WHILE ANALYSTS regularly deliver stock picks, it's rare in Singapore for the media to do so.

The Edge Singapore is an exception. Annually, at the start of the year, it comes up with its Top 10 stock picks.

The markets may be at its most inscrutable level now but that has not deterred the weekly magazine from keeping faith with its stock-picking practice.

Go buy a copy at $3.80 from the newsstands for its solid five-page cover story on its '10 stocks to ride a recovery'.

Source: The Edge

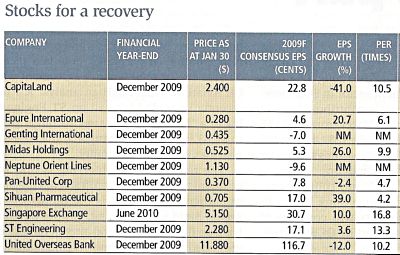

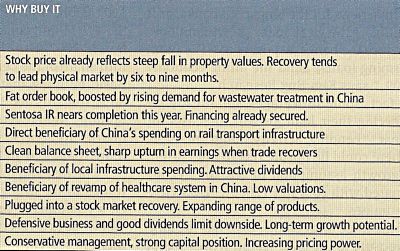

It said it limited itself to companies with the potential to deliver strong earnings in a recovery, and the financial wherewithal to make it through the current demand drought.

Many of its picks are blue-chip stocks beaten down to valuations not seen in years.

These include United Overseas Bank, CapitaLand, Singapore Exchange and Nepptune Orient Lines.

Aside from blue chips, the magazine is betting on a stock that will hog the headlines later this year.

“We are also betting that this will be the year Genting International will begin attracting investor attention again, as the completion of its integrated resort (IR) project on Sentosa Island draws closer.”

Reasons given for the respective stocks.

It also sees building materials supplier and port owner Pan-United Corp as an attractive value play, while ST Engineering offers both downside protection and long-term growth.

S-chips are represented in the list:

* Midas, which is set to benefit from a boom in infrastructure development in China

* Epure International, another infrastructure play.

* Sihuan Pharmaceutical, a beneficiary of China's expanding social safety net and rising health care spending.