Excerpts from analyst reports...

Credit Suisse maintains Outperform call on STX OSV

Analysts: Gerald Wong and Christopher Chang

Credit Suisse maintained its ‘Outperform’ call and target price of S$1.80 on offshore vessel builder, STX OSV, after Brazilian oil major Petrobras was reported to be expanding its offshore fleet.

“We believe STX OSV is well positioned to benefit from increased demand for OSVs in Brazil due to its established position in the market. It is constructing a new yard in Brazil, which will triple its production capacity in Brazil from 2-3 to 7-9 vessels.” – Credit Suisse

Firstly, Petrobras is looking to order up to 20 offshore support vessels (OSVs). In the tender for 18,000 bhp AHTS vessels, Norskan Offshore, a customer of STX OSV, submitted the third-lowest bid.

Secondly, Petrobras is also looking to purchase six flexible pipelaying vessels in three different sizes. Leading oilfield engineering solutions provider Technip submitted a bid for the over 300-tonne category, and has nominated STX Brazil for its construction.

“We expect strong order momentum and the announcement of NKr$3.2bn of contracts with Transpetro following financing approval from Merchant Marine Fund to drive the stock’s re-rating.” – Credit Suisse

STX OSV has nine shipbuilding facilities in Norway, Romania, Brazil and Vietnam for offshore support vessels. It recently traded at S$1.21, translating to a market cap of S$1.4 billion. Credit Suisse’s S$1.80 valuation is based on 12X 2011PE, compared to currently market valuation of about 7.8X PE.

OIR raises target price for Biosensors to S$1.60

Analyst: Andy Wong Teck Ching

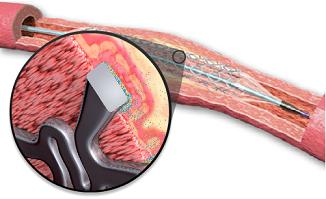

OCBC Investment Research (OIR) has maintained its ‘Buy’ call on Biosensors and raised its target price by 5 cents to S$1.60 after the medical devices maker increased its 50% stake in its drug-eluting heart stent JV, JW Medical Systems (JWMS), to 100%.

“We view this move positively from a strategic standpoint as Biosensors’ own BioMatrix drug-eluting stent has yet to obtain approval from the relevant authorities in China and currently penetrates the China market via JWMS.” - OIR

The purchase consideration amounts to about S$625.4m, comprising of

(i) a cash payment of S$160m;

(ii) issuance of 260m new ordinary shares to JV partner and share vendor Shandong Weigao at S$1.2215 per share (0.12% premium to 10 Jun closing price), and

(iii) issuance to Shandong Weigao of US$120m principal amount of 4% convertible notes due 2014. Assuming full conversion of the notes, Shandong Weigao will own 21.6% of Biosensors.

Biosensors International develops and manufactures medical devices for interventional cardiology and critical care procedures and is leading player for heart stents. It recently traded at S$1.26, translating to a market cap of S$1.7 billion.

CIMB maintains its ‘Outperform’ call on Yongnam

Analyst: Leong Weihao

CIMB maintained its ‘Outperform’ call and target price of 40 cents on Yongnam after the construction player’s contract wins picked up strongly during the second quarter.

Yongnam secured more than S$190 m worth of contracts during 2Q11, more than 40% of CIMB’s target for FY2011.

”We estimate that Yongnam is bidding for S$1.2bn worth of projects this year. The outlook in Singapore remains underpinned by numerous opportunities in the civil engineering space.

”The Middle East is another market with considerable infrastructure spending plans. We believe if the political situation stabilises there, construction firms like YNH could stand to reap major benefits.

”We expect stock catalysts from contract wins for projects such as the MRT Downtown Line and structural steelwork projects in the Middle East.” - CIMB

Yongnam provides structural steelworks including design, supply and erection of steel frames for aircraft hangars, high rise buildings, commercial and industrial buildings. It also operates civil and mechanical engineering businesses. It recently traded at 26 cents, translating to a market cap of S$326 million.

At 26 cents, Yongnam’s valuation at 5.2x CY12 P/E is undemanding compared to the peer average of 7.6x.