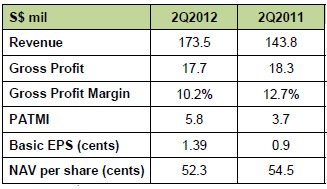

BROADWAY INDUSTRIAL's 2Q (ended June 2012) revenue increased 20.6% year-on-year to S$173.5 million due to strong contributions from the Hard Disk Drive business.

Broadway manufactures precision machined components for the electronics, semiconductor, automotive and other industries.

It is one of the top manufacturers of actuator arms and related assembled parts for the global hard disk drive industry.

Its 2Q gross profit was flat at S$17.7 million as gross profit margin decreased to 10.2% from 12.7% in 2Q2011.

The decrease in gross profit margin was mainly due to higher ramp-up costs and an increase in minimum wage in China across Broadway's business units.

Nevertheless, profit after tax and minority interest rose 55% to S$5.8 million in 2Q2012 due to other income of S$3.4 million in 2Q2012 arising from a change in fair value of its financial derivatives as well as a gain on disposal of other investments.

Broadway has recommended an interim dividend of 1 cent per share. The stock recently traded at 35 cents.

In its cashflow, Brodway enjoyed net cash from operations of S$39.3 million in 2Q while net cash in investing activties was S$20.2 million due to capex.

Net gearing stood at 34.8% due to higher bank borrowings for the group's expansion. Cash and cash equivalent stood at S$29.1 million compared to S$30.5 million a year earlier.

Last night (July 29), Broadway announced it is searching for a CEO to handle day-to-day operations and management of the Group.

It also announced that its executive chairman, Wong Sheung Sze, 62, had been diagnosed with Parkinson’s disease, and is undergoing specialist medical treatment to manage his condition.

"Based on professional medical assessment, Mr Wong is able to continue executing his management duties," said the company.

Sheng Siong reports 2Q net profit of S$7.0 million

Sheng Siong Group, one of the largest supermarket chains in Singapore, reported a net profit of S$7.0 million for 2Q ended 30 June 2012, down 2.0% year on year.

The Group declared an interim cash dividend of 1 cent per share (as compared to a recent stock price of 46 cents).

It also affirmed its intent to distribute up to 90% of its FY2012 net profit.

2Q revenue increased 5.2% to S$146.9 million due to higher same store sales and a net increase of 4 stores.

Gross profit margin declined 1 percentage point to 21.9% owing to continued competition among supermarket operators.

Sheng Siong also had to contend with higher operating expenses, mainly due to rental and utilities expenditures of new stores, a 5-10% adjustment of rental renewal rates for existing stores, and salary adjustments.

In 2Q, cash flow used in operating activities amounted to S$1.3 million, with the bulk of the cash outflow due to the stocking up of inventories for the Hari Raya and “Chinese Seventh Month” festive periods, and the payment of FY2011 staff and directors’ bonuses.

Cash flow used in investing activities was S$2.3 million mainly due to capital expenditure incurred for the new Toa Payoh and New World Centre outlets.

With the distribution of FY2011 final dividend amounting to S$24.5 million or 1.77 cents per share, cash and cash equivalents decreased by S$32.5 million.

Recent story: SUNTEC REIT, SHENG SIONG, TECHNICS: What Analysts Now Say…