Time & date: 11 am, 18 March 2014.

Time & date: 11 am, 18 March 2014.

Venue: Qian Hu, 71, Jalan Lekar. Kenny Yap, executive chairman of Qian Hu Corp: Convinced that the company is moving in the right direction and that positive results should be reflected in the Group’s FY 2014.

Kenny Yap, executive chairman of Qian Hu Corp: Convinced that the company is moving in the right direction and that positive results should be reflected in the Group’s FY 2014.

Photo: Youtube

It's a good turnout! Thirty six shareholders and four proxies made their way to Qian Hu Corporation's farm in Choa Chu Kang for the AGM. The article below is adapted, with permission, from the minutes of the meeting which Qian Hu uploaded to the SGX website.  Mano Sabnani, a retired newspaper editor. NextInsight file photo.Mr Mano Sabnani, a shareholder, complimented the company for the informative Annual Report 2013. Chairman Kenny Yap thanked him and said that the Group had considered comments made by various shareholders during previous AGMs. As such, it has increased its coverage of the Group’s accessories business in its Annual Report.

Mano Sabnani, a retired newspaper editor. NextInsight file photo.Mr Mano Sabnani, a shareholder, complimented the company for the informative Annual Report 2013. Chairman Kenny Yap thanked him and said that the Group had considered comments made by various shareholders during previous AGMs. As such, it has increased its coverage of the Group’s accessories business in its Annual Report.

He added that in the 2013 Annual Report, which has a “magazine style” design, there is ample write-up and introduction of the Group’s new range of innovative accessories products.

Mr Mano also praised the Company for scheduling its AGM as early as mid-March, which is ahead of many other listed companies having the same financial year-end.

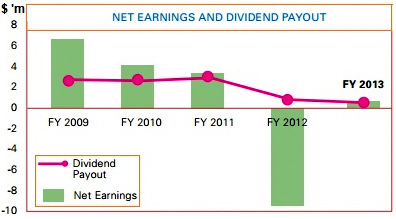

Although there was an improvement in the Group’s profitability in FY 2013, Mr Mano was concerned about the overall performance of the Group. Referring to page 28 of the Annual Report, he highlighted that the net profit attributable to equity holders for FY 2013 was $302K, which was lower than the CEO’s pay of approximately $304K as disclosed on page 133.

He further commented that while the loss of $9.1 million incurred in FY 2012 was due to the disposal of a major subsidiary in Malaysia, the Group did manage to register a higher net profit of approximately $6.5 million, $4.2 million and $3.5 million in FY 2009, FY 2010 and FY 2011 respectively.

He further commented that while the loss of $9.1 million incurred in FY 2012 was due to the disposal of a major subsidiary in Malaysia, the Group did manage to register a higher net profit of approximately $6.5 million, $4.2 million and $3.5 million in FY 2009, FY 2010 and FY 2011 respectively.

With the reduction in earnings, the Group’s financial ratios had deteriorated over the years. The market capitalisation of the Company stood at $39.05 million as at 13 January 2014 (first trading day after the announcement of its audited results) as compared to $74.02 million as at 12 January 2010. Mr Mano would like to know of the Group’s business plan for turning in a respectable return.

Chairman admitted that the Group had not performed up to expectations for the past few years and the reasons have been explained in the Group’s annual reports/SGXNET announcements as well as at past AGMs.

Since FY 2010, the Group’s ornamental fish export business has been affected by a prolonged period of uncertainty and continuous weakening in purchasing sentiment in European markets. Its Dragon Fish sales faced intense price competition caused by an oversupply of the fish, which resulted in a significant dip in the Group’s overall revenue and profitability.

Despite the multiple whammy, the Group continued to enhance its productivity as well as strengthen its market capability so as to create opportunities for itself in new markets. Chairman emphasised that in moving to the next level of growth, innovation has become a vital strategic thrust for Qian Hu.

|

As to the comment on the CEO’s pay being higher than the net profit of the Group in FY 2013, Chairman said that the company’s co-founders had shown discipline by not increasing their salary for the last two years as well as forgoing all their bonus entitlement. |

Profit margins: Making reference to pages 32 and 33 of the Annual Report, Mr Mano sought clarification on the low profit margins derived from both the Group’s ornamental fish and accessories business segments. He agreed with Mr Tan Tow Ee that the new innovative products should have potential markets; however, the sale of these products did not seem to have lifted profit margins in FY 2013.

He asked if there is any solution to improve the overall profit margins of the Group.

Ms Lai Chin Yee, Finance Director, replied that the profitability of the Group’s ornamental fish segment was affected by the swift decline in the selling prices of Dragon Fish since FY 2012 due to its oversupply, coupled with the gradual increase in overall operational costs as thorough efforts were made to expand market share.

Nonetheless, the profit margin from this business segment had recovered as the selling prices of these fish had stabilised by the end of the 1st half of 2013. The Group should see a steady growth in its ornamental fish segment’s revenue and profitability in FY 2014. She further said that the ornamental fish export business had continued to turn in improved revenue and generate respectable profit margins.

As for the accessories business segment, Chairman pointed out that the innovative products were mostly launched in the second half of 2013. As such, time is needed to penetrate markets and to realise the full potential of these new products. The Group prefers to familiarise customers with these products before the customers could appreciate the revolutionary nature of these products.

He is convinced that Qian Hu is moving in the right direction and that positive results should be reflected in the Group’s FY 2014.

In reply to Mr Mano’s query on whether these innovative products are patented, Chairman confirmed that is indeed the case.

Chairman shared that it is one of the Group’s objectives to be the world’s Number 1 ornamental fish exporter. Currently, Qian Hu exports ornamental fish to more than 80 countries around the world from its export hubs in Singapore, Malaysia, Thailand, Indonesia and China, capturing more than 5% of the global market share in terms of ornamental fish export.

Its long-term goal is to gradually increase its global market share to 10% and to be able to export ornamental fish to more than 100 countries – this would make Qian Hu the top ornamental fish exporter in the world.

Selling prices of the Dragon Fish have fallen in recent years owing to intense competition.

Selling prices of the Dragon Fish have fallen in recent years owing to intense competition.

Photo: CompanyDragon Fish: Mr Mano next asked if the Company comprehended the worst-case scenario for the Dragon Fish market.

Chairman replied that although the Group experienced a huge loss on the disposal of Kim Kang Aquaculture Sdn Bhd in FY 2012 when the Group’s Dragon Fish business faced intense competition as a result of an oversupply of mass market Dragon Fish which has exerted downward pressure on selling prices of these fish, it was a timely decision to enable the Group to unlock the value of assets in Kim Kang and to allow the Group to rationalise its financial and capital resources.

Citing the disposal as an example, Chairman said he had no doubt that the management team is capable of handling different business scenarios in the best interest of the Group. In that respect, he was positive that Qian Hu would survive without the Dragon Fish business.

On the protection of the intellectual property (“IP”) of the Company, another shareholder, Mr Chew Kim Hoong, commented that some smaller and less established entities in China generally do not respect IP rights. He would like to know what precautions Qian Hu had undertaken to prevent imitation of the Group’s innovative products.

Chairman clarified that certain companies chose not to patent their IPs as the production of their products may involve only straightforward steps/procedures. In addition, the IP registration process would require comprehensive disclosure of such rights. He informed shareholders that the IPs owned by the Group are deemed to be advanced and sophisticated such that even with full disclosure, they would not be easily comprehended, let alone copied.

Mr Chew cautioned that the revenue and profit margins of a traditional technology company could be subject to volatility due to the possible availability of imitation products.

To this, Chairman explained that once Qian Hu has embarked on becoming a company powered by technology with innovation being a key part of the Company’s culture, it would not rely on just the existing innovative products. There should be more star products developed every year to embrace the changing environment and to continue differentiating Qian Hu from its competitors.

On the amount due from Guangzhou Qian Hu Aquarium and Pets Accessories Manufacturing Co., Ltd (“GZQH”), a former subsidiary of the Group, which was guaranteed by a major shareholder of the Company of approximately $11.5 million as at 31 December 2013 as mentioned on page 124 of the Annual Report, Mr Goh Lian Teck, a Qian Hu shareholder, enquired on the estimated timeframe for the repayment of this outstanding amount.

Chairman replied that as mentioned in past AGMs, as there is still an on-going business relationship with GZQH, the management had formalised a plan with the management of GZQH to reduce the outstanding amount substantially within four to five years after the divestment in the 4th quarter of 2011.

Another shareholder, Mr Sim Juay Cheow, complimented the Chairman for his contribution to the Company which has grown to become a strong Singapore brand.

Leasehold land: Mr Sim then referred to the tenure of the leasehold land parcel, 69 & 71 Jalan Lekar, which was renewable every three years, and would like to know whether the revised rental charges have increased, hence affecting the profitability of the Company. He also enquired how the White Paper on the proposed re-development of Sungei Tengah and its surrounding area would affect the said leasehold land.

Chairman commented that the Singapore Land Authority (SLA) has extended the lease term of the leasehold land in November 2013 for three years with a lower rental rate. As to the future lease terms upon renewal in Year 2016, he explained that the Animal and Veterinary Authority (AVA) is currently working on a formula to measure the productivity and innovation efforts implemented on the leasehold land as a basis to determine the period of lease. In any case, he understood that the leasehold land was earmarked for agriculture, green space and recreation purposes.

|

Mr Chua commented that as the performance of a technology-related company could be unpredictable, he was of the view that it does not align with the Group’s aim to become a debt-free and high dividend payout company. Big Four auditor: A shareholder, Mr Ow Yong Eng Seng, asked whether it was necessary for the Company to engage a Big Four auditing firm (i.e. KPMG LLP) as external auditors. He was of the view that the Company would be able to save cost by engaging a second-tier auditing firm. To this, Chairman commented that the Audit Committee reviews the cost effectiveness of the audit and independence and objectivity of the external auditors. |

article. But want to remark on some general things, The website style is great, the articles is really great : D.

Good job, cheers