Joseph Yeo started a thread in the NextInsight forum, Thoughts on the market, in which he shared his stock picks for 1Q. In subsequent posts in other company-specific threads, he elaborated on his stock picks. Here are his substantive posts and we will be providing updates on the performance of the portfolio at the end of 1Q (or earlier, if he sells out).  For past months, the market was rattled by 2 major issues : 1) US government debt ceiling and 2) QE tapering.

For past months, the market was rattled by 2 major issues : 1) US government debt ceiling and 2) QE tapering.

Glad to know that these 2 issues have passed by smoothly n the market is more stable now.

The first half of December had been been volatile n uncertain. With the passage of these 2 issues, the market should now be more stable. And it has indeed firmed up.

Normally when the market firms up in December, the "bulls" will charge in in January given the historical pattern n the Capricorn efect. The probably of a "bull" is now very high in my view.

I am vested n will be holding my stocks all the way to earliest end-January. Fyi, I am vested in these stocks :

1. Sunningdale Technology (13.9 c)

2. Excelpoint (8.9 c)

3. Federal International 2000 (2.8 c)

4. Valuetronics (24.5 c)

5. Global Invacom (19.6 c)

All these stocks were profitable in the last quarter. Most have shown "big" improvements in the topline n bottomline. Excelpoint, Sunningdale Technology n Valuetronics give excellent dividends.

Note: dividend yields above 5% are deemed excellent in my view.

Pls do your own analysis n draw your own conclusion. This is not an invitation to invest or to put money into the counters I mentioned. It's just for sharing. In investment things can always go wrong. All the best to all.!!!

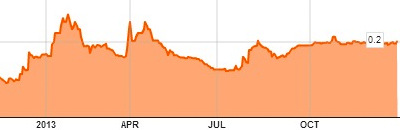

Global Invacom -- what could catalyse the stock price? Global Invacom (stock price: 19.9 cents) has a market cap of S$46 m. Chart: BloombergI buy stocks based on fundamentals n when it's undervalued.

Global Invacom (stock price: 19.9 cents) has a market cap of S$46 m. Chart: BloombergI buy stocks based on fundamentals n when it's undervalued.

I will then wait for it's value to be realised. Sometime I got it right n sometimes I got it wrong. It's better for you to do your own analysis n come to your own conclusion.

I share with you an earlier posting on 22 Oct on the same site. Here goes:

This company looks interesting :

1. improving top n bottom line

2. trading below nta (nta US$0.2496 against current price of S$0.205 at time of posting)

3. negligible debt - US$199,000 and net cash - US$24,016,000

4. active share buy back ...

800000 shares on 16 oct'13 @ 19.7 cts

800000 shares on 17 oct'13 @ 19.8 cts

1,000,000 shares on 18 oct'13 @ 19.6

1,400,000 shares on 21 oct'13 @ 19.6

I wish to share with you why I pick Federal. Here goes .... Federal (stock price: 3.4 cents) has a market cap of S$47.9 million. Chart: Bloomberg 1. it's a turnaround company. In the last financial year the company registered a loss of S$35 mil mainly from various impairment, but since the beginning of this financial year the company has turn around w 3 quarters of decent profit. See below :

Federal (stock price: 3.4 cents) has a market cap of S$47.9 million. Chart: Bloomberg 1. it's a turnaround company. In the last financial year the company registered a loss of S$35 mil mainly from various impairment, but since the beginning of this financial year the company has turn around w 3 quarters of decent profit. See below :

1st quarter profit : S$1,178,000

2nd quarter profit : S$2,993,000

3rd quarter profit : S$2,132,000

Profit for 9 months : S$6,303,000

2. company is under the SGX watchlist. Normally when a company has turn around it should have no problem exiting from the "watchlist" status. Historically, when a company exit it's "watchlist" status the share price go up to reflect the new fundamentals.

3. it has an absolute low price of 3.1 cts (based on the last closing price on 27 dec 2013).The 52 weeks high is 4.6 cts and low is 2.2 cts. The low was a reflection of it's huge loss in the last financial year but given that it has shown continuous improvement in the last 3 quarters the 2.2 cts low is likely to be a thing of the past. The potential for a price review is very high given it's present profitability.

4. it is currently trading below it's nav of 5.56 cts

5. as of 8 oct 2013 it has a book order of S$38 mil .. this compares with it's 3rd quarter of S$37 mil. And management commented that : "The Group remains focused on the core trading business and expects a healthy flow of orders for 2014." The core business take up 95% of it's total revenue.

6. it's in the oil n gas sector .. a vibrant sector and certainly not a sunset industry.

7. it had recently resolved it's problem with it's business in Panzhihua City. I believe this to be good news as it frees up management time for more important business. Further the disposal seem to have other benefits. See below on a quote from the management :

Quote : "The divestment of the Group’s 99% interest in FEEW will improve the Group’s networth and gearing positions. Assuming that the Proposed Transaction was completed on 31 December 2012, the Group’s net asset value per share would have increased from 6.84 cents to 6.92 cents. The Group’s gearing ratio would have reduced from 0.93 to 0.63."

8. Given the recent in interest in the company, I expect to see better days ahead w regards to it's share price barring unforeseen circumstances or a major market crash. See below for volume traded in the last few days :

17 dec (tuesday) - 0.5 mil shares traded.

18 dec (wed) - 0.6 mil

19 dec (thurs) - 6.2 mil

20 dec (fri) - 7.5 mil

23 dec (mon) - 8.3 mil

24 dec (tuesday, Christmas eve) - 1.3 mil

26 dec (thurs) - 22.5 mil

27 dec (fri) - 25.2 mil

Conclusion : I am vested in the counter and above are just my views n ways of looking at things. I could be wrong in my assessment, so if you should be interested in the counter, pls do your own analysis n draw your own conclusion.

Reasons for picking Valuetronics are : Valuetronics Holdings is an integrated electronics manufacturing services (EMS) provider.

Valuetronics Holdings is an integrated electronics manufacturing services (EMS) provider.

Photo: annual report1. Consistently high dividend .

Year 2013 : HK 8.0 cts per share

Year 2012 : HK 16.0 per share + special div of HK 1.0 cts. Total HK 17 cts.

Year 2011 HK 14.0 cts per share.

2. High payout ratio.

Year 2013 : 36.5 %

Year 2012 : 46.6 %

Year 2011 : 40.9 %

3. Expect high dividend payout of 2.23 singapore cts per share this financial year.

Half year profit: HK 72,901,000. Assuming the same level of profit is maintained, the full year profit would be HK 145,802,000.

Assuming a payout ratio of 35% (low estimate) the total payout would be HK 51,030,000. The payout per share would then be total payout amount divided by the number of shares.

HK 51,030,000 divided 365,188,750 shares = HK 13.97 cts.

In S$ terms n based on exchange rate of 1$HK to S$0.1629, the dividend per share in Singapore currency would be 2.23 cts.

4. Decent profits for the past 3 years.

2011 - 19.7 mil

2012 - 21.2 mil

2013 - 12.8 mil / 19.3 mil (19.3 mil from continuing business)

5. Good profit trend in last 2 quarters:

Apr to June - HK $33274 in S$5,420 (x1000)

July to Sept - HK $39627 in S$6,455 (x1000)

1st 6 months or half year results - HK $72901 in S$11,875 (x1000)

Note that the first half year profit is almost equal to the whole of last year profit. Hence, this year full year profit is likely to show a great improvement over last year. 6. Company has no debt.

7. Company has cash of HK $288732 or S$63.3 mil.

8. Company has only 365,188,750 number of shares. This is a small number compared to most companies.

Recent stories:

GLOBAL INVACOM: Positioning itself as a growth story

Stock picks for 2014: Will these 50 stocks outperform?