Excerpts from analysts' reports

Maybank initiates coverage of BreadTalk with $1.40 target

Analyst: James Koh & Juliana Cai

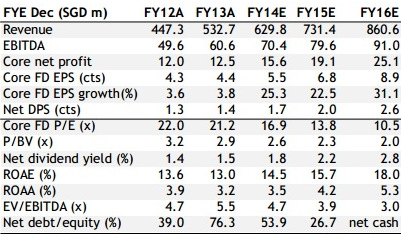

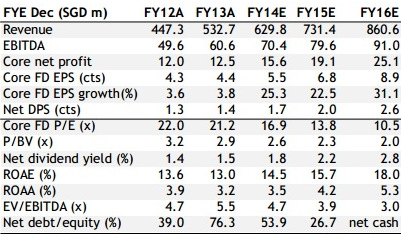

Source: Maybank Kim EngInitiate BUY on this under-researched company with a TP of SGD1.40, implying 50% upside. BreadTalk is by far the most successful Singapore F&B company, boasting a solid regional presence for its homemade brands via more than 800 outlets across 15 countries. Its target for 2014 is to raise store count to 1,000.

Source: Maybank Kim EngInitiate BUY on this under-researched company with a TP of SGD1.40, implying 50% upside. BreadTalk is by far the most successful Singapore F&B company, boasting a solid regional presence for its homemade brands via more than 800 outlets across 15 countries. Its target for 2014 is to raise store count to 1,000.

Maybank initiates coverage of BreadTalk with $1.40 target

Analyst: James Koh & Juliana Cai

Source: Maybank Kim EngInitiate BUY on this under-researched company with a TP of SGD1.40, implying 50% upside. BreadTalk is by far the most successful Singapore F&B company, boasting a solid regional presence for its homemade brands via more than 800 outlets across 15 countries. Its target for 2014 is to raise store count to 1,000.

Source: Maybank Kim EngInitiate BUY on this under-researched company with a TP of SGD1.40, implying 50% upside. BreadTalk is by far the most successful Singapore F&B company, boasting a solid regional presence for its homemade brands via more than 800 outlets across 15 countries. Its target for 2014 is to raise store count to 1,000.Operational statistics are healthy with EBITDA growing rapidly. This should allay fears on BreadTalk’s lacklustre profit growth, hitherto blamed on poor management or a flawed business model though our analysis shows it is a matter of accounting.

Going forward, higher-margin businesses should also help lift earnings.

Going forward, higher-margin businesses should also help lift earnings.

George Quek, founder and chairman of BreadTalk. File photo

George Quek, founder and chairman of BreadTalk. File photo

Thailand-based Minor International’s 11% stake may be a prelude to a takeover offer in the next 12-24 months. If so, this would be a bonus for investors.

China presence an attractive trait. Minor International (MINT TB, BUY, TP 24.30THB) has accumulated an 11% stake in BreadTalk Group since Aug 2013. The Thai hospitality and F&B group is noted for its history of acquisitions but reputation aside, we think its portfolio complements that of BreadTalk’s. We believe BreadTalk’s presence in China – more than 300 outlets in 48 cities – is definitely a key attraction.

Value emerging, act before it’s too late. We see value emerging.

Our TP of SGD1.40 is based on 7X FY14E EV/EBITDA, which is only half of regional peers’ average. We expect BreadTalk’s net profit to grow at 26% CAGR over the next three years as expansion efforts start to bear fruit.

Using a SOTP approach to cross-check the replacement value of the firm, we coincidentally arrive at a conservative net value of SGD1.40 per share (SGD403m). Initiate with BUY.

Credit Suisse has outperform rating and $2.14 target for Linc Energy

Analysts: David Hewitt and Horace Tse

Our TP of SGD1.40 is based on 7X FY14E EV/EBITDA, which is only half of regional peers’ average. We expect BreadTalk’s net profit to grow at 26% CAGR over the next three years as expansion efforts start to bear fruit.

Using a SOTP approach to cross-check the replacement value of the firm, we coincidentally arrive at a conservative net value of SGD1.40 per share (SGD403m). Initiate with BUY.

Credit Suisse has outperform rating and $2.14 target for Linc Energy

Analysts: David Hewitt and Horace Tse

We initiate coverage on Linc Energy (Linc) with an OUTPERFORM rating and a S$2.14 TP, implying 49% potential upside.

■ Core value and growth in conventional oil and gas. Our DCF valuation for Linc's proved reserve oil production represents 80% of the current share price, but, in addition, the company has two potentially material projects in Alaska and Wyoming should they be sanctioned in the next 24 months.

Linc Energy CEO and MD, Peter Bond. The company reported a net loss of A$63.8m for FY2013 (ended June) but Credit Suisse forecasts a net profit of A$8.7 m for the current financial year.

Linc Energy CEO and MD, Peter Bond. The company reported a net loss of A$63.8m for FY2013 (ended June) but Credit Suisse forecasts a net profit of A$8.7 m for the current financial year.

Photo: Company■ Australian shale — early days. The un-risked prospective resource estimates from two reserve auditors for Linc's acreage in the Arckaringa Basin are staggering—103 bn to 233 bn barrels of oil equivalent (boe); the next stage is further delineation of the opportunity, for which it would seem logical to bring in a strategic partner with deep pockets and shale expertise.

Linc Energy CEO and MD, Peter Bond. The company reported a net loss of A$63.8m for FY2013 (ended June) but Credit Suisse forecasts a net profit of A$8.7 m for the current financial year.

Linc Energy CEO and MD, Peter Bond. The company reported a net loss of A$63.8m for FY2013 (ended June) but Credit Suisse forecasts a net profit of A$8.7 m for the current financial year. Photo: Company■ Australian shale — early days. The un-risked prospective resource estimates from two reserve auditors for Linc's acreage in the Arckaringa Basin are staggering—103 bn to 233 bn barrels of oil equivalent (boe); the next stage is further delineation of the opportunity, for which it would seem logical to bring in a strategic partner with deep pockets and shale expertise.

■ Underground coal gasification (UCG): The next big thing? Linc has developed proprietary UCG technologies that it is now moving to monetise via license and royalty agreements with stranded coal asset owners. The first agreement is in place (in South Africa) with other opportunities in Russia and Ukraine at initial stages of agreement.

■ Valuation: 20% discount to risked NAV implies 49% potential upside. We use a risked NAV methodology to arrive at an NAV valuation, to which we then apply a 20% discount to arrive at our TP of S$2.14, implying 49% potential upside. There are several potential catalysts in the next 12/24 months (Alaska reserves moving to the 'proved' pool, a CO2 supply agreement in Wyoming, further UCG license agreements and a farm-in to the shale play).

■ Key risks include crude price weakness, failure to migrate reserves to the proved category, failure to source a CO2 supply in Wyoming and failure to sign definitive technology agreements for UCG.

For more on the company, see its Powerpoint Presentation material.

For more on the company, see its Powerpoint Presentation material.