Excerpts from latest analyst reports….

UOB Kay Hian issues first report on CHINA NEW TOWN, says dual listing to be a near-term catalyst

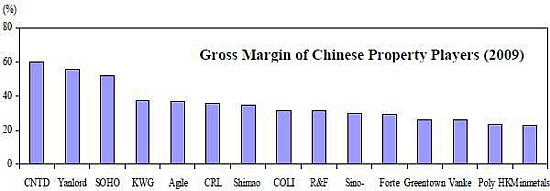

A leading niche player in primary land development. China New Town Development (CNTD) (CNTD SP) is the only listed Chinese company that focuses on land development in China. It has 16.3m sqm of residential land available for sale, which bodes well for land sales over the next 5-10 years.

Beneficiary of rapid urbanisation in China. As urbanisation gathers pace in China, more and more new towns will be built to meet the housing needs of a growing urban population. CNTD is set to benefit from this trend.

Plugged into long-term land appreciation in China. By securing large-scale land development projects, CNTD can reap the benefits of land appreciation over a long period of time. This gives it an unparalleled advantage over home builders who have to replenish landbank every year and take the risk of timing the market.

Dual listing to be a near-term catalyst. CNTD plans to seek dual listing on the mainboard of Hong Kong Stock Exchange by introduction. Although there will be no issuance of new shares, the dual listing should help diversify CNTD’s investor portfolio, enhance liquidity of the stock and boost the likelihood of a re-rating.

Key investment risks: a) Volatile land sales and earnings due to limited land sales for each project within each year, b) huge capex needed at the early stage of land development, c) CNTD being a margin player rather than a volume player due to capex restrictions and government control of land sales schedule, d) reliance on the Shanghai Luodian project and Shanghai property market for the next few years, and e) policy and operational risks of the Shenyang project.

Decent discount to NAV. We estimate CNTD’s NAV at S$0.21/share. Thus, the stock is trading at a 48% discount to NAV, which is lower than the sector’s 40% discount to NAV.

OCBC IR initiates coverage of UNITED ENVIROTECH with 52-c target price

Analyst: Carey Wong

Leading MBR specialist. United Envirotech Limited (UEL) is a comprehensive environmental solutions provider, providing both environmental engineering and environmental consultancy solutions.

UEL provides engineering services which involve the design, fabrication, installation and commissioning of membrane based water and wastewater treatment systems using its advanced membrane technology namely membrane bioreactor (MBR) and continuous membrane filtration (CMF) processes inmicro-filtration, ultra-filtration and reverse osmosis.

Balance of industrial and municipal projects. UEL has an established track record in MBR, especially in the chemical, petrochemical and industrial park sectors. Some of its clients include petrochemical giants such as Sinopec, CNPC, CNOOC. Besides industrial projects, UEL has also ventured into the municipal sector with the building of one of China's largest MBR plants in Guangzhou City. It is also actively investing and operating several BOT/TOT municipal waste-water treatment projects in China.

Helping to solve China's water woes. China currently faces a severe strain on its water resources, depleted by more than a decade of rapid industrial growth. With water pollution fast becoming a concern as well, UEL believes it is well placed to ride on the government's growing emphasis on environmental responsibility and stricter rules on discharge limits. It notes that its membrane-based water treatment systems have gained recognition as a more cost-effective and efficient solution for large-scale projects and difficult to treat wastewater. Its advanced MBR technology also allows wastewater to be more efficiently treated to a higher degree before it is discharged or recycled.

Opportunities to expand into overseas markets. Besides China, management is also keen to venture overseas. UEL believes it could start by building the water treatment facilities for its existing Chinese petrochemical customers as they expand overseas. Separately, UEL is exploring a potential TDR listing in Taiwan to gain exposure to more foreign investors and also enter the waste-water treatment market there.

Initiate coverage with BUY and S$0.52 fair value. Buoyed by the optimistic outlook for China's water and waste-water industry, UEL believes that there are opportunities to secure both new and upgrading projects in the industrial and municipal sectors. Funding is unlikely to be an issue as it had recently secured a RMB3b credit facility. Assuming a long-term growth rate of 2%, a required return on equity of 7.6%, we derive a FCFE fair value of S$0.52 per share. Given the 36.8% upside from the current stock price, we initiate coverage on UEL with a BUY rating.

Recent story: UNITED ENVIROTECH: Record profit, more recurring revenue to come