DVS Vickers says it's "fair price for a great company," ARA Asset Management.

Analyst: Derek Tan, CPA 4Q12 results in line; FY12 PATMI of S$72.7m in line. ARA reported a 4Q12 PATMI of S$17.7m (+33 y-o-y) on a 39% increase in topline to S$36.9m.

4Q12 results in line; FY12 PATMI of S$72.7m in line. ARA reported a 4Q12 PATMI of S$17.7m (+33 y-o-y) on a 39% increase in topline to S$36.9m.

This was brought about by a 24% increase in recurring fees from its managed REITs and private funds on the back on an enlarged AUM (acquisitions by Fortune REIT and Cache Logistics Trust) and fee income contribution from its private funds – ARA Asia Dragon Fund 2 (ADF2) and ARA China Investment Partners (CIP).  John Lim, Group CEO of ARA Asset Management. Photo: CompanyThese more than offset lower fees from ADF1 as it has started to return capital to investors during the year.

John Lim, Group CEO of ARA Asset Management. Photo: CompanyThese more than offset lower fees from ADF1 as it has started to return capital to investors during the year.

Together with a final DPS of 2.7 Scts, ARA also announced a 1-for-10 bonus issue, where the bonus units will also be entitled to this final dividend.

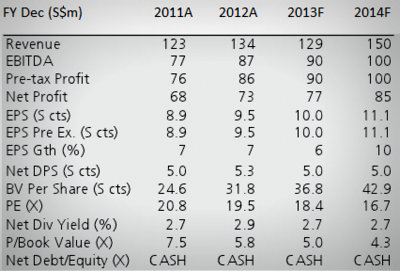

Downgrade to HOLD, TP adjusted to S$1.94 (S$1.76 post 1-for-10 bonus). ARA trades at a premium to global asset managers which average c17x-18x PE.

Our SOTP target price is adjusted to S$1.94 based on (i) 18x PE on blended FY13//14F income from the fund management business and (ii) market value of its listed investments.

After accounting for bonus issue, TP is adjusted to S$1.76. Given limited upside to our target objective, we downgrade to HOLD.

Recent story: ARA ASSET celebrates 10 years of extraordinary success

SIAS Research says King Wan Corp's intrinsic value is 40 cents Ms Chua Eng Eng, 42, is MD of King Wan Corp, whose core businesses are M&E engineering services and rental of the largest fleet of mobile toilets in Singapore.

Ms Chua Eng Eng, 42, is MD of King Wan Corp, whose core businesses are M&E engineering services and rental of the largest fleet of mobile toilets in Singapore.

Photo: annual report.Though King Wan Corp's 3Q revenue declined 25% y-o-y to $11 million, gross profit climbed 5% y-o-y to $3.38 million owing to the completion of a few better margin contracts.

King Wan recently ventured into the transport arena by acquiring a 30% stake in a 58,000 dwt Supramax. Cash equivalents position declined $5.55 million q-o-q while borrowings rose $3.2 million, mainly owing to advances to associates, particularly the property development at Dairy Farm Road.

We expect borrowings to increase further owing to the purchase of the Supramax vessel.

We also anticipate the company to distribute three cents dividend for the next five years, on the back of gains from the Thai associates. Intrinsic value of 40 cents.

Recent story: OSK-DMG initiates coverage of King Wan with 40-c target