Excerpts from latest analyst reports.....

Ziwo's VP for investor relations, Leong Yeem Mei, presented the Ziwo story at CIMB yesterday. A key Ziwo product is foamed SBR for making many products ranging from diver suits to mouse pads and laptop bags. Photo: Leong Chan Teik

Ziwo's VP for investor relations, Leong Yeem Mei, presented the Ziwo story at CIMB yesterday. A key Ziwo product is foamed SBR for making many products ranging from diver suits to mouse pads and laptop bags. Photo: Leong Chan Teik

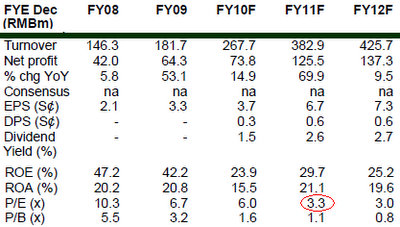

CIMB reiterates ‘buy’ call on ZIWO, looks to up the target price

Ziwo’s share price has risen steadily of late; a trend we believe is due to a combination of strong recovery in profitability and positive reception for its TDR plan. We see more positives ahead for the stock, and believe that near term stock catalysts could come from

(i) upside to our FY10 forecasts from earlier-than-expected contributions from expanded capacities; and

(ii) premium pricing of its TDR.

We are currently in the process of reviewing the stock’s valuations in view of the recent announcement for new capacity addition.

• Reiterate BUY, TP of S$0.43 (under review).

Net cash per share stands at 70.9 RMB cts (13.9 scts) as at 30 Sep 2010, with total borrowings remaining at zero (since 2Q10).

Ziwo continues to generate healthy cash flows from its business in 2010, with operating cash flows coming in at RMB81.8m for the first nine months of the year.

Recent story: ZIWO: Up 79% since IPO on strong business; headed for TDR listing

DMG & Partners sets 53-c target for LEADER ENVIRONMENTAL

Analysts: Tan Chee How & Terence Wong, CFA

Initiating coverage with BUY; TP S$0.53.

Leader Environmental Technologies (LET) tackles pollution in China through manufacturing of desulphurisation systems and dust removal systems, as well as offering wastewater treatment solutions.

The China-based Industrial Waste Treatment equipment maker is set to grow steadily in the next few years, driven by

1) favourable regulatory policies in China,

2) strong presence in the heavily polluted Northern China, and

3) popular desulphurisation systems.

Backed by expected strong new order wins of RMB400m-RMB450m during FY10F-FY12F, we believe LET is able to achieve PATMI CAGR of 36% in the period. Based on 8.7x FY11F earnings, we are valuing LET at S$0.53.

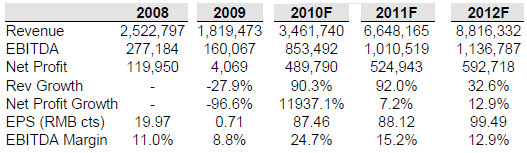

AmFraser sets $1.02 target for SUNVIC CHEMICAL

Analyst: Winston Peak

We initiate coverage on Sunvic Chemical Holdings Ltd with a BUY recommendation and fair value of S$1.02. This represents a 55% premium over the last close price of S$0.66. After studying their listed peers on the SGX and HKEx, we peg a 6x P/E valuation on their FY2010E earnings of S$0.17 (exchange rate of RMB1:SGD0.195) to arrive at our FV.

GROWTH PROSPECTS

1. Venturing upstream into Propylene. Since propylene prices have a big impact on Sunvic’s gross margins, it makes sense for the Group to move upstream to secure their raw material. Sunvic’s new cracking plant producing propylene and other petrochemical products is expected to be operational by end Q1FY2011.

2. New AA plant in 2012. To meet surging demand, Sunvic started construction of a new AA plant with total production capacity of 320,000 tonnes per annum. It will be completed in two phases with the first phase of 160,000 tonnes expected to begin commercial production in 2012.

Revenue, EBITDA and profit figures in '000.

Revenue, EBITDA and profit figures in '000.

Recent story: Hot stocks on first day of trading: JUKEN, XINREN, CHINA GAOXIAN, SUNVIC, ROXY-PACIFIC

SIAS Research pegs TECHNICS' intrinsic value at $1.17

Analyst: Ng Kian Teck

Technics Oil & Gas Limited (Technics) announced two positive developments yesterday (03 January 2011).

Firstly, the company has received approval from the Securities and Futures Bureau of Taiwan Financial Supervisory Commission, Executive Yuan for the offering and listing of up to 80m TDRs on the Gretai Securities Market of Taiwan.

Secondly, Technics has secured a S$23.5m EPCC contract from Middle East Oil & Gas Company. In view of these two announcements, particularly the latest contract win, we are upgrading Technics’ intrinsic value to S$1.17 per share (27.2% upside). Maintain Increase Exposure.

Technics’ quality products and timely delivery have won the trust of many clients – which can be demonstrated by the S$84.1m contracts secured by the company and its subsidiaries over the last four months. We estimate the company to secure about S$120m of new orders in FY2011F.

Recent story: TECHNICS receives TDR listing approval, announces $23.5 m contract win