catalyst of the China Everbright deal.

It could become an acquisition target by virtue of its advanced membrane technology. However, we rate it a HOLD, given its smaller recurring income base and currently high valuations.

Control room at a water treatment facility of HanKore. File photo

Control room at a water treatment facility of HanKore. File photoWe believe such high valuations are underpinned by robust growth, which could serve as a big plus in the event of an acquisition.

|

In our view, two types of companies stand to benefit from the current wave of consolidation. They are: Big companies with low cost of funding and strong balance sheet. We believe the SOEs are better placed in the consolidation cycle because of their easy access to cheap funding and good relationship with local governments which facilitates project negotiations. Small companies with good quality assets. They could become attractive acquisition targets for the big players. Within our coverage universe, SIIC and possibly Hankore (if the CEI deal goes through) have strong SOE background and will have a competitive advantage in acquiring water assets. United Envirotech is the only Singapore-listed China water company which has decent WWT capacity and good membrane technology. It is also the only one under our coverage which does not have an SOE background yet. We think it could be a potential takeover target by the big SOEs, though its current high valuation may be a deterrent. Key risks Project sourcing. As water companies expand into new markets, their relationship with the local government, track record and cost advantage will be vital to their ability to secure projects. Refinancing risk. Water companies are in a capital-intensive industry and need to rely heavily on capital market to fuel growth. Potential equity fund-raising could result in EPS dilution. Credit risk from local governments. The main clients of water companies are the local governments. Delay in water tariff payment by the authorities could result in cash flow problems for the companies. |