Charles Hui (right), CFO of Texhong, with Aries Consulting's Terence Wong. Photo by Andrew van Buren

TEXHONG TEXTILE Group Ltd (HK: 2678) may not sell directly to overseas customers, but the provider of textiles to mainly garment and clothing makers in China is not immune to the global slowdown which has taken a big bite out of external demand.

However, the Hong Kong-listed firm enjoyed a lagtime of sorts, as export weakness took time to trickle down – or up -- into reduced or cancelled orders.

In an exclusive interview last week with NextInsight and Aries Consulting, Texhong CFO Charles Hui said the firm was well-equipped – literally and figuratively – to withstand the slowdown and position itself for market-leading status going forward.

“The first quarter was very tough. It was lower on the global slowdown, but margins remained more or less stable for the first half,” Mr. Hui said.

Texhong was confident that not only would external demand crawl back to pre-doldrum levels, but the 800-pound gorilla of markets – China’s 1.3-bln strong potential consumer space – would help Texhong remain on top of its game.

“We are upbeat on demand going forward. We’re this year still among the 20 most competitive Chinese enterprises in the cotton textile industry. Previously the ranking was solely based on turnover but now it’s a more comprehensive ranking system that takes into consideration a wider range of variables.

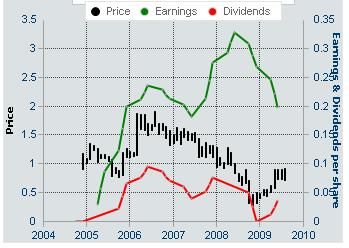

Snapshot of Texhong's financials.

“We believe that we’re actually ranked about No.7 but we understand that the Nos.1-6 companies do not focus in the production of core-spun yarn and fabrics,” Mr. Hui said.

The company was lucky enough to be engaged in an industry which China considers important enough a part of the fabric of the nation’s livelihood to deserve special treatment.

“Textiles are among 10 state-targeted industries for support. Thanks to this, we enjoy benefits in the form of export tax rebate hikes as well as a newfound attention paid to the domestic market by government economic planners,” he said.

China’s economic planners in Beijing were also loathe to release the hounds of recessionary leveling on an industy that employed so many in the country, a great number of whom are migrant workers seeking to better their fortunes in cities.

“The commitment of China’s government to sustain economic growth and to stimulate domestic demand contributes to an enormous domestic market.”

To further stimulate domestic consumption and to sustain the healthy development of the industry, Beijing issued on April 24 of this year its “Textile Industry Restructuring and Stimulus Plan.”

“Under the government stimulus plan, domestic demand continued to grow, helping to compensate for the adverse impact initiated by sluggish foreign demand.”

He added that the value-added tax (VAT) export rebate hike for the textile industry to 16% from 14% in April of this year has relieved some pressure on the profit margins of export-oriented enterprises and that orders should remain healthy at home.

“Domestic demand for high value-added textile products is still expected to grow continuously.”

Texhong over the years.

No more looming hurdles for textile spinner

The textile producer, with 12 plants centered around the Yangtze river delta near Shanghai, believes its cost-effective expansion model and core competitiveness in high-margin product categories will continue to win it orders and investor attention going forward.

“Yes, the first quarter was extremely difficult. But we feel we are a leader in our sector. Our strategy is that we don’t try to compete head-to-head with larger, volume-based textile producers because they have bigger economies of scale. Instead we focus on our higher-margin, better-selling products. In this way we are differentiated from other cotton product producers,” Mr. Hui said.

The company has traditionally relied on non-organic methods for capacity growth and this has made investors very happy given some of the fire sale prices Texhong has paid for struggling acquisitions.

“From the beginning, our chairman and founder (Mr. Hong Tianzhu) has acquired some state-owned enterprises (SOEs) that were financially troubled or loss-making. After buying them out, we upgraded, reformed and retooled them and brought them into our group.

Texhong's cotton spun yarn production facilities. Photo: Texhong

“This has been an important part of our business model. Before we listed in Hong Kong, we had eight production facilities. Among them, five or six were cash-strapped SOEs that we acquired. Now we have 13 plants in total. We acquired some bankrupt SOEs on the cheap. It’s a quick, easy, cheap way to expand.”

Texhong has recently seen more organic growth, but its strategy mirrored its product line, and it believed in a more elastic growth policy which was not wed to the organic expansion model.

“We have no M&As on the table at this point, but we are always on the lookout,” Mr. Hui added.

However, Texhong was not in the business of propping up laggard firms and only sniffed where there was a whiff of potential. It also realized that to make money, some had to be spent first.

He said SOEs in the sector, or even smaller private peers, failed for a reason, and it usually had something to do with quality control or degrees of technological backwardness.

“The textile industry is always changing, and its very competitive. Therefore, you can’t use old equipment to make new, innovative market-leading products. (Eastern China’s) Xuzhou was the location of our first SOE acquisition and we are still using it after restoring it and making adjustments.”

And the nature of the animal was chameleon-like, which meant that the names of the game were upgrade, change, upgrade.

“We are seeing rising demand, but its face is always changing. So our equipment must be multi-functional to meet actual demand and requirements.”

Texhong's factory in Vietnam. Resembles some fabled mansion, doesn't it?

Flexible fabrics, stretched margins

Texhong’s textiles often ended up on the backs of overseas’ consumers in the form of finished clothing. But the immediate buyers of their spun and woven yarns and fabrics were mainly domestic Chinese fabric and garment producers.

This meant that a slowdown in Peoria did not immediately translate into a slump in orders at Texhong.

“Our major customers are still Chinese fabric makers, so we are still more or less upstream. We enjoy some lag time,” Mr. Hui said.

At the end of the day, Texhong’s core strength was understanding -- and acting upon -- its core strength.

“Stretchable yarns comprise over 50% of our total sales, and within this category we see margins remaining stable. That being said, profit margins are very hard to predict this year,” he said.

Texhong's cotton spun yarn production facilities. Photo: Texhong

Another reason to keep one’s chin up at Texhong was the fiscal benefits derived from a major offshore plant in Vietnam. The 210,000 spindle-strong facility in China’s neighbor to the southeast takes advantage of the January 1, 2009 abolishment of the original 5% yarn import tax of such products from ASEAN member countries, as well as the lower labor costs in many of these countries.

“We also stand to benefit from less competition as some weaker competitors have closed down their factories since the financial crisis from September of last year.” Mr. Hui added that Texhong would continue to focus on its core strengths to ensure vibrant results going forward.

“Actually, our direct competitors are not that direct. We feel we are a market leader in the core-spun cotton textile product category. And for some key products, we don’t always make the same or have the same mix so we have few direct competitors that vie with us on every product category.

“There is no practical need to try and produce every possible yarn or fabric. We stick with our strengths.”

About Texhong

Texhong Textile Group was first established in 1997 by entrepreneur Mr. Hong Tianzhu and listed in Hong Kong in 2004.

As one of the largest suppliers of cotton/spandex fabrics in the world, it is specialized in production and trading of high value-added cotton fashion fabrics.

Headquartered in Shanghai, its total assets account for around 3.2 bln yuan.

Equipped with 700,000 sets of spindles and 1,000 sets of air jet looms, Texhong adopts 90% of the productivity in production of cotton/spandex yarns and fabrics by a team of 13,900 staff members. In addition, it is serving over 2,000 clients from home and abroad.