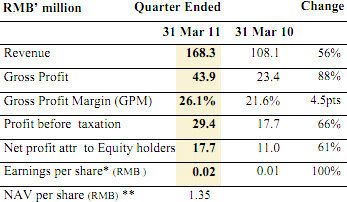

FUXING CHINA Group Ltd (SGX: FUXC) had a breakout first quarter, with net profit surging 61% to 17.7 mln yuan, on top line growth of 56% to 168.3 mln.

Therefore, the company’s CFO Koh Choon Kong is unsure why the PRC’s No.2 zipper maker’s Singapore-listed shares are not reflecting the robust earnings, as he explained to NextInsight in an interview.

Fuxing China, a leading vertically-integrated zipper manufacturer and the second largest in Mainland China, saw revenue from its zipper and trading segments increase 57.5% and 55%, respectively, in the first three months of 2011, with sales of zippers reaching 139.5 mln yuan or 82.8% of total revenue.

The Singapore-listed firm said that improved contributions from finished zippers, zipper chains and sliders arose from the increase in volume due to strong demand from customers in the PRC and overseas markets as a result of the improvement in the economy.

Meanwhile, Fuxing China’s trading segment contributed 28.8 mln yuan or 17.2% of total revenue, up 55% from a year ago.

More impressive was the fact that the group’s January-March gross profit increased 88% to 43.9 mln yuan, while the overall Gross Profit Margin (GPM) improved by 4.5 percentage points to 26.1%, while GPM for the zipper segment rose to 31.0% from 25.9% a year earlier.

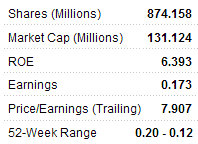

Therefore, NextInsight wanted to learn from the person most familiar with Fuxing China’s financial and market performance exactly why its share price is still lingering near 52-week lows.

NextInsight: Fuxing's shares in Singapore fell 6.5% last Friday but rebounded somewhat today (Monday) by 3.4%, and are currently at 0.15 sgd, which is near to the 52-week low of 0.12 sgd. This is despite the excellent first quarter results being just released on May 3.

Any idea why this is happening?

Fuxing China CFO Koh Choon Kong: I am not too sure about the price fluctuation. The market has taken a hit quite a fair bit.

However, we would point to two new reports that are somewhat at odds with our current valuation.

DMG has continued its “buy” call on Fuxing after the release of our results, while NRA Capital has a “neutral” call on Fuxing, putting a fair value of 19 cents on the company.

Additionally, we are all aware of the historic elections taking place in Singapore. Therefore, I wonder if current share price performance is a factor of the ‘election effect’ to some degree?

Your end-March cash&bank position of 506 mln yuan is indeed very strong. How has this changed from the end-2010 cash&bank position?

Will this primarily be used for new acquisitions (including the three companies dealing with colour dyeing, yarn and electroplating businesses approved at the SGM on March 4), or will it be used for organic expansion, or perhaps dividends?

Mr. Koh: Our cash balance at end 2010 was about 494 mln yuan. Yes, the company will need to make the remaining 90% of the acquisition consideration (334.8 mln yuan) quite soon upon full legal completion.

Fuxing China has been expanding its capacity and output progressively, in line with good demand coming from existing and new customers.

Additionally, our dividend has already been approved and will be paid on 20 May.

As we move along, the company will release its cashflows from the prepayments made to its key suppliers, and that is something we are monitoring closely.

Our company is currently in an expansion mode.

Mr. Koh’s optimism was shared by company executives.

“We are happy to see the increased demand from both local and export customers in this quarter.

"We continue to look for growth areas, and in the next month or two, we are going to launch a new product -- Y-teeth metal zippers which provide a ‘smoother feel’ of zipping, and which is much more efficient as production wastage is kept to zero compared to production of normal metal zippers,” said Fuxing China’s Executive Chairman and CEO Hong Qingliang.

Mr. Hong added in a company statement that with this new product, Fuxing hopes to produce “many such metal zippers” to satisfy growing demand.

“We will continue to explore further business opportunities to invest in businesses within the zipper business outside Fujian Province to increase our market share in the PRC. This will make us operationally stronger, and also allow the Group to capture viable revenue streams and expand our profit base.”

See also:

FUXING: Share Price Dipped 12% Despite Good Results. Why?

FUXING: China’s No.2 Zipper Firm 2Q Net Nearly Triples, 2010 Looking Good

Listed on SGX-ST in September 2007, Fuxing China is the PRC’s No.2 producer of zippers, and one of the few integrated manufacturers of zippers in the country, serving more than 1,600 customers in diversified consumer segments including luggage/bags, apparel, camping equipment, and footwear, with branded clients including Anta, LiNing, Fujian Peak, 361˚, Samsonite, Septwolves and many others. Based in Jinjiang City, Fujian Province, Fuxing China has the ability to manufacture the entire zipper product from mould-making for the production of zipper sliders to manufacturing of fabric tape for zipper chains. Fuxing China has been awarded the PRC Top 10 Famous Zipper Brands and the Symbolic Brand of China award for its “3F” brand.