DMX’S ENERGETIC LADY boss, Ms Jismyl Teo, is very excited about the development of the pay-TV market in China, where it is a leading digital media solutions provider.

At home in Singapore, Singtel’s mio TV and Starhub’s cable TV have been around for years, with each offering over 100 channels of current affairs, sports, education movies and entertainment from TV stations around the world.

In contrast, China’s digital media industry is nascent and rapidly growing, said Ms Teo during an investor briefing yesterday, when she shared how China's mandate to switch cable operators from analog to digital content delivery by 2015 is benefiting DMX.

The transformation is dramatic: For example, not possible in the analog days, any episode of popular Chinese TV drama is now easily searchable on www.ku6.com, which comes with home video-sharing features not unlike Youtube’s.

Photo: Leong Chan Teik

DMX generated US$58.6 million of revenues during 2Q10, of which 74% came from China, compared with 72% in 2Q09.

The macro numbers look exciting:

Firstly, the government mandate has set the stage for “3-network convergence” - that is, integrating cable, telecom and Internet. And China has earmarked some US$5 billion of capital expenditure for this over the next two to three years.

Secondly, China’s cable TV market is expected to more than double its digital cable TV subscribers from 63 million in 2009 to 165 million by 2015.

In the past, systems integration for information communication technology (ICT, or the design and installation of IT architecture that connects a myriad of ICT equipment including servers and routers as well as diverse solutions ranging from data security, application acceleration and bandwidth management) contributed the bulk of DMX’s revenues.

But in Dec last year, KDDI, Japan’s no.2 telco player and the world’s only provider of fixed line, mobile and broadcasting services under-one-roof, took a 52%-stake in DMX by injecting S$183 million of cash.

With KDDI’s strong mobile and network convergence connection, Ms Teo envisions digital media to contribute half of the group’s top line in 5 years. The other half is expected to come from ICT Infrastructure work.

”We are targeting earnings growth of 20% or more a year over the next 5 years,” she adds.

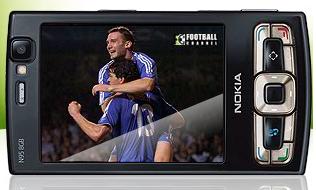

Convergence of broadcast and mobile networks enables viewers to enjoy live! soccer matches on mobile phones.

Convergence of broadcast and mobile networks enables viewers to enjoy live! soccer matches on mobile phones.