The following was recently posted in the NextInsight forum by 'Sumer', who is well-recognised as the forum's resident guru on property stocks.

HERE ARE 2 lists of property stocks I own/have owned or monitored.

Note that RNAVs are subject to changes as new developments in a company or the prop market surface; so it's not a fixed figure.

These RNAVs are only my personal (and adequately prudent, I believe) estimates based on certain assumptions.

To me, (1) estimating RNAV as well as (2) attributing a certain discount to a stock's RNAV are both more of an art than science; so differences between my figures and others' are to be expected.

Also note that share prices are a function of demand and supply for a company's shares, and demand and supply can be due to several reasons, of which a company's fundamentals (like RNAV, earnings, etc) is only one of many.

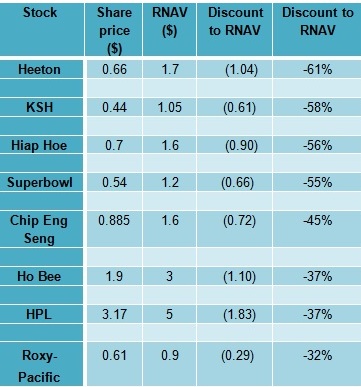

Stocks I still own (but I have reduced some as prices rose) are in the table at the top right corner.

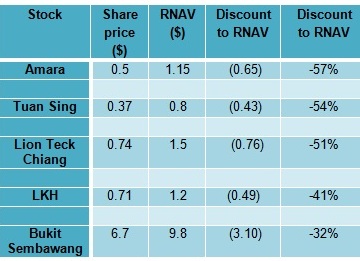

Stocks that I owned previously (and may own again) are in the table on the right.

While I like the safety of high RNAVs, it does not mean that I pick stocks based solely on "the bigger the discount the better" (so, at the moment, I do not own the stocks listed in the 2nd table, for eg).

I take into consideration management's agility and past records, prospects of monetizing of assets, dividend payout, major shareholders' honesty and care for minority shareholders, immediate catalysts, etc.

Then, I decide, for eg, that Chip Eng Seng can trade up to 70% of RNAV (ie, 30% discount) before I am concerned.

Again, all these personal targets and views are not stationary. If for eg, the government comes up with yet another set of measures to curb demand for any type of property, then I will have to relook at the maths and adjust the RNAV discount I am comfortable with.

As stock prices rise, don't forget to take some money off the table; prudence is a good habit and being content is a good guard against greed.

How I estimate RNAV

Basically, calculate:

(1) the unbooked earnings from a developer's present and future projects, based on taking selling prices (estimated or actual) less all costs (land, construction, marketing, finance, etc), on a psf basis. (Eg, $1,000 psf selling price minus cost of $800 psf).

The difference is the gross profit psf. Then get the GFA (gross floor area) based on (1) brochures or (2) multiplying land area by plot ratio and then add 5-15% more GFA based on your expectations of how much more "free" balcony, garden and roof terrace spaces. Multiply gross profit by GFA and you get the total gross profit for the project.

You can then discount it to present value (pse google what this means), or to skip this step (it's basically an estimate after all), you may choose to estimate more conservative GFA, sales price or higher costs, which will let you have a lower gross profit. For net profit, simply deduct tax from gross profit. Divide net profit by the outstanding shares, and you get the NAV per share for the future earnings (A).

(2) for assets owned or will be owned (eg, a hotel under construction), estimate based on studying similar buildings, room values, etc. For eg, if a company is building a 500 room 4-star hotel, after studying recent hotel transactions, valuation of hotels of listed companies, etc, you may decide that it's worth $600,000 per key.

Likewise, for office or retail space owned or under construction - just do your estimation based on researching values and prices in the market. Then, simply do the maths to arrive at a value for the assets.

Then take this value and minus the present book value (for an asset already owned) or the total cost of constructing the building (for an asset to be developed and kept) to arrive at the valuation above cost or book value. Divide this by the outstanding shares, and you get an excess NAV per share for the asset (B).

(3) take the NAV per share (C ) already given by the company at the end of each quarter or half year and add (A), (B), (C) up to get your total RNAV.

Above is just my crude method of arriving at RNAV which I find to be reliable enough. Of course there are more refined methods. However, in all methods, a good amount of assumptions and opinions are involved, and these are the variables that affect the final figure, not so much the method of calculation.

For eg, when I bought into SC Global at about $1-$1.20 last year, my estimate of its RNAV was about $3 - $3.50. I remember reading an analyst report setting a target price for the counter at below $1. I was thinking then that a 40% discount to RNAV would be a good target to hold the stock until, ie, at about $1.80-$2.10.

I don't think the wide difference in our target price was due to the way we calculated the RNAV of SC Global, but the assumptions and estimates we used in the calculation. I suppose my assumptions must have leaned more towards a neutral scenario rather than a free fall in physical property prices.

Recent articles:

SUMER: Property Prices to Fall but Some Property Stocks Still Undervalued

|

Sumer: "Many Of My Property Stocks Have Performed Smartly In 2012" |

As an example, when I looked at CES when it was below 50ct, it was not RNAV per se that made me invest in it, but the string of catalysts listed in my earlier posts (launch of Alexandra shops, PS100, Tower Melbourne). Then, as I add in the future profit stream (lots of its props were already pre-sold), I discovered that its RNAV could surge substantially.

So, if catalysts are lacking, and a co is losing money, again you have to see if it's a one-off loss, or recurrent, etc. And if there are many positive catalysts apart from that lack of earnings, you then have to consider which side the final judgment tilts towards.

Boh Tea: RNAV is about assumptions and estimates, and hence, my estimates were based on certain assumptions, naturally. I think my estimate for HH floats between the co keeping ZP for recurrent income (which would have a low value) and finally selling it off after 2 years (which would give a high value; note I think the 2 year thing is to avoid tax). I then decided on an "in between" kind of figure.

I understand the co is taking up 1 or 2 floors of the office space, but this is insignificant compared to the total GFA of the 2 hotels, retail and office spaces.

COSTs: Sorry, I don't quite understand the part where you talk about cost. RNAV is based on estimates and assumptions, which are necessary for you to arrive at any figure. You have to "stop" somewhere between the most optimistic and most pessimistic scenarios, otherwise you can never arrive at any RNAV. That's why10 other people doing a calculation on RNAV will arrive at 10 different figures, depending on where they "stop" in that scale of scenarios.

For eg, in the case of Heeton, taking The Lumos alone, my estimate is based on a final selling price of $2,000 psf for its remainder units. This is $500 psf lower than the current price the co is trying to sell at, and $1,000 psf below the prices of the units they had already sold. I could "stop" at $2,500 psf, or $1,500 psf, but I chose $2,000 psf, which to me, at this moment, is reasonably "doable", taking into account they did not sell any unit at their current asking price of $2,500-2,700 psf, and also that a stock clearance sale of $1,500 psf would be unnecessarily pessimistic.

RNAV calculation is an art and not a science. So there will always be questions on why this assumption is taken or why another estimate is not chosen. I can only say that the figures given in my table earlier are only "my" estimates of the RNAVs - one of perhaps 100 estimates that can be arrived at by 100 different people. I don't think my estimate is "right" but just "one of many possible estimates".

Finally, do use RNAV in conjunction (perhaps as a support) with your takes on catalysts, theme plays, market timing, new flows, management's trustworthiness and agility, etc. Ultimately, it is demand and supply for a share that affects the share price, not RNAV per se.

Btw, I am currently busy with some personal business, so I may not be able to contribute for the time being.

I have a feeling it doesn't but shouldn't it? How can investors buy into a high RNAV stock while the business suffers losses or thin earnings?