BRING OUT the baijiu to celebrate!

In the first nine months of FY2011, during which its liquor sales were boosted by Chinese New Year celebrations, Dukang Distillers crossed the RMB1 billion mark in sales for the first time in its history.

The company, previously known as Trump Dragon Distillers, achieved RMB1.17 billion of sales.

Net profit amounted to RMB149.4 million, up 76.4% year on year.

A major contributor was Luoyang Dukang, which was acquired for RMB600 m cash in May 2010, said Dukang Distillers, a producer of baijiu products based in Henan province.

Luoyang Dukang has proved to be a solid acquisition as it achieved record revenue of RMB295.3 million in 3Q11 (ended March), accounting for 57.3% of Group revenue.

Luoyang Dukang came with its “Dukang” (“杜康”) and “Ruyang Dukang” (“汝阳杜康”) brand names, which are renowned baijiu brands in the PRC established in 1968 and 1972, respectively.

It also boosted the Group’s production capacity significantly, adding 2,932 fermentation pools, 34 distillation lines and 14 baijiu bottling lines.

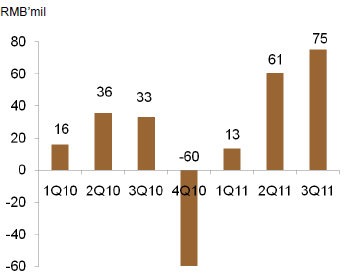

With this latest set of results, Dukang Distillers is firmly on the road to a sharp turnaround in its bottomline for the full-year ending June 2011.

Dukang's FY10 net profit was beset by non-cash loss of RMB119.8 million from the accounting of convertible bonds it had issued during the purchase of Luoyang Dukang.

If the convertible bond loss was excluded, Dukang would have recorded a 38.0% increase in profit attributable to owners to RMB144.8 million in FY2010.

That hypothetical figure is already surpassed by Dukang's 9M2011 net profit of RMB149.4 million.

Gross margin of 35% in 3Q

Baijiu, not being a basic consumer item, commands a decent profit margin.

It also helps if the drink has a strong brand that enables the producer to pass on any, or most, of an increase in the cost of raw materials.

In the case of Dukang Distillers the gross margin was 35%, sharply higher than the 30.9% achieved a year earlier.

For an idea of the pricing of baijiu, consider that its newly-launched Jiuzu Dukang sells for between RMB100 to more RMB500 per 500ml bottle.

In 3Q, the overall Average Selling Prices of Dukang's products indeed rose 32% to RMB41.8/kg.

At 59 cents recently, Dukang stock is sharply down from the 90-cent level they were trading at the start of the year.

The trailing PE is 78X, according to Bloomberg.

However, taking the 9M2011 earnings per share and annualising it, resulting in 4.89 Singapore cents, the current-year PE is about 12X.

Dukang is a relatively large-cap S-chip with a value of about S$470 million, which renders it investible by funds if they so choose to.

Another attractive feature is its cash and cash equivalents, which stood at RMB 848.4 million (about S$166 million) as at 31 March 2011. This is due mainly to net cash of RMB 73.2 million generated from operating activities, and net cash of RMB 277.6 million generated from its listing of TDRs in Taiwan this year.

Despite its sound fundamentals, it lacks analyst coverage in Singapore.

Dukang's 3Q Powerpoint presentation can be acessed here.

杜康酿酒:全年业绩正在反弹

张加海驻厦门翻译

举白酒庆贺!

2011财年前9个月,受到中国新年庆祝的刺激,杜康的烈性酒销售大幅增长,历史上首次突破10亿人民币销售大关。

这家前身为祥龙控股的白酒酿制企业取得了11.7亿的销售额。

净利总额达到1.494亿人民币,同比去年增长76.4%。

2010年5月,以6亿人民币现金收购的“洛阳杜康”成为了杜康――这家位于河南省的白酒酿制集团的主要销售来源。

事实证明,收购洛阳杜康是正确的。截止于3月的2011年第一季度,它创造了2.953亿人民币的销售收入,占集团收入的57.3%。

洛阳杜康旗下拥有“杜康”和“汝阳杜康”两个品牌,分别成立于1968年和1972年,都是中国知名白酒品牌。

它也使得集团的产能有了显著的提升,增加了2,932个发酵池,34条蒸馏线和14条白酒灌装线。

根据最近这一系列的业绩看来,杜康2011财年(截止于6月)的全年净利肯定会有一个巨大的增长。

杜康2010财年净利受到1.198亿非现金亏损的影响。该损失是来自其发行的可转换债券,用以收购洛阳杜康。

如果不包括可转换债券带来的亏损,杜康2010财年可贡献给股东利润达到1.448亿人民币,增幅达到创记录的38.0%。

但这个假设的数值已经被杜康2011财年前9个月的净利(1.494亿人民币)超过了。

第三季度的毛利率为35%

白酒不是一种基础性的消费项目,这样的利润率是相当不错的,并没出人意料。

如果这种饮料的品牌很强大,就能帮助生产商将原材料成本的提高传递给消费者。

就杜康所取得的35%毛利率来说,已经比一年前的30.9%有了很大的提升了。

关于白酒的价格,新推出的每瓶500毫升装的酒祖杜康售价在100元人民币至500多元人民币之间。

第三季度,杜康产品的平均销售价格上涨32%至41.8元人民币/千克。

杜康的股价从年前的90分新币的水平一下暴跌至近期的59分。

据彭博数据,该交易价的市盈率为78倍。

然而,以2011财年前9个月的每股收益进化年化,每股净利应该为4.89分新币,也就是说动态市盈率大约为12倍。

杜康市值约为4.7亿新币,是只盘子较大的股,对基金而言,还是相当有投资价值的。

另一个吸引人的是,截止于2011年3月31日,杜康的现金及现金等价物为8.484亿人民币(大约1.66亿新币)。这主要是来自经营活动所产生的7320万人民币净现金,和今年在台湾发行存托凭证所融得的2.776亿人民币。

尽管它的基本面很不错,但在新加坡却缺少分析员的关注,就我们所知是这样。

要查看杜康第三季度业绩说明,请点击acessed here.