This is reproduced from the blog of Ernest Lim, a remisier. He can be contacted at crclk@yahoo.com.sg

In 1HFY10, Sino Grandness succeeded in developing its own-branded newly developed beverage products and selling them to the domestic market. This new segment contributes about 23.5% of 1HFY10 revenue as compared to 17.6% of FY09 revenue.

Some aspects which I find it interesting

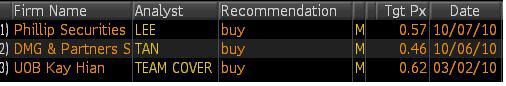

a) Consensus TP: $0.51, dividend yield of 5%

According to Fig 1 below, the consensus analysts’ target price for Sino Grandness is $0.51 (last done price was around $0.425), representing a potential capital appreciation of 20%.

According to Bloomberg, analysts are forecasting a dividend yield of around 5% for Sino Grandness. If their forecasts materialize, this would represent a potential total return of 25%.

Secondly, it is noteworthy on how the analysts determine their target prices. Most of them ascribe a PE multiple on Sino Grandness FY10F earnings.

As 1H has already passed, analysts are likely to increase the target price as they roll their valuation method to FY11F earnings or FY10F/FY11F blended earnings (this is based on the premise that Sino Grandness continues to report robust results).

b) FY10 results likely to meet analyst targets, representing approx 35% and 45% year on year growth in revenue and net profit.

Based on 1HFY10 results, some may worry that Sino Grandness is unable to meet the analysts’ estimates. However, 2H is typically much stronger than 1H.

I noted that Sino Grandness 2HFY09 revenue amounted to RMB330M, as compared to RMB121M in its 1HFY09. 2HFY09 net profit was also twice that of 1HFY09 net profit.

Although this does not guarantee that 2HFY10 will replicate the growth rate experienced last year (as 1HFY09 was from a low base), it does show that 2H is typically stronger than 1H.

Secondly, the own-branded newly developed beverage products bears promise. As at 31 Jul 10, Sino Grandness has signed distributorship agreements for new bottled juices with 16 distributors from a variety of provinces such as Beijing, Guangdong, Hunan, Hubei etc.

In 1HFY10, Sino Grandness’ beverage product segment (i.e. canned herbal drink and bottled juices) generated RMB57.2m. It is highly likely that this segment will generate stronger sales in 2HFY10, post the signing of the distributorship agreements.

In a nutshell …

In a nutshell, if Sino Grandness is able to meet analysts’ projections of revenue and earnings, this represents approx 35% and 45% year on year growth in revenue and net profit. With such growth and trading at a consensus analysts’ estimated PE of 5.1x FY10F earnings, it seems to be a growth stock, trading at low valuations.

Disclaimer

The information contained herein is the writer's personal opinion and provided to you for information only, and is not intended to, or nor will it create/induce the creation of any binding legal relations. The information or opinions provided herein do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or invest in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein are suitable for you. The writer will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials appended herein. The information and/or materials are provided “as is” without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Recent story: ERATAT LIFESTYLE, SINO GRANDNESS: What analysts say now.....