Ernest Lim, CFA, CPASWIBER HOLDINGS has dropped 8% in seven trading days, from an intra-day high of $0.685 on 3 Apr to $0.630 on 12 Apr.

Ernest Lim, CFA, CPASWIBER HOLDINGS has dropped 8% in seven trading days, from an intra-day high of $0.685 on 3 Apr to $0.630 on 12 Apr. Contrast this with its 57.5% owned subsidiary Kreuz which closed at $0.530, near its all-time closing high of $0.535.

Swiber’s 4QFY12 results

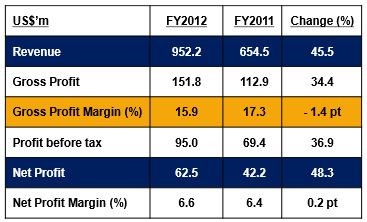

Swiber reported a good set of results on 27 Feb 2013, achieving record earnings and revenue since listing. See table below.

Gross profit margins were in line with management guidance of 15-20%.

Swiber’s share price momentarily gapped up after the results and traded to an intraday high of $0.720. However, it

Swiber’s share price momentarily gapped up after the results and traded to an intraday high of $0.720. However, itsubsequently drifted lower.

Achieved a milestone in project execution

Swiber announced on 20 Feb 2013 that it had successfully executed floatover operation in the B-193 Field Development project in India for the country’s national oil company, Oil and Natural Gas Corporation Ltd. (“ONGC”), Swiber’s long-standing customer in India.

This was noteworthy. Firstly, this floatover method involved extensive engineering capabilities.

Secondly, Swiber managed to use most of its in-house assets in the project execution. Thirdly, this method resulted in significant cost savings for ONGC which strengthened their relationship and might lead to more collaborations and contract awards.

Order & tender books

As of end Feb 2013, Swiber’s order book stood at around US$1.35b. Swiber’s tender book was around US$2.4b and might reach US$3b by end 2013. OCBC Research estimated that about 50% of the order book would be recognised in 2013 and 20-25% of the tender books are for commencement in 2013.

As of end Feb 2013, Swiber’s order book stood at around US$1.35b. Swiber’s tender book was around US$2.4b and might reach US$3b by end 2013. OCBC Research estimated that about 50% of the order book would be recognised in 2013 and 20-25% of the tender books are for commencement in 2013. Swiber’s business ex Kreuz worth only approx S$213m

Swiber has about 57.5% in Kreuz. With reference to my previous writeup on Kreuz, Kreuz’s business seems to be on an uptrend. On the back of its order book and potential variation orders,

Kreuz is likely to turn in a better FY13F than FY12, though FY12 was already a record year in terms of revenue and net profit since listing.

The industry dynamics for subsea business remains sanguine.

As a result, the investment community may be starting to warm up to Kreuz. Kreuz closed at $0.530, near its all-time closing high of $0.535.

Kreuz’s market capitalization is around $295m. Swiber’s market capitalization is around $383m, of which 44% can be attributable to Kreuz. In other words, Swiber’s business (ex Kreuz) is only valued at approximately S$213m.

Some negatives

Some noteworthy points that the investment community are concerned about are firstly, Swiber’s leverage and negative operating cash flow. With the exception of 4QFY12, Swiber recorded five quarters of negative operating cashflows.

In addition, based on Swiber’s 4QFY12 results, about US$207m of loans are repayable in one year or less. To address this, Swiber has been active in tapping the debt markets, albeit (typically) at a higher cost than their existing loans.

Secondly, some investors pointed to Swiber’s lumpy results and management’s guidance of gross margin of 15-20% which is rather broad and makes forecasting difficult.

To be fair, companies in this sector typically have lumpy results. The wide gross margin guidance can be due in part to the contract type. Engineering, Procurement & Construction contracts have a higher material procurement portion which typically pushes gross margins lower than the pure execution of transportation and installation projects.

Valuations

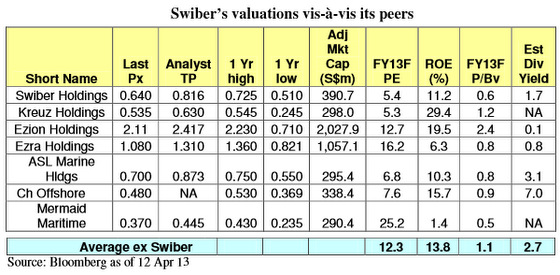

With reference to the table above, Swiber’s valuation is one of the lowest among its peers. Its FY13F PE and FY13F P/BV are the second lowest relative to its peers.

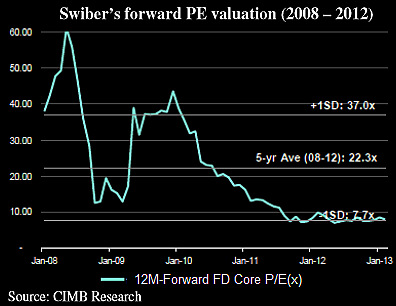

If we compare Swiber’s estimated PE valuation from 2008 to 2012 (see chart on the right), it is trading more than one standard deviation below the 5 year average estimated PE from 2008 – 2012.

If we compare Swiber’s estimated PE valuation from 2008 to 2012 (see chart on the right), it is trading more than one standard deviation below the 5 year average estimated PE from 2008 – 2012. On the back of strong order and tender books and given the buoyant industry outlook, it is likely that Swiber may, in future, beat its record revenue and net profit set in 2012.

Besides its results, investors may warm up to the stock if Swiber can continue to execute its projects well, improves its cash flow and win more contracts.

This article was recently published on Ernest Lim's blog http://www.ernestlim15.blogspot.com/ and is reproduced with permission

Comments