Swissco has a 32-vessel fleet for chartering to the oil & gas industry, and will expand it by another 8 vessels this year. Photo: Company

Swissco has a 32-vessel fleet for chartering to the oil & gas industry, and will expand it by another 8 vessels this year. Photo: CompanyCOMPANIES SERVING the bustling offshore oil & gas sector have reported good results for 2012, including Jaya Holdings, Nam Cheong Limited and Mencast Holdings.

One low-profile company, Swissco Holdings, also rode the wave -- it chartered vessels out at higher rates and its fleet was better utilised.

Following on that, Swissco marked a milestone in January this year when it was upgraded from Catalist to the Mainboard of the Singapore Exchange.

Swissco is now into Year 3 as an entity that resulted from the acquisition of Swissco International by C20 Holdings in 2010.

Swissco Holdings CEO Alex Yeo (left) is back in the driver's seat, with CFO Sam Kwai Hoong. Photo by Sim KihHere are some key takeaways from briefing on Wednesday (Mar 13) chaired by its CEO, Alex Yeo, and Group CFO, Sam Kwai Hoong.

Swissco Holdings CEO Alex Yeo (left) is back in the driver's seat, with CFO Sam Kwai Hoong. Photo by Sim KihHere are some key takeaways from briefing on Wednesday (Mar 13) chaired by its CEO, Alex Yeo, and Group CFO, Sam Kwai Hoong. It was Alex Yeo's maiden appearance at such a briefing since his appointment as the CEO on 1 Jan this year following the expiry of the employment contract of the previous CEO, Kang Hwee Meng.

Alex Yeo is a veteran of the industry, having been CEO of the acquired Swissco International and having stayed on as an executive director of the merged entity, Swissco Holdings.

1. FY2012 performance: Revenue rose 70% to $110.0 million while net profit soared 100% to $16.4 million.

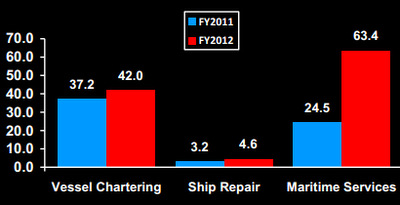

Revenue (S$'m) by business segments.All three business segments grew in revenue. The Group’s gross profit margin increased from 23.5% in FY2011 to 28.0% in FY2012.

Revenue (S$'m) by business segments.All three business segments grew in revenue. The Group’s gross profit margin increased from 23.5% in FY2011 to 28.0% in FY2012.Revenue from the vessel chartering segment grew 12.9% to S$42.0 million due to higher fleet utilization (from 60% to more than 70%).

The ship repair segment’s revenue increased 43.8% to S$4.6 million due to more and higher value repair and maintenance jobs completed at its 2 yards in Penjuru Lane, Singapore.

And the maritime services segment surged 158.8% to S$63.4 million, mainly due to the delivery of vessels and fees earned.

2. Maritime services segment: Analysts sought clarity regarding this segment.

Mr Yeo said that, among other things, Swissco provides consultancy to Middle East clients looking for new ships in Asia. Swisco would negotiate contracts for the clients, and supervise the shipbuilding.

In addition, Swissco would source for marine and offshore equipment for various offshore projects.

Would the revenue be lumpy from year to year? Mr Sam replied: "The market indicators are still very positive."

Mr Yeo: "There is enough interest in our order book going out to 2014."

Specifically, there are 6 anchor handling tug supply vessels (AHTS) for delivery. (AHTS are mainly built to handle anchors for oil rigs, tow them to location, and anchor them up. They are also used to transport supplies to and from offshore drilling rigs.)

Does Swissco need to invest in equipment or largely human labour? "It's very service in nature," replied Mr Sam.

Mr Yeo added: "It encompasses a very wide range of services -- even simple ones such as buying fuel."

The revenue for this business segment would include the vessel value, for example, while the costs would include the cost of vessel construction.

3. Vessel chartering business: Swissco has sought to diversify and expand its fleet in order to be a one-stop solutions provider to its clients, said Mr Yeo.

At 25 cents, Swissco trades at a PE of 6.6X and a discount to its NAV of 27 cents. Its market cap is about $108 million.

At 25 cents, Swissco trades at a PE of 6.6X and a discount to its NAV of 27 cents. Its market cap is about $108 million. Chart: FT.comAt end-2012, it had 32 vessels -- mainly utility tugs (12 vessels) and AHTS vessels (8 units).

This year, Swissco will take delivery of 8 vessels (four of which are AHTS) and in 2014, four more.

Swissco is emphasising AHTS above 5000 bhp, unlike its traditional focus on vessels below 5000 bhp.

The outstanding capex for them totals about S$120 million, reflecting the capital-intensive nature of the business.

Swissco is confident of the demand for vessels and is looking to raise its gearing from the current 33% level.

Mr Yeo said: "Rates for some vessels are giving us confidence to go out and raise more debt.

"One of our accommodation work boats was charted out at US$18,000 a day. An older boat, US$16,000 a day. We continue to see that kind of interest in those vessels this year.

"In the region, the amount of exploration and production work is enormous."

Swissco is not going to place out new shares to raise funds, at least not just yet. "We don't want to sell ourselves short."

4. Special dividend: As a result of its sharply improved earnings in 2012, Swissco is proposing a final dividend of 0.8 cent a share, of which 0.3 cent is a special dividend. The dividend yield is 3.2%.

For FY2011, the total dividend paid out was 0.5 cent a share.

For the Swissco Powerpoint presentation materials, click here.

Related stories: