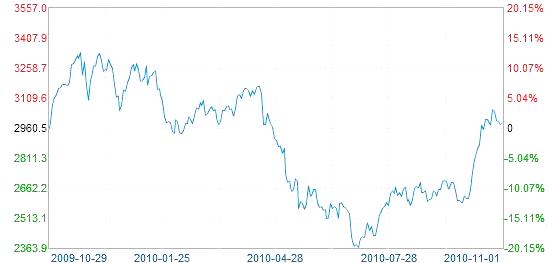

AFTER FOUR straight losing sessions, Chinese shares regained lost territory with a vengeance today, with the benchmark Shanghai Composite Index surging 2.52% to close at 3,054.02.

Hong Kong's benchmark Hang Seng Index closed up 2.41% at 23,652.94.

Banks and metals were some of the big winners after a key barometer of China’s industrial strength in October came in above consensus.

The Shanghai Composite, which tracks both A and B shares listed in China, started the week off with the biggest daily increase in seven weeks, ending well above the key psychological level of 3,000.

In a Chinese language piece in SinaFinance, analysts polled generally said the next major challenge will be the 3,100 mark, with some resistance expected.

Lingering anxiety over new possible anti-speculation measures from Beijing targeting the country’s runaway property market and anticipation over a series of US Federal Reserve meetings early this week with possible bond buyups on the table kept Chinese shares from rising even further today, analysts added.

Most sectors rallied today after the string of corrective sessions last week.

The bulls were out in force thanks in large part to just-released figures tracking investment and production activity in China’s industrial juggernaut.

The Purchasing Managers' Index (PMI), one of the front-line gauges of the level of industrial activity in a given economy, edged up to 54.7 for the month of October from 53.8 the previous month.

Meanwhile, a rival announcement from global banking giant HSBC saw its China PMI up to 54.8 from 52.9 over the same period, one of the sharpest rises since the lender first started issuing PMI readings for China in 2004.

Both October PMIs came in higher than expected, driving up shares in banks, metal stocks and other industrial-linked suppliers and financiers.

A PMI reading over 50 suggests manufacturing activity is in expansion mode, while a sub-50 reading indicates contraction.

Shanghai Pudong Development Bank Co Ltd (

China CITIC Bank Corporation Ltd (SHA: 601998) closed up 1.75% at 5.81 yuan and Industrial Bank Co Ltd (SHA: 601166) gained 2.25% to 27.77.

Other sectors were no slouches as the mining and metals sub-indices were the biggest gainers on the day, rising 6.7% and 4.1%, respectively.

China’s largest listed steelmaker Shanghai Baosteel Group Corp (SHA: 600019) finished up 1.7% at 7.29 yuan.

See also:

CHINA SHARES Surge 2.6% On Coal Profits To 6-Month High

CHINA SHARES Facing Test, Focus On Financials

WHAT RATE HIKE? A Shares Protect 3,000 Despite Central Bank Action