MORE AND MORE industry watchers are saying BYD’s days as an automaker may soon be over.

That doesn’t bode well for its 10% stakeholder -- a man that China calls “The Stock God” – Warren Buffett.

In fact, a Chinese-language piece in Finance World says they are not the only media outlet reporting that the odometer on BYD’s days as an automaker is about to max out.

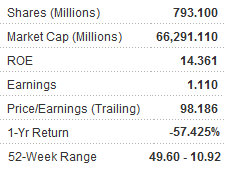

Holders of the Shenzhen-based firm’s Hong Kong-listed shares are all too familiar with the stalled status of the hybrid vehicle maker’s valuation, with one-year returns a dismal -57.4%.

But that hasn’t stopped diehard idealists and long-termers like Warren Buffett and company from holding on through thick and thin.

As proof of this dedication, despite dismal earnings of late, BYD’s Hong Kong-listed shares are still flirting with the three-digit mark, currently at around 98.1x P/E (trailing).

Buffett, “Stock God” in China but better known as the father of “Value Investing” elsewhere, is renowned for his patient, long-term positions on winners that ordinary mortals discover just a little bit too late.

The chairman and CEO of Berkshire Hathaway surprised pretty much everyone earlier this week by pumping 10.5 bln usd into IBM, as Buffett had also been known for not jumping headfirst into the IT tech boom last decade.

But he may have finally gotten in over his head with BYD, with many analysts now saying a decision by the Nebraskan to completely divest from BYD would not come as a big surprise.

Of course, money is the motivating factor. His stake in BYD peaked at 19.89 bln hkd two years ago, but has since lost around 80% in value and is currently worth around 3.89 bln hkd.

That’s enough of a plummet to scare of even market deities like Buffett.

Lessons Learned

Buffett’s bearish performance with BYD – as well as the rest of the firm’s shareholders – provides a teaching moment for all.

For a listed firm to evolve as a sustainable growth enterprise, it needs to constantly innovate and re-innovate, incessantly reinjecting the fruits of its R&D labors back into the company, in order for it to survive, let alone thrive, Finance World said.

It also added that apparently not even the aura and mystique of a major stake from the “Stock God” can breathe life into a firm for an extended period, and at the end of the day operational fundamentals and market forces will dictate the final outcome.

In other words, as sexy a concept as “New Energy” is, vehicles still need to sell well and continually have their insides innovated upon to meet the needs of a fickle and hypercompetitive marketplace, not to mention investors who may just be onboard for a short ride.

When Will the Good News Return?

It was just two short years ago when BYD owned the top-selling sedan in Mainland China and its mix between traditional, hybrid and all-electric vehicles made it the darling of the PRC’s up-and-coming auto industry.

Back in the Olympic Year of 2008, Buffett’s Berkshire Hathaway provided a spark plug to China’s car industry with a 1.8 bln hkd investment, purchasing 225 mln Hong Kong-listed shares of BYD at a price of 8 hkd per share, giving Buffett an equity stake of 9.89%.

By July 30, 2009, with Buffett’s stake riding high, a BYD-craze swept across China and investors flocked aboard to catch a ride on the “Buffett Express.”

In less than three months, BYD’s H-shares hit a peak of 88.4 hkd, over 10 times what Buffett originally paid, boosting the value he held in the firm to 18.1 bln hkd from an original purchase price of just 1.8 bln – which represented a profit of 1,005% at the time!

With shares currently under 20 hkd per, Buffett cannot be blamed too much for wistfully remembering the halcyon days of 2009 when the shares flirted with 90 hkd, the report said.

But even the “Stock God” has his limits, and Buffett cannot perpetually be the driving force of an automaker that chronically underperforms in showrooms across Mainland China.

See also:

Buffet-Invested BYD Loses 20 Bln Yuan, Automaker's Shares On Verge Of Collapse

TENFU: Tea For Two? Or Two Billion?