Excerpts from analysts' reports

OSK-DMG keeps Nam Cheong's 48-c target on latest news of vessel sales

Analyst: Lee Yue Jer

Nam Cheong's constructed Armada Tuah, Malaysia's first diesel-electric multi-purpose platform supply vessel, in 2012.

Nam Cheong's constructed Armada Tuah, Malaysia's first diesel-electric multi-purpose platform supply vessel, in 2012.

Photo: Lee Yue Jer

Nam Cheong (NCL) has secured sale contracts for two vessels - a Platform Supply Vessel (PSV) and an Anchor Handling Tug Supply Vessel (AHTS) - for a combined sum of USD43.1m.

The PSV was sold to a repeat customer in West Africa, E.A. Temile and Sons Development Company of Nigeria Limited, while the AHTS vessel went to a new customer, Kayfour Development Corporation Sdn Bhd in Malaysia.

NCL's order book is maintained at a strong MYR1.4bn.

We expect both vessels to be delivered in the next three months, giving a boost to 1Q/2Q FY14 figures. We continue to like NCL for its dominant position in the shallow-water OSV market. Maintain BUY with an unchanged TP of SGD0.48.

Recent story: Terence Wong: "My $1 m model portfolio has grown to $2.5 m"

OSK-DMG keeps Nam Cheong's 48-c target on latest news of vessel sales

Analyst: Lee Yue Jer

Nam Cheong's constructed Armada Tuah, Malaysia's first diesel-electric multi-purpose platform supply vessel, in 2012.

Nam Cheong's constructed Armada Tuah, Malaysia's first diesel-electric multi-purpose platform supply vessel, in 2012. Photo: Lee Yue Jer

Nam Cheong (NCL) has secured sale contracts for two vessels - a Platform Supply Vessel (PSV) and an Anchor Handling Tug Supply Vessel (AHTS) - for a combined sum of USD43.1m.

The PSV was sold to a repeat customer in West Africa, E.A. Temile and Sons Development Company of Nigeria Limited, while the AHTS vessel went to a new customer, Kayfour Development Corporation Sdn Bhd in Malaysia.

NCL's order book is maintained at a strong MYR1.4bn.

We expect both vessels to be delivered in the next three months, giving a boost to 1Q/2Q FY14 figures. We continue to like NCL for its dominant position in the shallow-water OSV market. Maintain BUY with an unchanged TP of SGD0.48.

Recent story: Terence Wong: "My $1 m model portfolio has grown to $2.5 m"

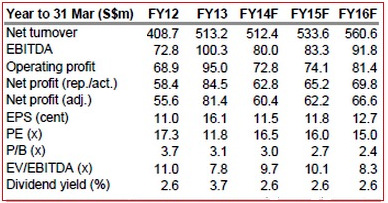

UOB Kay Hian downgrades Boustead to 'hold' Analyst: Andreas Isabel Co, CFA

Downgrade to hold with a higher target price of S$2.00 after outperformance. After share price climbed by as much as 18% since Feb 14, the upside to our target price is now less compelling. Nonetheless, we continue to like the group’s business model and see potential catalysts. We raise our FY14-16F net profit forecasts by 7% after tweaking our margin assumptions and imputing some contribution from the water division. Entry price is S$1.74. |