Kim Eng initiates coverage of XTEP with a "BUY" on fashion forte

Kim Eng has begun coverage of Xtep International (HK: 1368) with a BUY and a target price of 7.40 hkd, which implies an upside potential of 31% thanks to increasing brand equity, a strong distribution network, and distinctive market positioning.

“This should help Xtep close its valuation gap to top tier players, as its robust trade fair results underpin our forecasts of a 24% topline growth and 20% bottomline growth for FY11,” Kim Eng said.

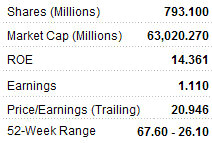

It added that its three year CAGR is 16.6% over FY11-13F, saying the stock trades at an undemanding 9.2x FY12 PER, a discount of 28%, vis-à-vis the average PER of 12.8x of the consumer apparel and footwear sector.

Leading fashion and trendy sportswear player: “Xtep is a trendy and fashionable domestic sportswear company which targets the mass market mainly in China. With a distinct and differentiated positioning,” Kim Eng said.

It added that Xtep has been able to escape from direct competition with the majority of functionality-targeted sportswear players. In addition, its mass market positioning has also allowed Xtep to take advantage of the increasing urbanization and the rising disposable income in China.

Strong trade fair result: Xtep’s overall 2011 trade fair result was strong, in which volume growth posted 24% y-o-y, ahead of peers. ASP recorded double-digit growth in apparels and single digit growth in footwear.

“Coupled with the management’s guidance of a topline growth rate of 10% for the Disney sport brand, we have derived the following estimates for FY11: topline growth of 23.6% and bottomline growth of 20%.”

Undemanding Valuation: Kim Eng says Xtep trades at an undemanding 9.2x FY12 PER, in comparison to the average of 12.8x PER in consumer apparel and footwear sector.

“We believe that Xtep’s distinctive market positioning, rising brand equity, and continuous penetration into lower-tier cities in China would close the gap to top-tier players in the industry.”

See also:

XTEP, INTIME, LE SAUNDA: What Analysts Now Say...

XTEP 2010 Net Up 25.7%: What Analysts Now Say...

Deutsche says DONGFENG is top pick in China auto sector

Deutsche Bank says that while there are many concerns on the Street, it sees no damage to long-term prospects for Hong Kong-listed China passenger vehicle (PV) stocks under its coverage, which have declined 3-21% (except for Brilliance) since March.

“Investors are perplexed about the extent of the Japan-quake related auto parts supply shortage and its impact on auto production. Moreover, concerns regarding more restrictive measures on auto sales and fewer government incentives persist.”

Deutsche added that it will continue to look beyond such near-term hiccups, however, and stay positive on China’s auto sales outlook, reiterating our BUYS on Dongfeng, Guangzhou Auto (GAC) and Geely.

In April 2011, China recorded merely 2.8% y-o-y growth in PV sales, which is below 1Q11 y-o-y PV sales growth of 9.1%.

“However, we believe that the decline in April sales was caused neither by a dramatic demand slowdown nor Beijing’s restrictive measures. Indeed, stripping out the impact of a 13.1% y-o-y drop in the Japanese brands’ PV sales due to production cutbacks and 10.5% shrinkage in mini-car sales, the remaining PV sales actually rose 12.0% in April.”

The brokerage expects a sales pick-up in 2H11E and low risk of policy discouragement. With Japanese auto JVs in China likely to produce at below-normal levels, it expects y-o-y sales growth to stay suppressed in near term.

BUY Dongfeng, GAC and Geely; SELL on BYD

The China auto sector is trading at about 10x FY11E P/E, below its historical average of 11x. Deutsche said it believes this already reflects the slowdown in 2011E growth and additional downside risks on sales volume/earnings due to recent production cuts.

“We still like Dongfeng Motor (HK: 489) and GAC given their below-sector-average valuation and sustainable growth outlook, with Dongfeng being our top Buy as we think that its well-diversified business model will enable the company to mitigate excessive risks from production disruption.”

It added that it also rates Geely BUY because the company has achieved above-market sales growth with its newer and higher priced models YTD.

“More importantly, we still expect the aforementioned three companies to attain respectable 12-22% FY11-13E three-year earnings CAGR. We maintain Brilliance China at Hold, even after acknowledging its exponential sales volume growth from the BMW JV, considering the already stretched valuation.”

Lastly, Deutsche says its SELL recommendation on BYD (HK: 1211) is intact as there is no clear signal that its sales are solidly recovering YTD, with a still good chance of seeing disappointing 1H11 results.

“A key sector upside risk to our stance is stronger-than-expected sales driven by a faster Japan auto parts supply chain recovery. A key downside risk is prolonged macroeconomic weakening depressing sentiment.”

See also:

HK-LISTED INSURERS, RETAILERS, AUTOS: What Analysts Now Say...

CHINA AUTO SECTOR In ‘Downhill’ Skid: What Analysts Now Say...