Excerpts from analysts' reports Straco's stock gain every year has been hefty since 2009, except for 2010. Chart: FT.com

Straco's stock gain every year has been hefty since 2009, except for 2010. Chart: FT.com

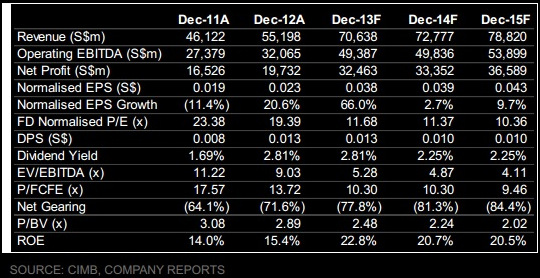

CIMB highlights Straco's strong ability to generate cash

Analysts: Jessalynn CHEN and Kenenth NG, CFA

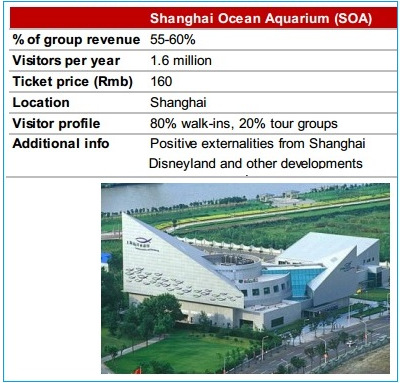

Shanghai Ocean Aquarium accounts for 60% of Straco's revenue. Source: CIMBStraco operates two ocean aquariums in China.

Shanghai Ocean Aquarium accounts for 60% of Straco's revenue. Source: CIMBStraco operates two ocean aquariums in China. We initiate coverage on Straco with an Add rating as its tourism assets can benefit from the rising domestic consumption and demand for tourism in China.

We also like the company for its strong cash generative ability and the prospects of higher operational efficiencies through stronger sales volumes.

We use a DCF valuation to derive a target price of S$0.60, which implies 13.9x CY15 P/E.

We see strong potential catalysts from:

1) China's domestic consumption policies,

2) improved accessibility in China via new railway networks,

3) stronger visitor arrivals in Shanghai from the opening of Shanghai Disneyland and the Shanghai FTZ,

4) the upgrading of an existing aquarium, and

5) the opening of a new tourist attraction.

Cash generative business Straco has the ability to generate very strong cashflows, as its business has little maintenance capex and working capital needs.

The major capex is typically forked out upfront, whether for the development of a new tourism asset or the acquisition of an existing asset.

Straco has not had any debt on its balance sheet since 2007. As at 3Q13, it has S$101.1m worth of cash and equivalents.

This translates into net cash of S$0.12/share, or 26.7% of its current share price. Cash makes up 27.8% of our S$0.60 target price.

Full 28-page CIMB report here.

Previous stories:

Peter Graham Lancashire: "Why my favourite stock is STRACO"

STRACO CORP: After another solid year and a bigger cashpile, will there be M&A?

UOB KH highlights Tai Sin Electric's dividend yield and profit track record

Analyst: Loke Chunying

A worker transports a drum of finished cable. Tai Sin Electric's CEO (since Jul 2013), Bernard Lim, is in the foreground.

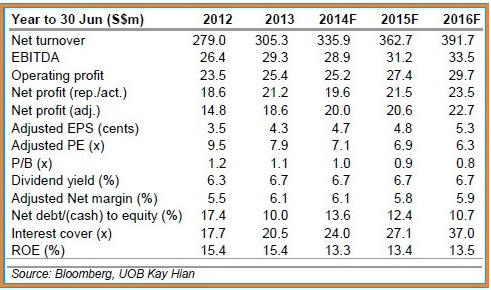

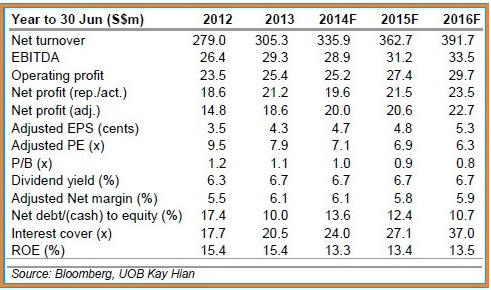

A worker transports a drum of finished cable. Tai Sin Electric's CEO (since Jul 2013), Bernard Lim, is in the foreground. NextInsight file photoWe initiate coverage on Tai Sin Electric with a BUY recommendation and target price of S$0.435.

Despite being in a highly competitive industry, Tai Sin has emerged as a market leader that has consistently outperformed its peers.

Profitable for the last 10 years, Tai Sin has an excellent growth record with net profit growing strongly at a CAGR of 26.7% in FY02-FY13.

DPS also grew at a CAGR of 14.7% over the same period.

Given its attractive dividend yield (6.7%), solid balance sheet and consistent earnings track record, we believe Tai Sin offers good value at a fair price.

Attractive valuation. At its current valuation of 6.3x trailing 12M PE, Tai Sin is trading at a 32% discount to its regional (ex China & Taiwan) peers’ average trailing 12M PE of 9.1x.

Given its attractive dividend yield, superior ROE, solid balance sheet (6% net debt/asset) and consistent earnings track record, we believe Tai Sin offers good value at a fair price.

Previous story: TAI SIN ELECTRIC: Electrifying 53% gain in stock price in year-to-date

Given its attractive dividend yield, superior ROE, solid balance sheet (6% net debt/asset) and consistent earnings track record, we believe Tai Sin offers good value at a fair price.

Previous story: TAI SIN ELECTRIC: Electrifying 53% gain in stock price in year-to-date