EDWARD MENG, CFO of specialty steelmaker China Gerui (Nasdaq: CHOP), believes in putting his money where his mouth is.

In an exclusive interview as part of our series bringing you glimpses into how Chinese executives live, work and most importantly – invest – we discover that the US-educated CFO is as careful with his own money as he is with his company’s.

Mr. Meng joined Gerui in 2009.

Zhengzhou-based Gerui is China’s largest producer of high precision cold-rolled narrow strip steel, with an estimated market share of 12.5%.

Previously, Mr. Meng was CFO of A-Power Energy Generation Systems (Nasdaq: APWR), a provider of distributed power generation systems in China and a manufacturer of wind turbines.

Prior to that, he held executive positions at several US-listed firms with Chinese operating units or directly for the PRC subsidiaries of foreign multinationals.

NextInsight: You’ve served as CFO at several firms, so you must be an expert at personal financial management. Would you say that you are conservative with your money, or do you spend quite liberally? In other words, do you purchase groceries on impulse or do you clip coupons and only buy those items on your list and/or those on sale?

CFO Meng: My personal spending style is rather conservative. First of all, I am not one of excessive material needs. Secondly, I tend to spend within a budget. Although I do look for items on sale, I will not hesitate to spend on absolute necessities.

Are you more a fan of credit cards, or do you prefer to pay in cash? And do you currently rent or own your home?

Credit cards are part of my life. But I refuse to be enslaved by undisciplined credit spending. I currently own my home in China as it was purchased back before the real estate market in China took off to its current price levels.

I bought my home back in 2007 in a high-end neighborhood. Riding on the real estate market boom over the last 3-4 years, its market value almost tripled, so, for hindsight, it’s an investment with a descent return.

Did you attend university? Did you learn more inside or outside the classroom? How did you finance your university education?

I attended Georgetown University from 1995 to 1997 for its full-time MBA program, majoring in Finance. It was my first choice since I truly appreciated the Georgetown program’s international focus.

My first year in the program was a bit painful as I transitioned from a fast-pace “work” mode (8 years prior professional experience) to one of a full-time student. But I came to enjoy the program for its many eye-opening courses and the opportunity to interact with a mix of both international and native local students, many of whom came from diverse professional backgrounds.

I funded my two-year study with my own means.

Are you married, with children? For long holidays, do you prefer to visit family, or go off on a far-away adventure?

I am married with two children. For long holidays, I usually prefer to travel within China or sometimes abroad with the family. I try to give my children as much exposure to the rest of the country and of other countries as possible in their early age.

However, for the typical Chinese holidays where a family get-together is usually expected, I would join my siblings and parents.

What plans have you made for your Golden Years in terms of retirement planning/financial planning?

To make sure I have properly paved the way for my Golden Years, I am currently still working, making sure that my kids will have their future education fully provided for and that my retirement is supported by stable income planning.

I do have insurance coverage for the family, including both life and medical. With my personal investment portfolio, I have always tried to achieve the optimal mix and weight as possible, considering my investment horizon and changing and adjusting risk profile.

What is the best investment you ever made? And the worst? How has your MBA degree helped you become a better investor?

The best investment is yet to come, but so far the highest returns are from real estate properties and art collections.

Financial investment aside, I do believe and am thankful that my over two decades of professional experience with the government, multinational firms in China and in the US has helped me develop a broad vision and ability to adapt to a diversified business environment. An MBA degree or other certifications might be helpful in securing a career opportunity, but where one excels to a large extent depends on a combination of a set of soft skills related to communication, interpersonal abilities and time-management.

What market do you find the most hassle free to invest in and why? Singapore? Hong Kong? A-shares? US? Where do you invest in most of your stocks? Any sectors in particular stand out for you as having high potential?

All capital markets have good and bad times. And given that the markets are now so globally intertwined, no one is immune from the common ills of the global economy. Therefore, I choose to be a value investor. My investment is heavily weighted towards healthcare, education, agriculture and consumption-related sectors.

Photo: shaolin.org

Do you spend most of your time in Zhengzhou, Henan, or do you also live in New York to be close to your US investors? What are some of the perks to living in Zhengzhou?

Around two-thirds of my time is spent in Zhengzhou and a third in Beijing or on the road in Hong Kong or the US for investor events or non-deal road shows. I choose to stay close to the company operations in Zhengzhou. I believe that as a CFO, I have to be close to the skin of the company business to truly understand the story behind the numbers and be able to be an integral part of the management decision making.

To engage in business travel so as ensure regular communication with US investors is just an inevitable part of being in a US-listed Chinese company. Zhengzhou is a city of rapid growth and of dynamic change over the past 5-6 years. With the Chinese government tilting its policy towards encouraging growth in “Central China” (including Henan province), Zhengzhou is set for tremendous growth opportunities over the next 5-10 years.

Other than investing in China Gerui shares, what other companies or sectors in China do you consider high-growth choices for investment, and why?

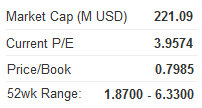

For investors just getting to know China Gerui, the company is usually grouped under the broad umbrella of “steel” industry. However, investors will hopefully gradually appreciate the fact that China Gerui possesses a unique company profile as a leader in the niche market of high value-add, metal-processing business. It’s a gem yet to be fully appreciated by investors.

Other sectors in China that I would encourage investors to look into are education, agriculture, energy and healthcare, which are bound to prosper given the on-going transformation of the economy towards consumption-oriented.

The US stock market just finished a very poor quarter, but so did A-shares and Hong Kong. What made China Gerui decide to list in New York originally, and why did you choose it over Hong Kong, Shanghai, Shenzhen or Singapore?

Way back in 2007 and 2008, when the company was seeking an overseas listing, it evaluated the overall pros and cons of Hong Kong, Singapore, Toronto and the US. As the old saying goes, “every dog has its day.” Back then, the Hong Kong and Singapore markets where not as favored as they are today and the company eventually settled on the US primarily for its overall stringent regulatory governance, a broad but diversified investor base and far more advanced and diversified financing alternatives, both for primary and secondary financing.

How do you yourself cope with the rising costs of living in Zhengzhou? Inflation in China is rising much faster than in other developed countries, so how are you handling this pressure?

Living cost increases are a common phenomenon almost everywhere in China nowadays. Relatively speaking, living in Zhengzhou is still less costly than most first-tier cities and the cities along the southeast coastal area. That is also one of the reasons and incentives for relocation of companies like Foxconn.

For China Gerui, labor cost inputs account for a small percentage of its cost of goods sold since the company’s operations are highly automated, thus limiting the impact on its overall cost structure.

Shifting to economics, what is your opinion on the current overall state of the PRC economy? Do you think the country is successfully shifting to a more domestic-consumption led growth from an over-reliance on exports?

Yes. Although there is still considerable risk of a hard landing, I do believe China will achieve a soft landing which is evidenced by the recent published government statistics. The Chinese government has built a proven track record recently for managing the macro economy over the past 15 years or so. With a target of 9% GDP growth in 2012, it is still a healthy pace compared to more mature markets in the US and Europe.

In its 12th Five-year Plan, the Chinese government has reiterated its determination to shift the economy from export-oriented to consumption-driven, which will significantly benefit China Gerui because most of the end markets it serves are riding on the robust growth of domestic consumption power.

Back to your family, are you planning to send your children to local schools, or abroad?

Managing children’s schooling in China is a grave challenge for any parent. Local Chinese schools are well known for their disciplined curricula and heavy homework load, and parents tend to pile on their children with way too many extra-curricular activities just to remain in the competition.

As my plan stands now for my children, I would most likely put them up and through the international schools in China, allowing them to enjoy a true childhood, enjoy the exposure to both Chinese and international cultures, and develop and groom their diversified interests before they make their own choices and settle down in any particular academic field.

And I would be remiss if I didn’t ask a CFO about his company’s performance. Your revenue increased by an impressive 63.4% in the third quarter. What were the major reasons?

China Gerui’s Q3 revenue increased by 63.4% compared to the same period last year. This was primarily due to the increased output from the new cold-rolled wide-strip steel capacity that was completed in Q2 and started official production in Q3. After ongoing capacity expansion, China Gerui will boast a total of 500,000 tons of cold-rolled steel processing capability, out of which 50% can be further chromium-plated, positioning the company in a leading position to serve a variety of end markets including food & beverage packaging, construction and decoration, home and electrical appliances and wire and cable manufacturing.

Your third quarter net profit rose 76.2% year-on-year, faster than your top line. Was this mainly due to higher selling prices? Or higher margin sales?

It is mainly due to higher ASP or average selling prices that is a direct result of both the direct pass-through of raw material cost increase and the fact that company now has a higher percentage of its output chromium-plated than in Q3 2010. Please note that the company has improved the gross margin of its non-plated cold-rolled steel product to around 28% while chromium-plated margins are north of 30%.

Are most of your products exported, or sold in the PRC? Has your firm been at all affected by anti-dumping or anti-subsidy measures in overseas markets and how did you respond?

Although China is now a net exporter of crude steel, it’s still a net importer of high-end, specialty steel including ultra-thin precision cold rolled steel. In domestic China, supply of high-end precision CR steel is lagging demand since there is either not enough capacity or most Chinese producers lack the technology to produce them. China Gerui, as the leader in this niche market, has been selling its output to domestic Chinese customers only. The anti-dumping or anti-subsidy measures do not impact China Gerui as it is now not engaged in export activities.

What is the latest earnings guidance you can give for the October-December 2011 period or FY2012?

We expect revenue of between USD$330 million and $345 million, gross profit of between $115 million and $120 million, adjusted net income of between $70 million and $75 million, and adjusted diluted earnings per share of between $1.20 and $1.25. No guidance has yet been provided for FY2012 while China Gerui assesses the impact of recent overall hot-rolled steel price volatility on its outlook for the next year.

See also:

Counting the costs of living in SHENZHEN

XINREN: China's aluminum demand stable despite uncertain economy